Panoptic Blog

Discover the latest product features, cutting-edge technology, solutions, and news on our blog!

2min read

Featured

April 25, 2023

Options Trading 101: Straddles

Did you know that you can profit from the price moving both up AND down? Here's how.

2min read

April 17, 2023

Streamia: How Panoptic Prices Perpetual Options

Streamia (Streaming + Premia) aims to make options trading more accessible, capital efficient, and secure.

25min read

April 15, 2023

Panoptic Options Trading Strategies Series: Part I — The Basics

The basics of options trading and how options trading in the legacy system compares to the new decentralized world.

3min read

April 14, 2023

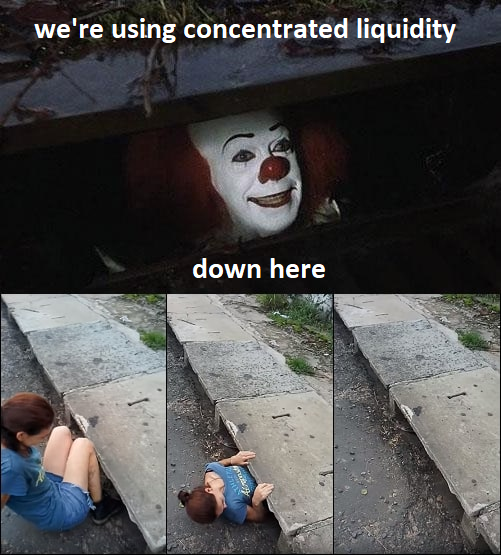

8 Reasons Why Concentrated Liquidity (and Panoptic) is the FUTURE

Uniswap v3's business license expired, sparking a massive wave of interest in Concentrated Liquidity Market Makers (CLMM). Here's why concentrated liquidity is here to stay.

2min read

April 11, 2023

How Concentrated is Concentrated Liquidity in Uniswap V3

The pareto principle applies to Uniswap, too.

3min read

April 7, 2023

What's the Most Capital Efficient Options Selling Strategy?

Maximizing your potential returns with minimal capital? It's not magic, it's capital efficiency!

2min read

April 4, 2023

Implied Volatility and Volatility Smile in Uni v3

Implied volatility and volatility smile are two concepts that underlie how the market prices options and perceives risk. In this post, we'll explore what they are, how they work, and what their role is in Panoptions.

3min read

March 31, 2023

Maximizing Profits: Naked Calls vs. Covered Calls

If you're looking for a way to earn extra income, selling call options can be a powerful strategy. But beware: selling naked calls can be risky. Here's what you need to know.

3min read

March 29, 2023

Panoptic: Unleashing the Power of 0DTE Options

One of the most intriguing aspects of Panoptic is its ability to facilitate 0DTE (zero days to expiry) strategies, which we'll explore in this blog post.