25 posts tagged with "LPs"

View All Posts

2min read

April 4, 2023

Implied Volatility and Volatility Smile in Uni v3

Implied volatility and volatility smile are two concepts that underlie how the market prices options and perceives risk. In this post, we'll explore what they are, how they work, and what their role is in Panoptions.

3min read

March 31, 2023

Maximizing Profits: Naked Calls vs. Covered Calls

If you're looking for a way to earn extra income, selling call options can be a powerful strategy. But beware: selling naked calls can be risky. Here's what you need to know.

2min read

March 15, 2023

Maximizing Profits: Buying ETH Call Options on Uniswap

How DeFi call options perform against HODLing.

3min read

March 8, 2023

Maximizing Profits: Buying Put Options on 16 Uniswap Pools

What if users could SHORT LP tokens and effectively BUY options...?

3min read

February 17, 2023

Forward Testing with Monte Carlo

How to simulate the future price of ETH.

2min read

February 15, 2023

Good Pools and Bad Pools on Uniswap V3

We analyze the most profitable (and unprofitable) pools to LP on Uniswap.

2min read

February 10, 2023

8 Reasons to Be Bullish on Financial NFTs

Uniswap v3 LP positions are the most traded NFT. Here's why we're bullish on financial NFTs.

2min read

February 8, 2023

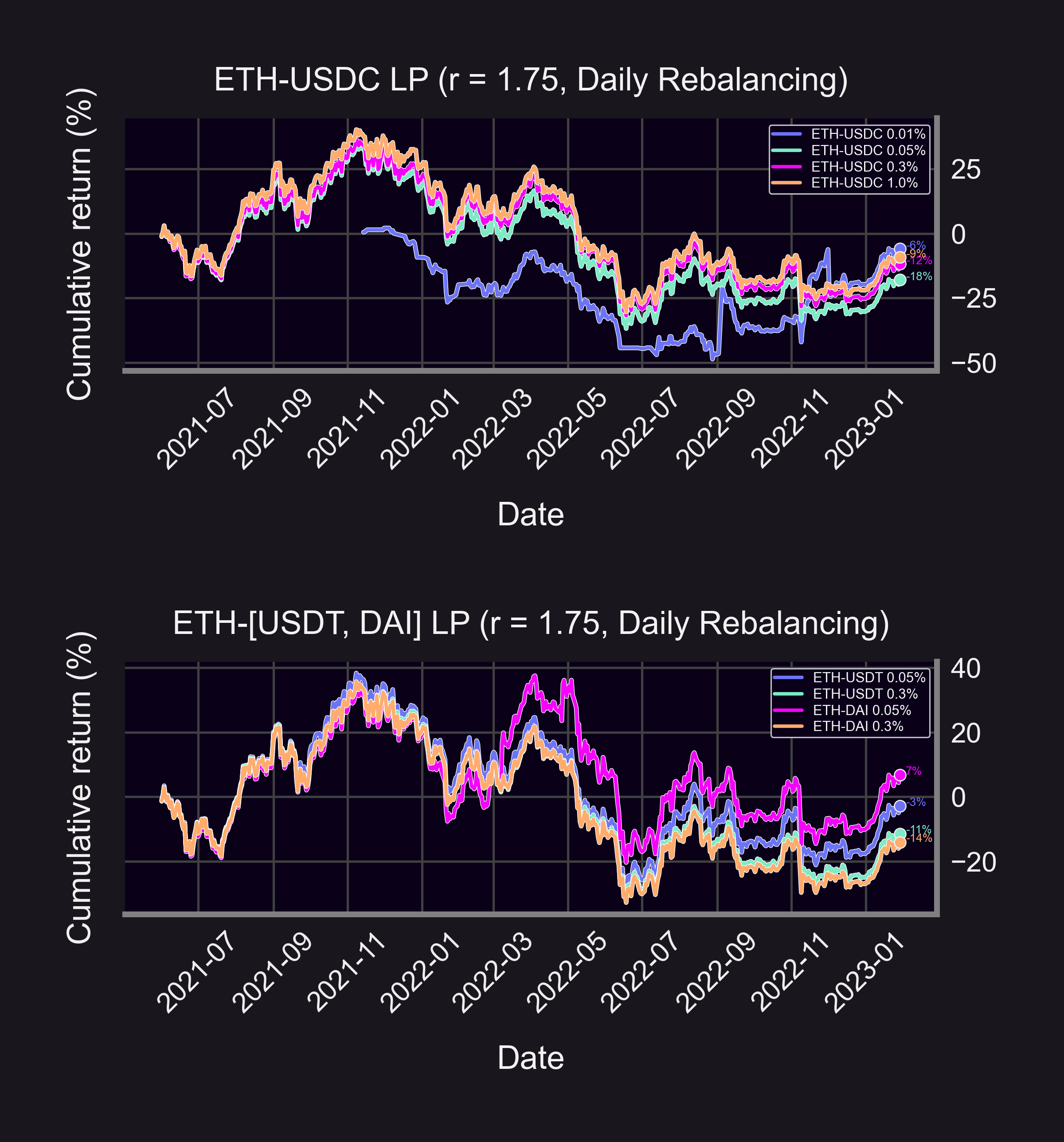

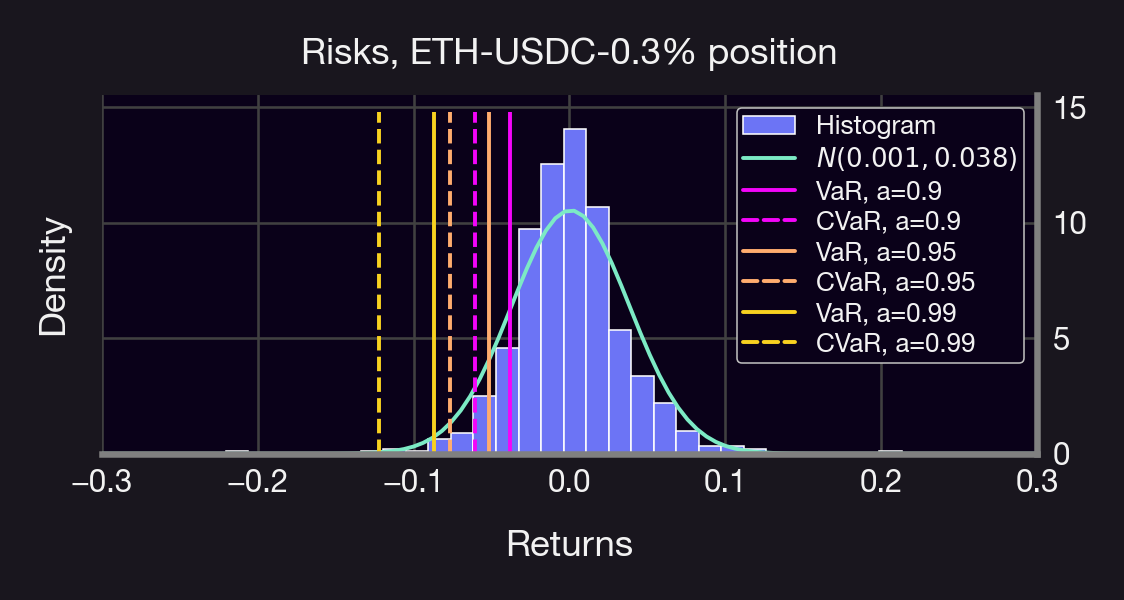

Maximizing Profits on Uniswap V3: 21 Popular Pools LPed

We simulated LP performance for 21 popular Uni V3 pools. The results will surprise you.

