Composability, Perpetuity, and Oracle-Freeness in Panoptic

We heard some of you might have some Q's regarding Panoptions:

- How are they priced?

- Are they any different from Vanilla European Options?

- Why can't we just use Black-Scholes (BSM)?

Read on to find out!

About Panoptic

First: Panoptic is a composable, perpetual ⌛️, oracle-free 🔮, instant-settlement options trading protocol built on top of Uni V3. We're doing for decentralized options what x · y = k automated market makers did for spot trading.

To do this, we make use of the observation that LPing in Uni V3 (i.e. LPing ranged positions) has a very similar payoff curve as selling covered calls. Buying/selling options is intimately related to adding/removing liquidity.

We mentioned that Panoptic is:

- Composable

- Perpetual ⌛️

- Oracle-free 🔮

These 3 characteristics make Panoptic different from other protocols! Let's describe them briefly:

Composability

By "composable" we mean that users can create multi-legged options positions on a single mint! This allows for a wide variety of strategies that can be adjusted to each user's needs. Wanna know more about multi-legged positions? We got you covered.

Perpetuity

Perpetual options have no expiration date & can be exercised at any time. This makes them more flexible than vanilla options. However, they can't be priced using Black-Scholes...but their pricing is based on a model that does not require an oracle.

Oracle-Free

Why did we choose to not rely on a price oracle 🔮?

Cons of oracles:

- Need to provide reliable data 100% of the time

- Are complex to integrate on chain

- Can be expensive to maintain

This is difficult in DeFi! So how do we calculate the price without oracles? Panoptic uses an oracle-free concept called streamia (streaming premia):

- No upfront payment

- Instead, buyers pay a small fee at every block to keep their position open, whenever it is near-the-money

- This per-block fee is computed from every change in price of the asset

Intuitively,

- If price changes a lot, volatility + fees are big

- If it doesn't change much, volatility + fees are small

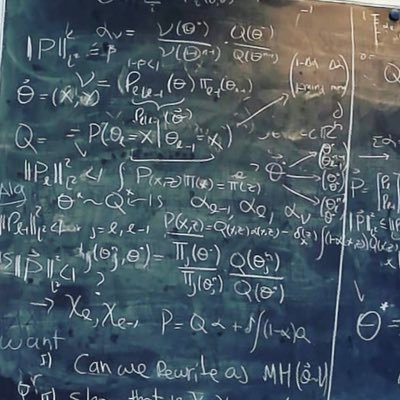

Mathematically, the total premium corresponds to integrating theta (θ) of the option over time (with θ the rate of change of the option premium, P, with respect to time), see formula below.

This corresponds to options that continuously expire at small time intervals (∆t). Does Panoptic integrate θ on-chain? No! 🙅♂️ In practice, this premia corresponds to the LP fees in the Uni V3 pool! Does this converge to BSM? Yes! 🤯 We can verify this w/ Monte Carlo:

Ok, so how do we implement this on chain? Using Uni V3-like structure!

- We keep track of fees + liquidity associated to each pos.

- As price moves, fees accumulate

- A buyer that opens at

t1& closes att2pays fees proportional to Uni v3 fees (plus an additional liquidity-based spread) betweent1&t2 - Indeed, UniV3 collects fees.

where

fgupperandfglowerare thefeegrouwthOutside0x128of the upper and lower ticks in Uni v3, andfginsdelast = feeGrowthInsde0lastX128, and liquidity is the liquidity owned by the protocol.

In this setting, the option buyer would pay a premium as shown below to the seller:

😮💨 We tried hiding a lot of the "mathier" details, but we hope that wasn't too much to digest! If it was, or if you want to learn more about Panoptic, you can read our whitepaper.