25 posts tagged with "LPs"

View All Posts

5min read

February 25, 2025

Loss Versus Panoptic: Why LPs Are Leaving Money on the Table—and How to Get It Back

LP positions on Uniswap may be losing up to 67% in fees compared to the same positions in Panoptic, the on-chain options layer on Uniswap.

6min read

November 28, 2023

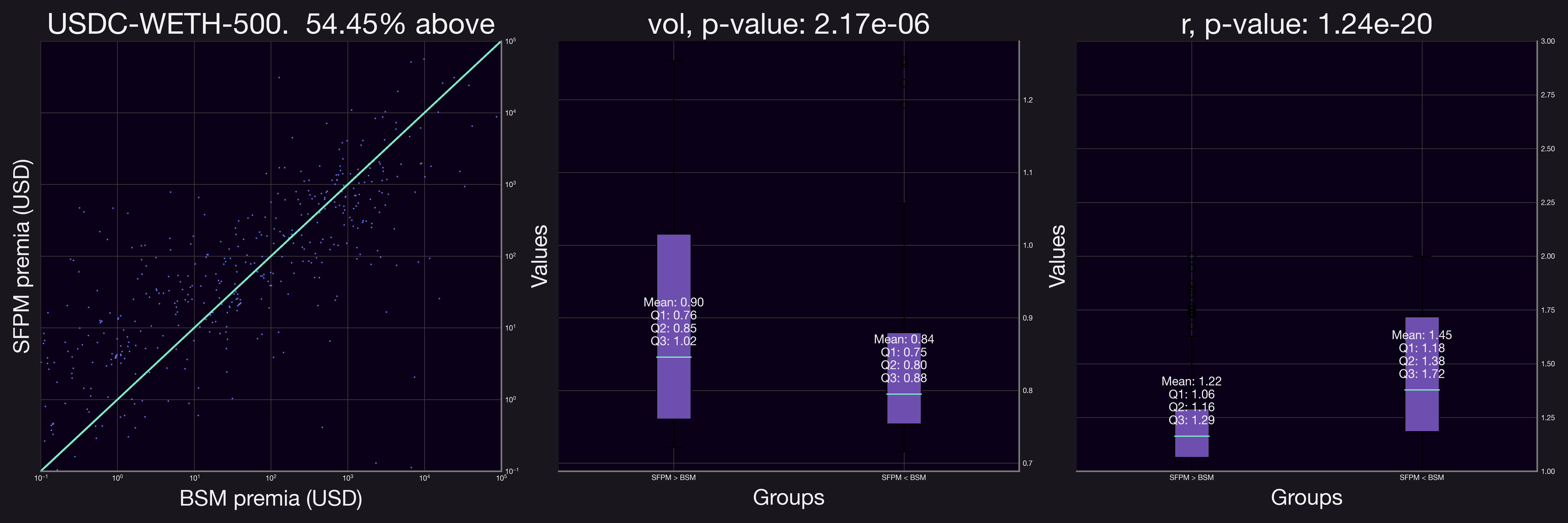

Streamia vs. Black-Scholes Model: A Comparative Study

Have you ever wondered how selling traditional options priced via the Black-Scholes model compare to selling Panoptic options? We analyze hundreds of real LP positions across multiple Uniswap pools to find out.

