The Evolution of Financial Systems: From Spot to Derivatives and Beyond

It happened in TradFi and DeFi, and now it's happening to NFTs with JPEG "perps".

- How did we get here?

- What are NFT perps?

- What's next?

How did we get here?

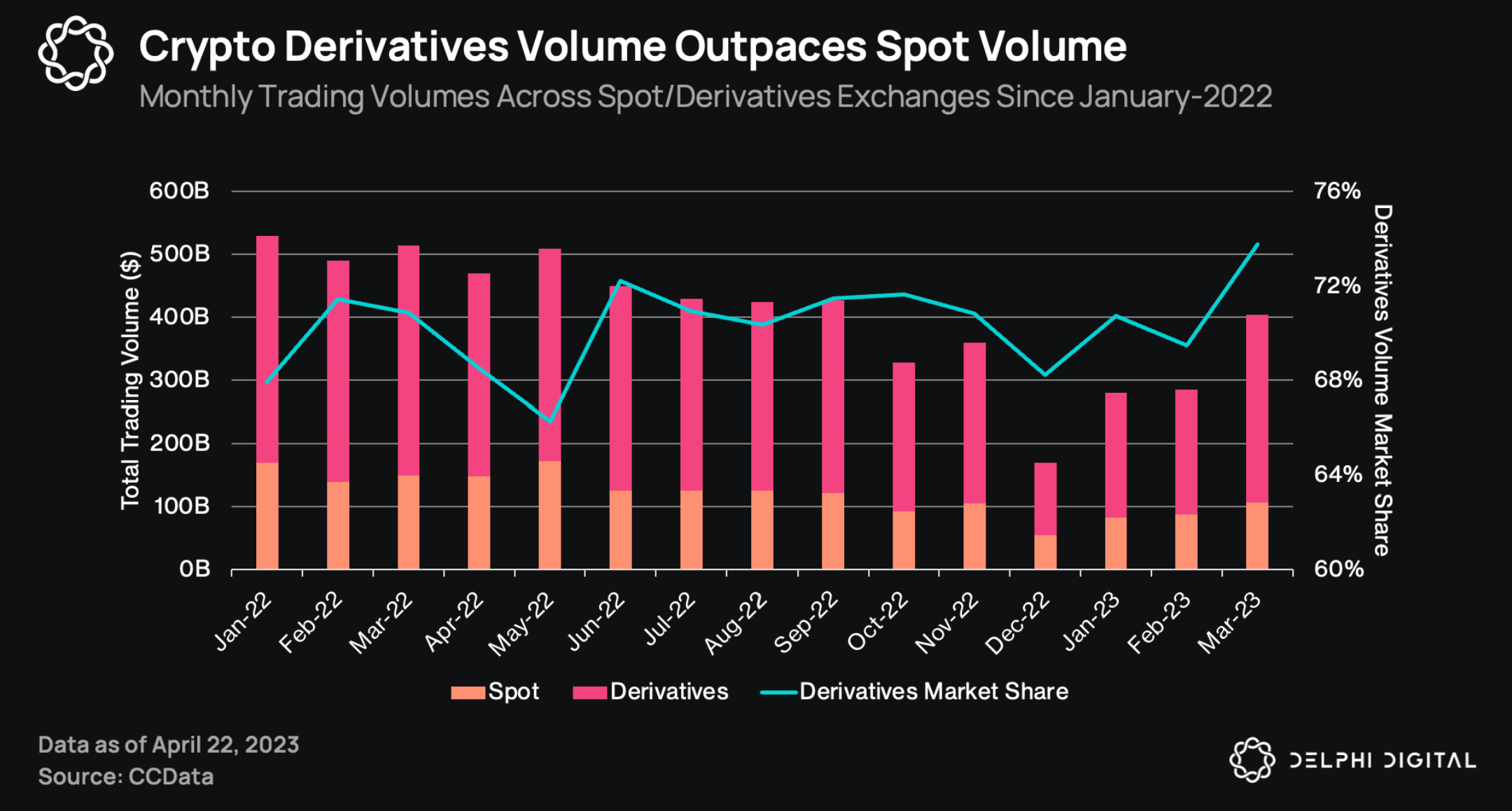

First, some background. Recent research from Delphi Digital shows crypto derivatives outpace spot trading, with NFT "perps" slowly emerging.

