29 posts tagged with "Options Traders"

View All Posts

6min read

December 18, 2023

Introduction to Synthetic Perpetual Futures

In this series, we embark on an in-depth exploration of perps (perpetual futures) and their unique implementation within the Panoptic options trading protocol

6min read

November 28, 2023

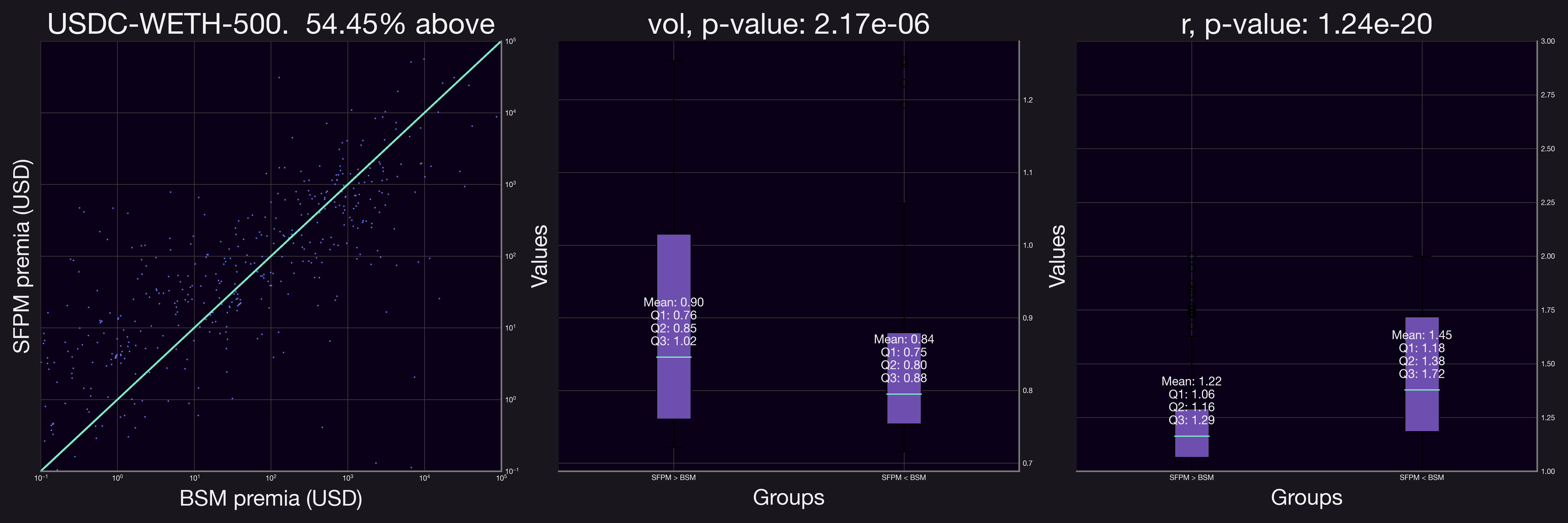

Streamia vs. Black-Scholes Model: A Comparative Study

Have you ever wondered how selling traditional options priced via the Black-Scholes model compare to selling Panoptic options? We analyze hundreds of real LP positions across multiple Uniswap pools to find out.