2min read

February 6, 2023

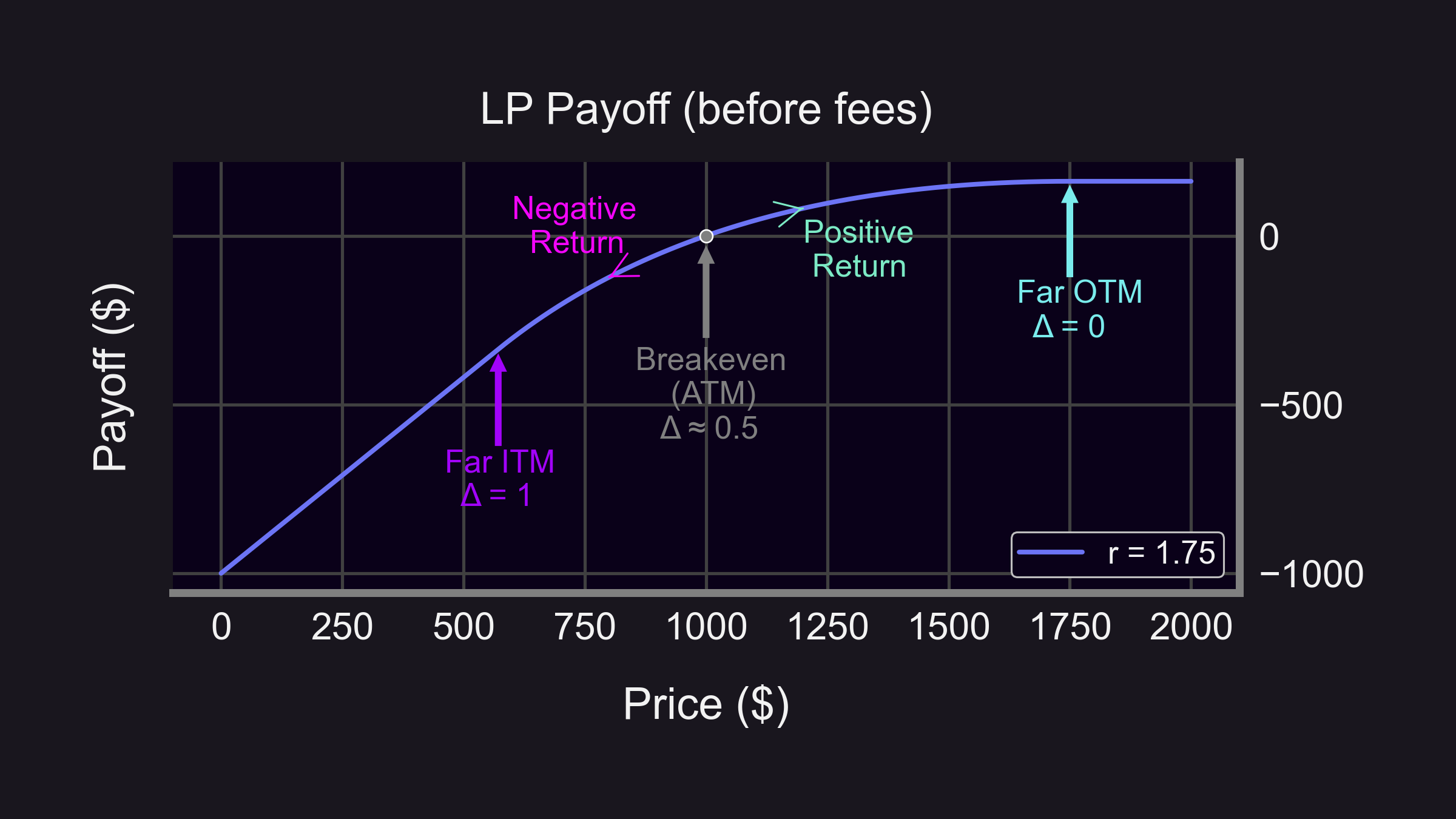

HODL or LP - What's Riskier?

Is LPing riskier than HODLing?