- Why are derivatives so popular?

- How are they better than spot?

We'll explain 👇

Spot vs. Derivatives

- Spot: This includes stocks, bonds, commodities, currencies, crypto, etc.

- Derivatives: Derive their value from underlying assets which can either be spot assets or other derivatives (derivative-ception 🤯). Includes futures, forwards, swaps, and options.

What can derivatives do that spot can't?

- Lock in prices

- Hedge positions

- Capital Efficient

- More liquid

- 24/7 trading

- Speculate on assets moving down, moving sideways, moving, not moving, and more...

The evolution of TradFi & DeFi: Spot → Derivatives

Derivatives volume massively overshadows spot in traditional financial markets. Crypto is following suit, b/c derivatives are superior for the reasons listed above. Crypto derivatives volume market share is already >65%.

1/ 📈 Crypto derivatives, like futures and options, derive value from assets like BTC and ETH. They let traders speculate or hedge without buying the assets themselves.

— yh.ΞTH🦇🔊 | Delphi Digital (@yh_0x) May 17, 2023

A three-month streak of increasing derivatives volume shows a growing preference for this trading approach. pic.twitter.com/ZRRmJOPGN3

What are NFT perps?

The Evolution of NFTs: Spot → Derivatives

As NFT spot markets mature, higher demand for liquidity, shorting, leverage, and hedging leads to derivative products entering the NFT space. Derivatives include fractionalization, indexes (e.g. floor prices), and now perps!

1/12 The weekly volume on all NFT trading platforms was $120M last week. This includes BAYC, CryptoPunks, LOOT, Azuki, etc.

— Panoptic (@Panoptic_xyz) February 10, 2023

But...

$23 billion (yes, with a B) of value was traded on Uni V3 as financial NFTs 📈

Here's 8 reasons why @Panoptic_xyz is bullish on financial NFTs🧵 pic.twitter.com/nQf7zsCPwQ

