Maximizing Profits on Uniswap V3: 21 Popular Pools LPed

We simulated LP performance for 21 popular Uni V3 pools (high TVL & volume). Results were surprising: LPs can be profitable! 📢

- 💰 Which pools made the most?

- 📏 Are narrow or wide ranges better?

Find out 👇

Backtest Strategy

Previously, we explored the ETH-USDC 30bps pool.

1/12 We analyzed simulated LP performance on ETH-USDC 0.3% pool.

— Panoptic (@Panoptic_xyz) February 2, 2023

Results were surprising:

📢 The optimal width was wider than expected.

• What's the optimal width for max returns?

• How does that change for 🐂 vs 🐻 markets?

Find out 👇

For this study:

- 🗓️ Jun 2021 - Jan 2023 (20 months) for most pools

- ⚖️ Daily rebalancing

- 📏 Narrow (r = 1.05) & wide (r = 1.75) ranges

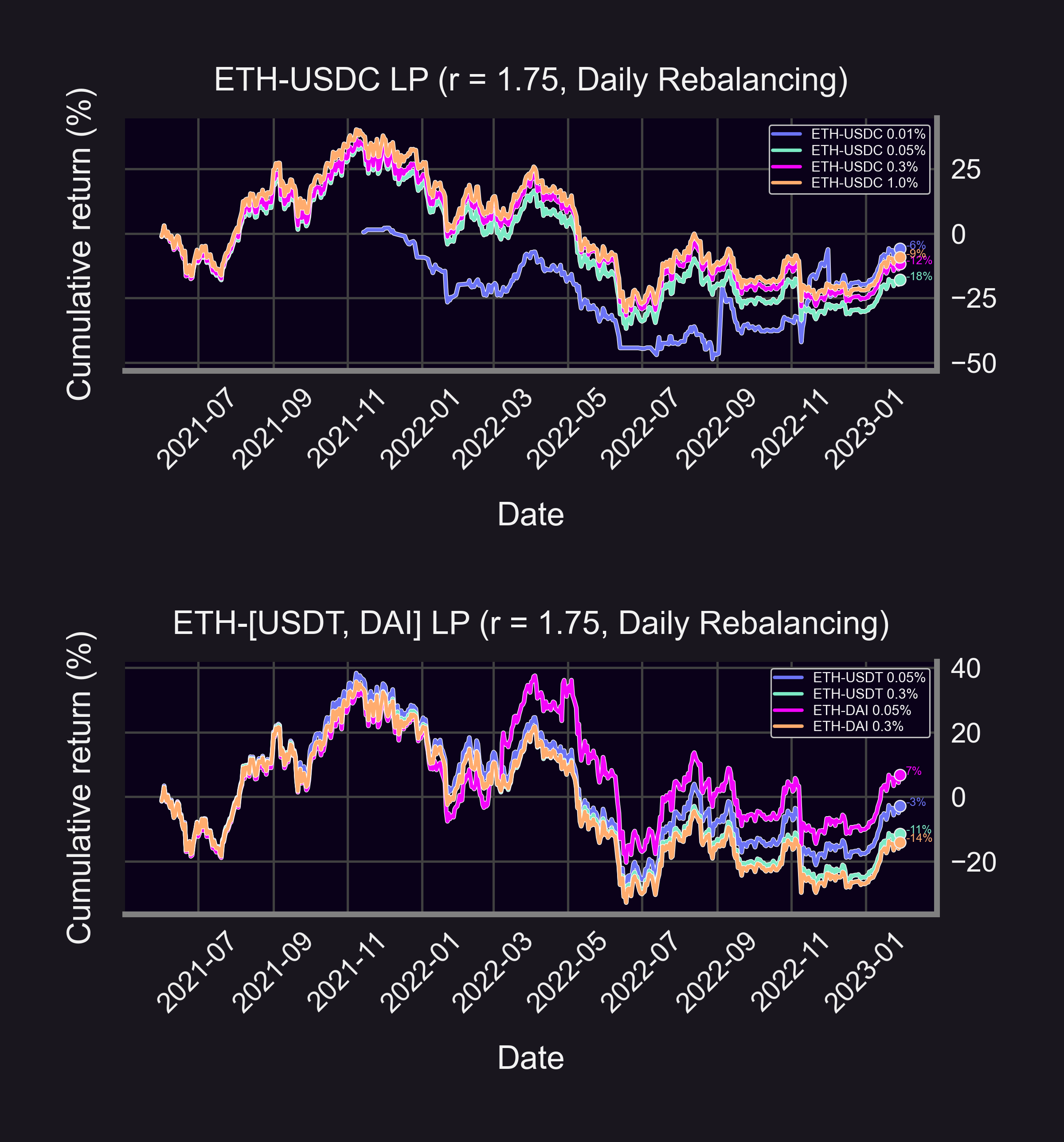

Here's how other ETH-stablecoin pools compare👇

ETH-Stablecoin Pools

Bad pools 😔 (but can you spot the good pool 🐶?)