9min read

October 31, 2023

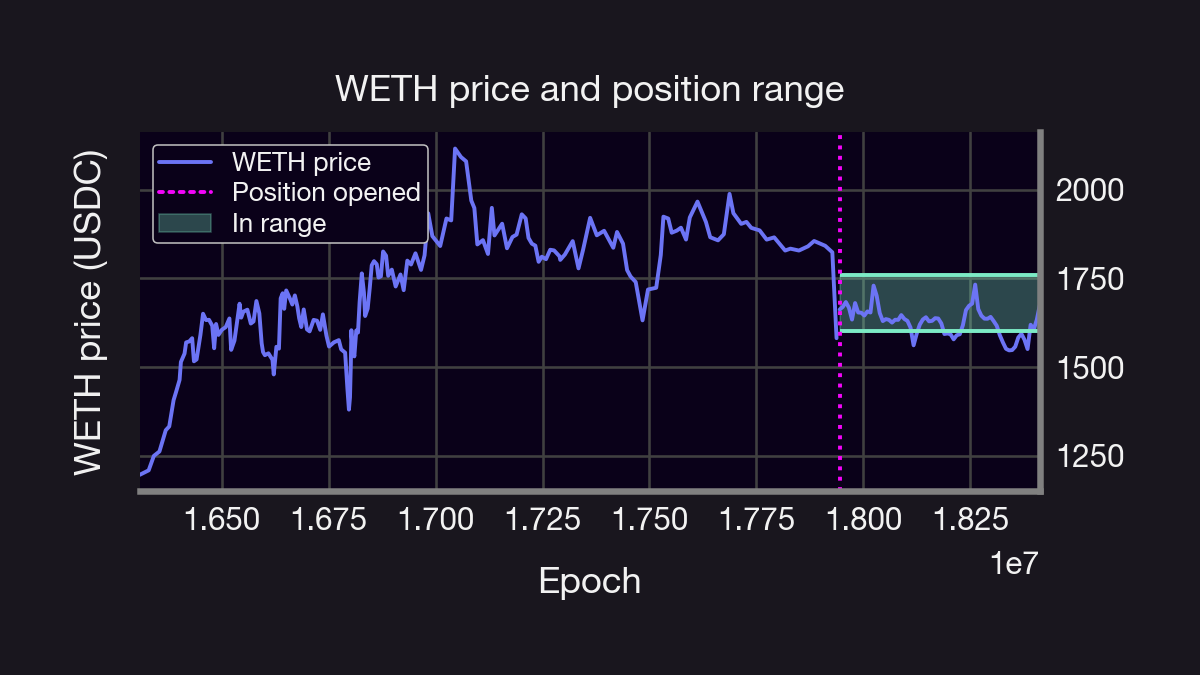

How does LPing in Uniswap V3 compare to selling options in Panoptic?

Have you ever wondered how deploying a liquidity position in Uniswap V3 compares to selling Panoptic options? Spolier alert: you'd be better off with Panoptic

4min read

October 11, 2023

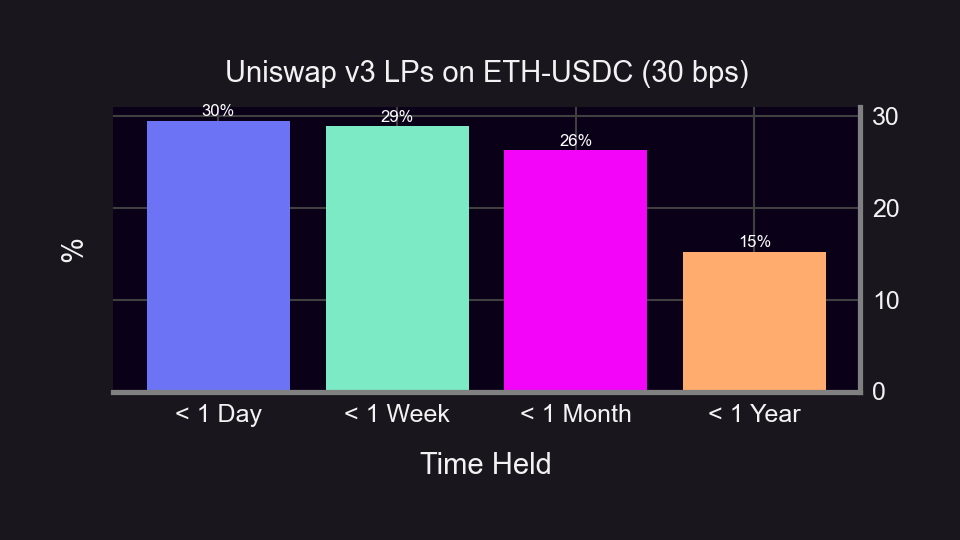

0DTEs on Uniswap – Insights from On-Chain LP data

LP positions are held for a short period of time – typically less than a day. We explore widths and holding time from the POV that LPs are option sellers with an implied expiry date.