NFT → NFT Perps

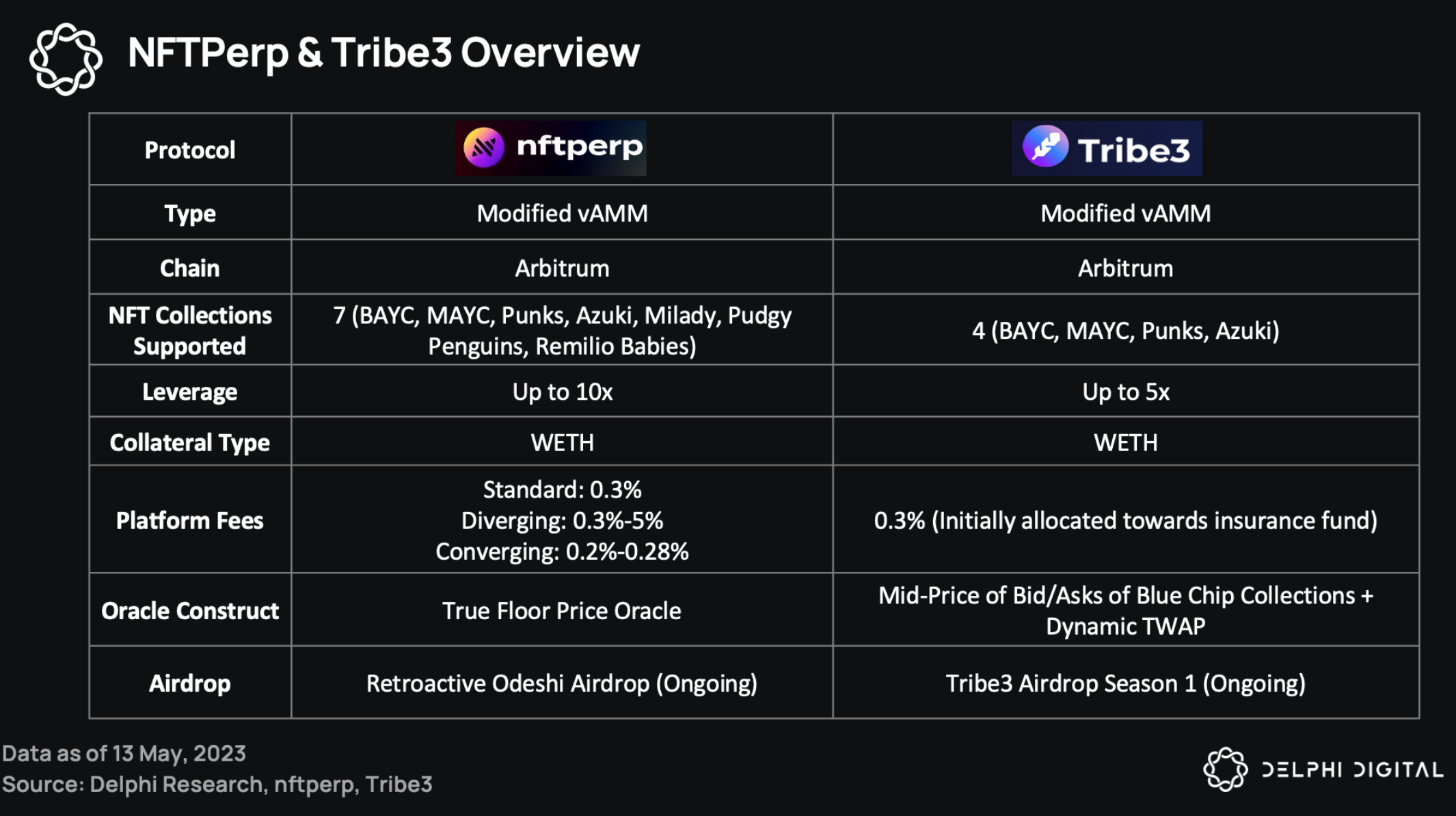

Protocols like nftperp and Tribe3 use perpetual futures to fill this demand:

- Track NFT floor price or bid/ask mid-price

- Long/short

- Up to 5-10x leverage

- "Cash" settled (with ETH)

- More liquidity

This financial breakthrough was powered by Perp Protocol's innovative vAMM design for perpetual futures trading.

What's next?

What's next? Tell us your best guess!

NFTs → NFT Perpetual Futures → ?

DeFi Derivatives Landscape

Similar to NFT markets, the more mature DeFi market has also quickly adopted derivatives like perpetual futures. But what's next?

Tokens → Perpetual Futures → ?

DeFi Perpetual Options: Tokens → Perpetual Futures → Perpetual Options

Like futures, options provide directionality and leverage. But unlike futures, options provide added flexibility:

- Capped losses

- Market-neutral

- Volatility bets

- Custom probability of profit and profit potential

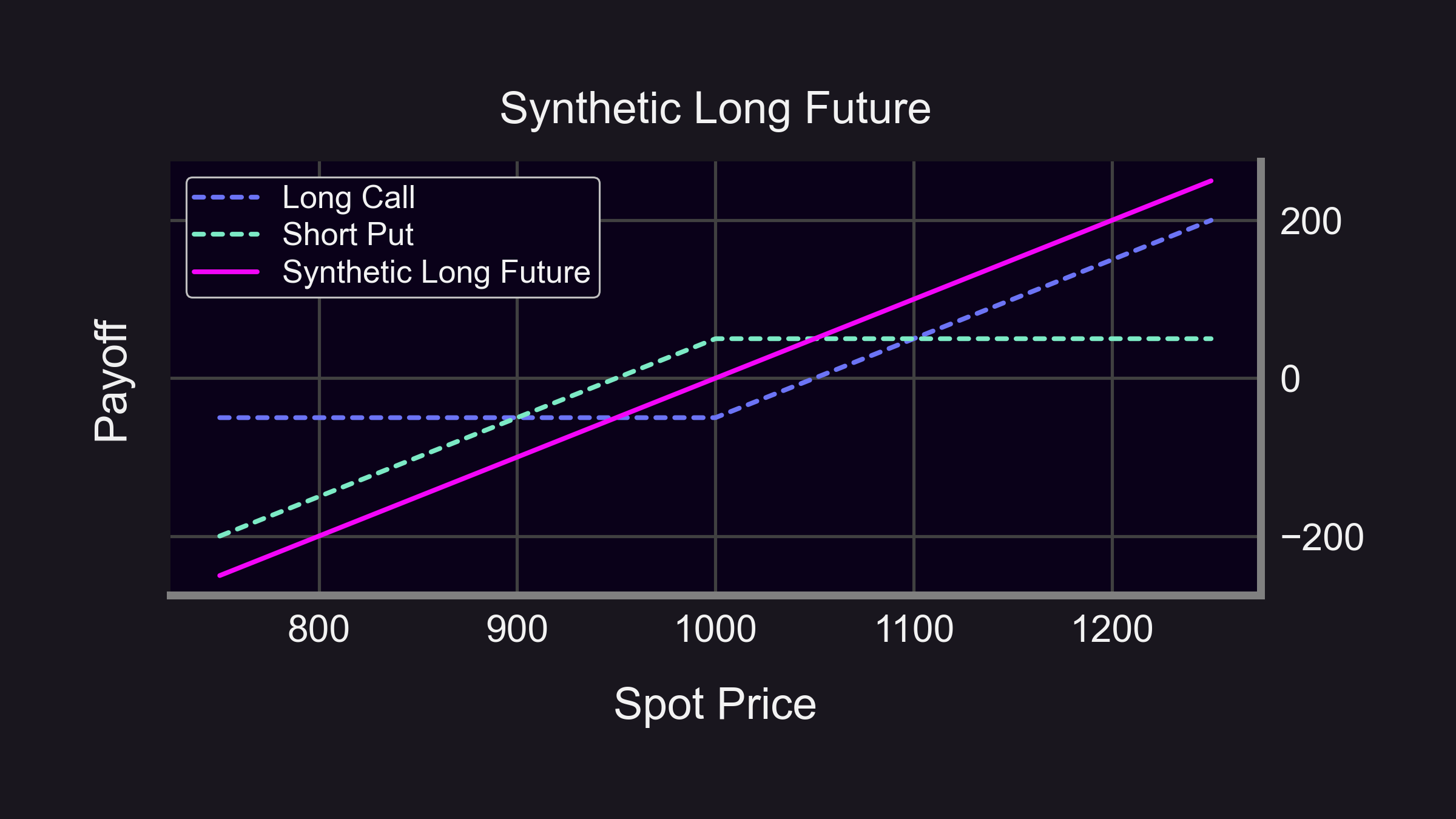

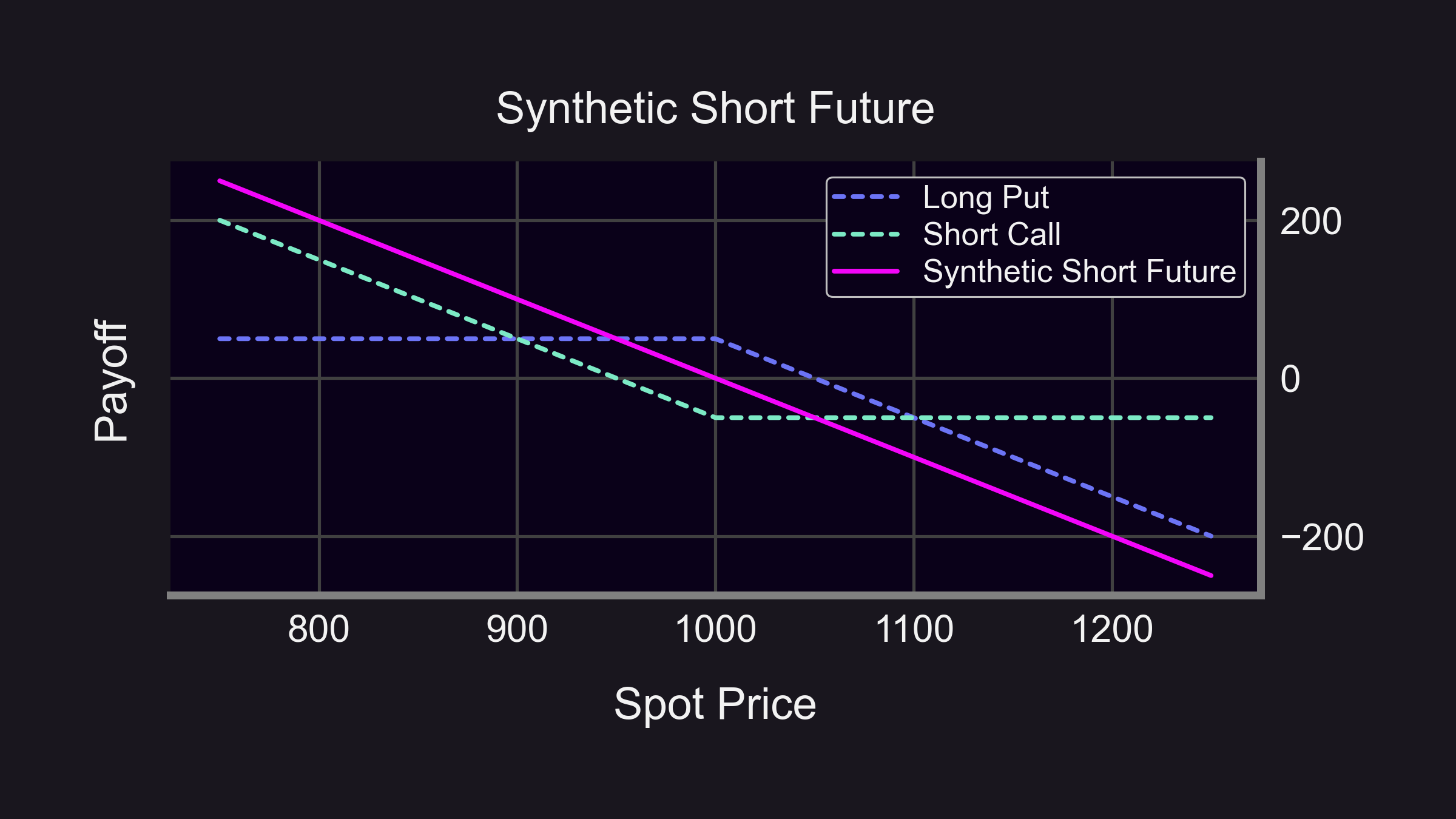

You can replicate futures with options, but not the other way around!

- Futures:

- Linear payoff

- Static delta (∆ = ±1)

- No gamma (Γ = 0)

- Options:

- Non-linear payoff

- Dynamic delta (-1 ≤ ∆ ≤ 1)

- Dynamic gamma (-1 ≤ Γ ≤ 1)

Combining options can yield a static delta with no gamma (just like a futures contract)! 🤯

Similarly, you can replicate "perps" (perpetual futures) with "XPOs" (perpetual options). You'll soon be able to trade perpetual options and synthetic perpetual futures on Panoptic with up to 3.33x leverage.

Options provide traders with added flexibility that futures fall short of. As crypto and NFT markets evolve and mature, they will follow the inevitable pattern of financial markets: Spot → Derivatives → (Perpetual) Futures → (Perpetual) Options