9min read

October 31, 2023

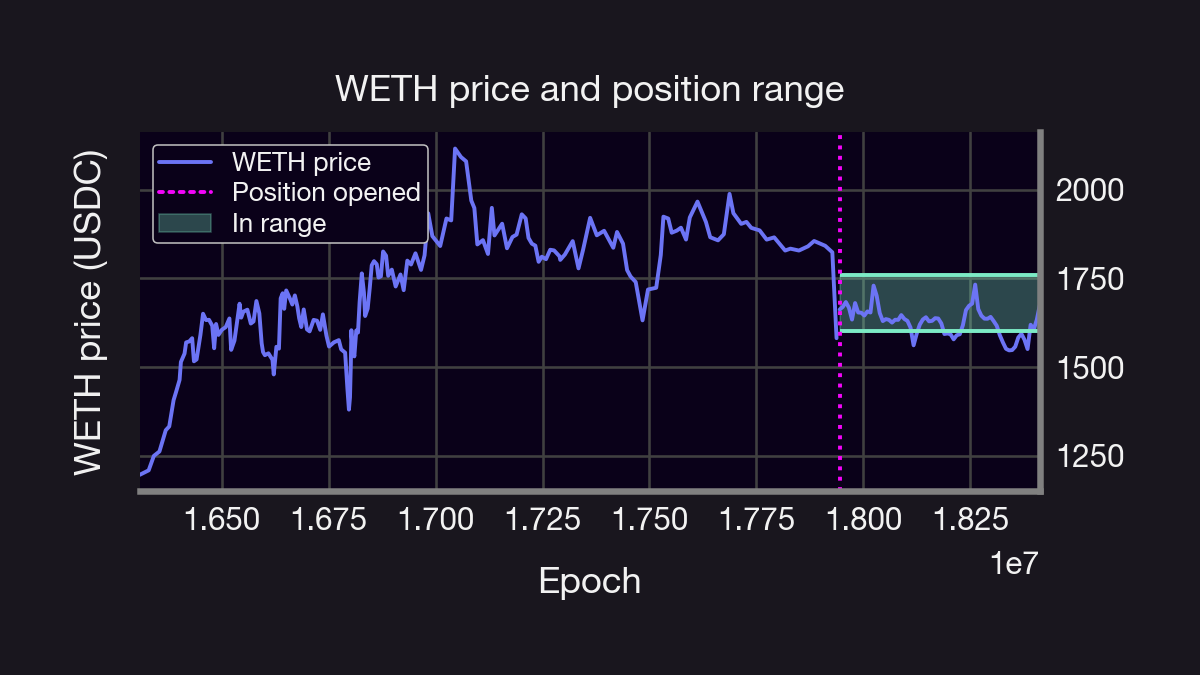

How does LPing in Uniswap V3 compare to selling options in Panoptic?

Have you ever wondered how deploying a liquidity position in Uniswap V3 compares to selling Panoptic options? Spolier alert: you'd be better off with Panoptic

4min read

October 11, 2023

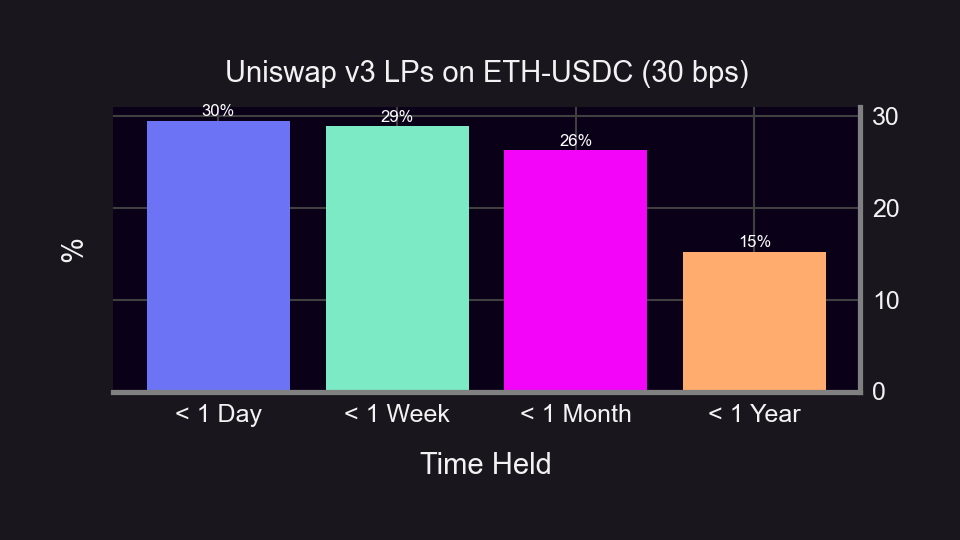

0DTEs on Uniswap – Insights from On-Chain LP data

LP positions are held for a short period of time – typically less than a day. We explore widths and holding time from the POV that LPs are option sellers with an implied expiry date.

4min read

August 5, 2023

Demystifying IL, LVR, JIT, and MEV

Demystifying impermanent loss, loss versus rebalancing, just in time liquidity, and maximal extractable value through the lens of Uniswap LPing as options selling.

3min read

May 2, 2023

Whale Watching - Uniswap v3 LPs

WE take a closer look at whale behavior in Uniswap v3, examine the top 5 positions in popular pools, and explore how this information can be valuable for other investors.

2min read

April 17, 2023

Streamia: How Panoptic Prices Perpetual Options

Streamia (Streaming + Premia) aims to make options trading more accessible, capital efficient, and secure.

3min read

April 14, 2023

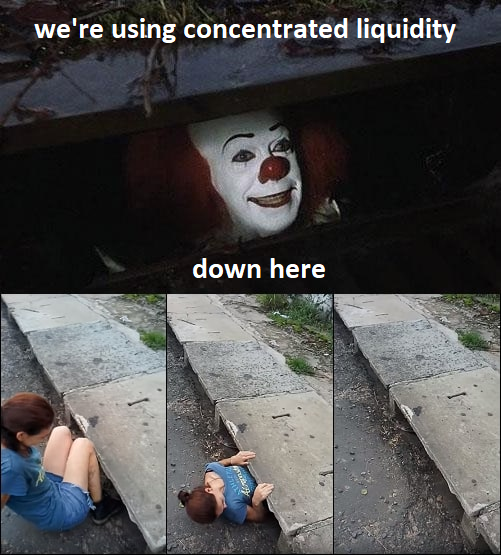

8 Reasons Why Concentrated Liquidity (and Panoptic) is the FUTURE

Uniswap v3's business license expired, sparking a massive wave of interest in Concentrated Liquidity Market Makers (CLMM). Here's why concentrated liquidity is here to stay.

2min read

April 11, 2023

How Concentrated is Concentrated Liquidity in Uniswap V3

The pareto principle applies to Uniswap, too.