11min read

August 21, 2023

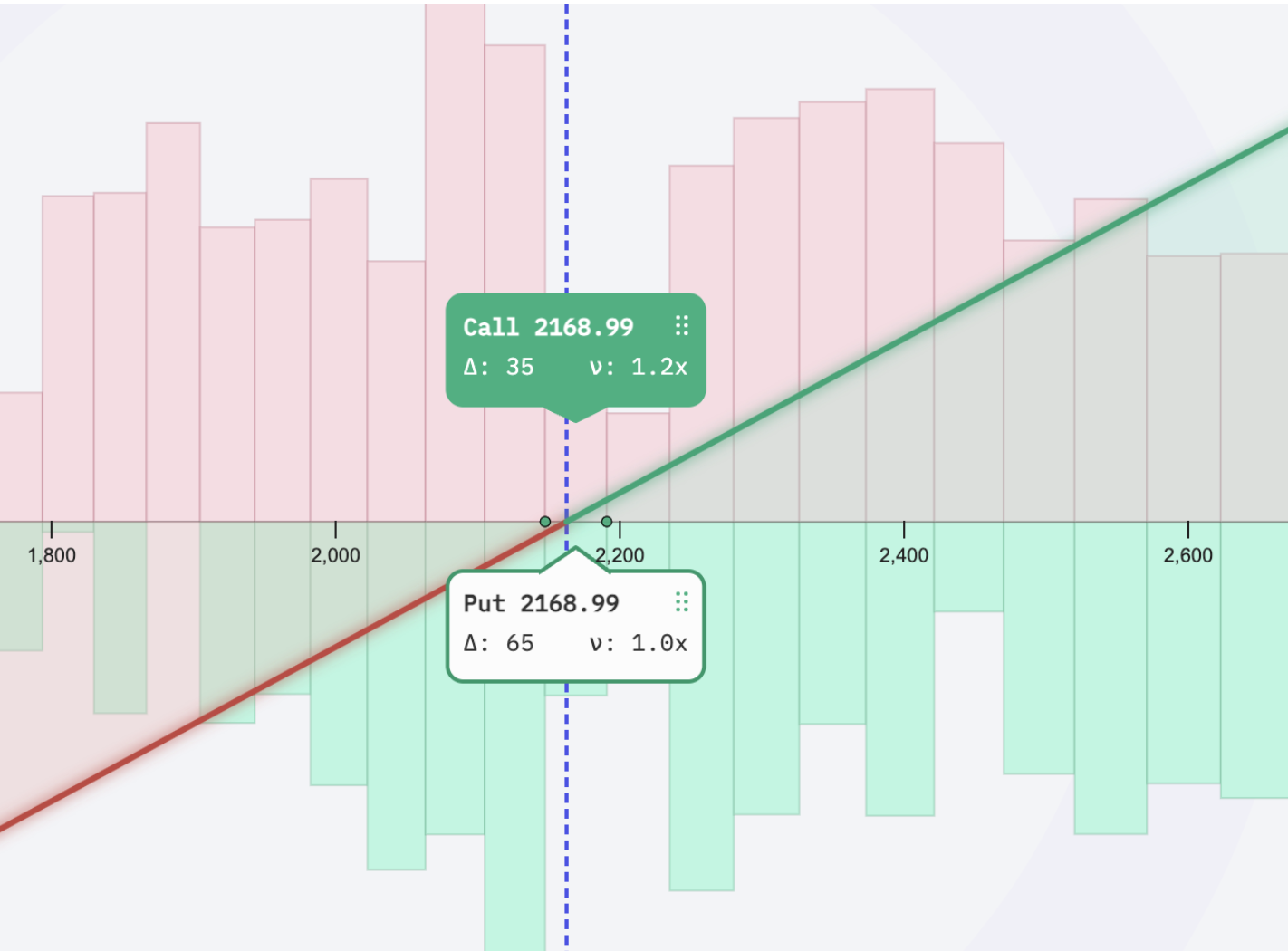

Panoptic Options Trading Strategies Series: Part II — The Covered Call and Active Position Management

The covered call strategy, actively managing your options position, and rolling options

4min read

August 5, 2023

Demystifying IL, LVR, JIT, and MEV

Demystifying impermanent loss, loss versus rebalancing, just in time liquidity, and maximal extractable value through the lens of Uniswap LPing as options selling.

5min read

July 20, 2023

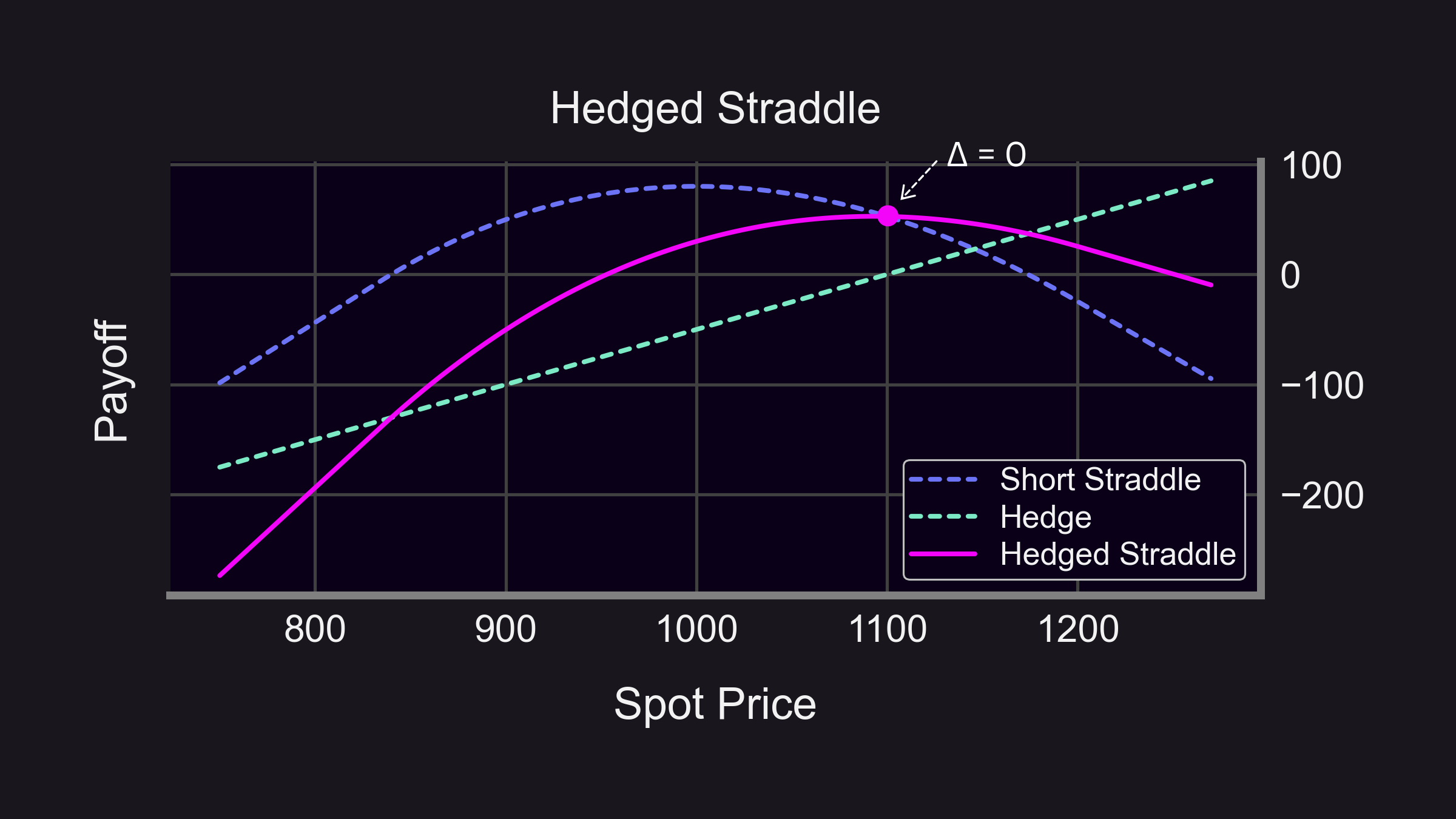

Options Market Making in Panoptic

How Options Market Making Works in Panoptic

8min read

July 6, 2023

Expirationless Options (XPOs) – Will They Replace Perps In Crypto?

Perpetual options are the next big thing - here's why.

2min read

June 6, 2023

Why Options Will Overtake DeFi

With the increasing trend of retail options trading in TradFi, it's only a matter of time before retail options sweeps into DeFi.