- ETH-USDC (5bps): -18%

- ETH-DAI (30bps): -14%

- ETH-USDC (30bps): -12%

- ETH-USDT (30bps): -11%

- ETH-USDC (100bps): -9%

- ETH-USDC (1bp): -6%

- ETH-USDT (5bps): -3%

- ETH-DAI (5bps): +7%

(Returns in stablecoin)

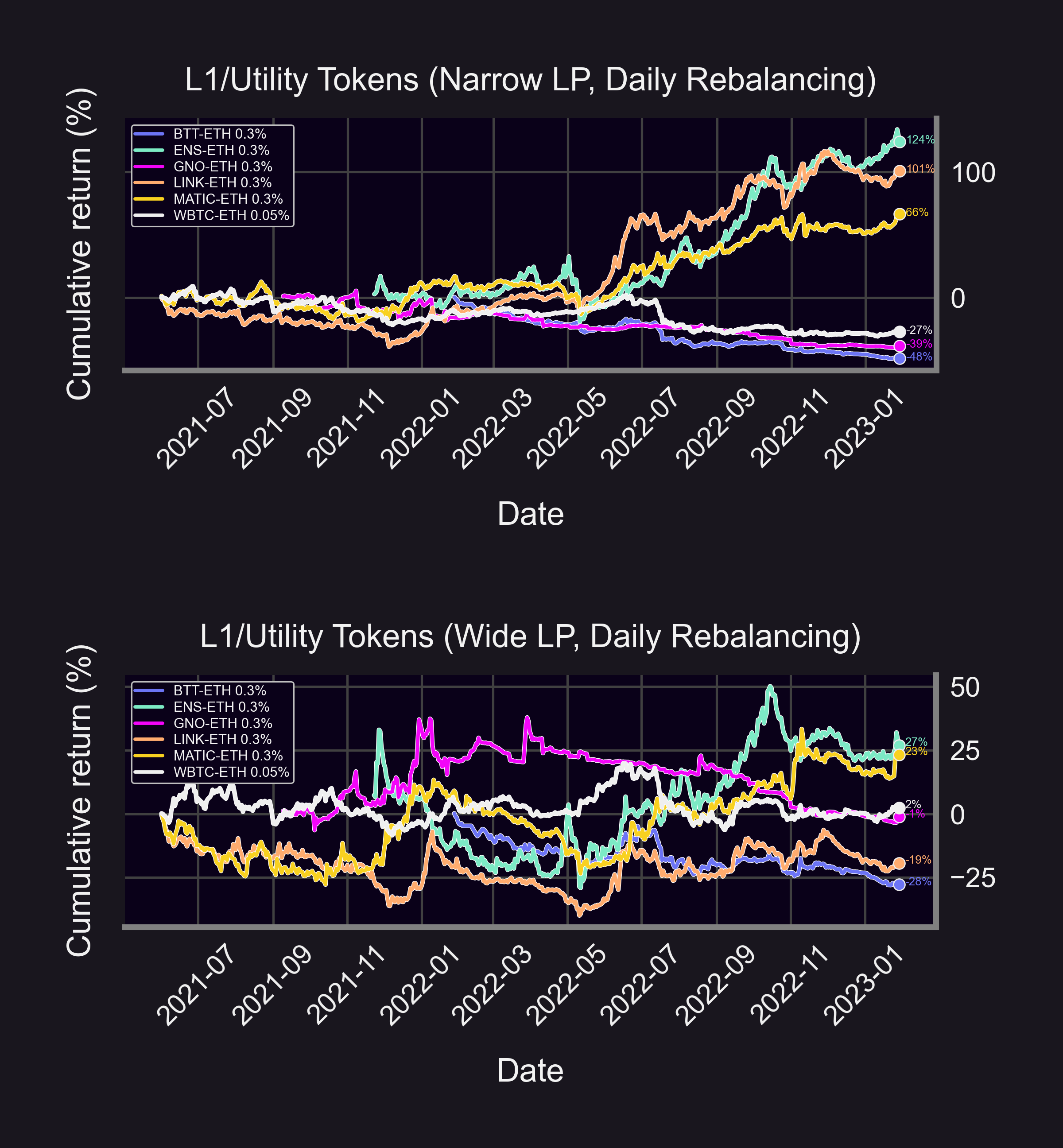

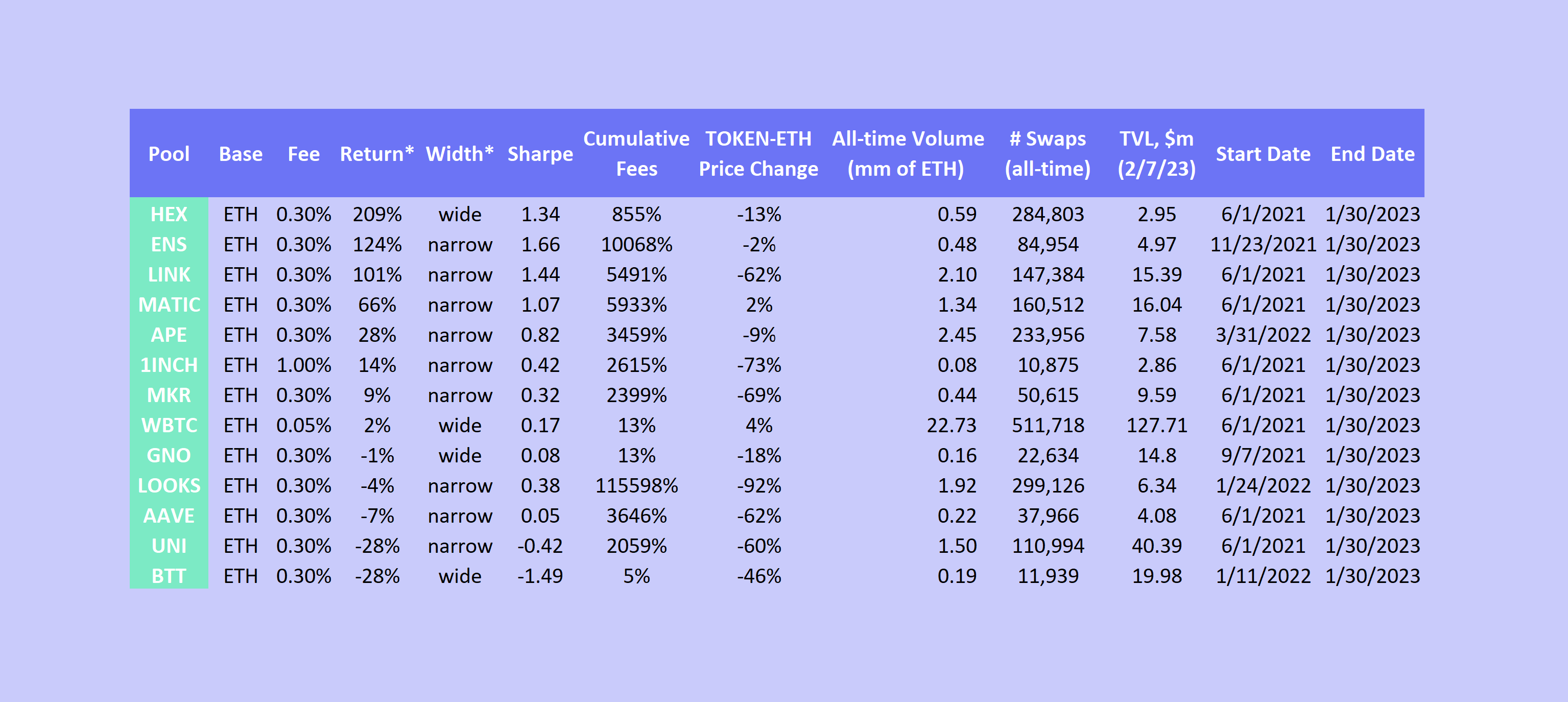

L1/Utility Tokens

We lump some pools together and slap the label "L1/Utility Tokens" on 'em (see legend 👇 for pool details)

Good pools:

- 😊 MATIC (+66%, narrow)

- 😍 LINK (+101%, narrow)

- 🤩 ENS (+124%, narrow)

Bad pools:

- 😦 WBTC (+2%, wide)

- 😢 GNO (-1%, wide)

- 😭 BTT (-28%, wide)

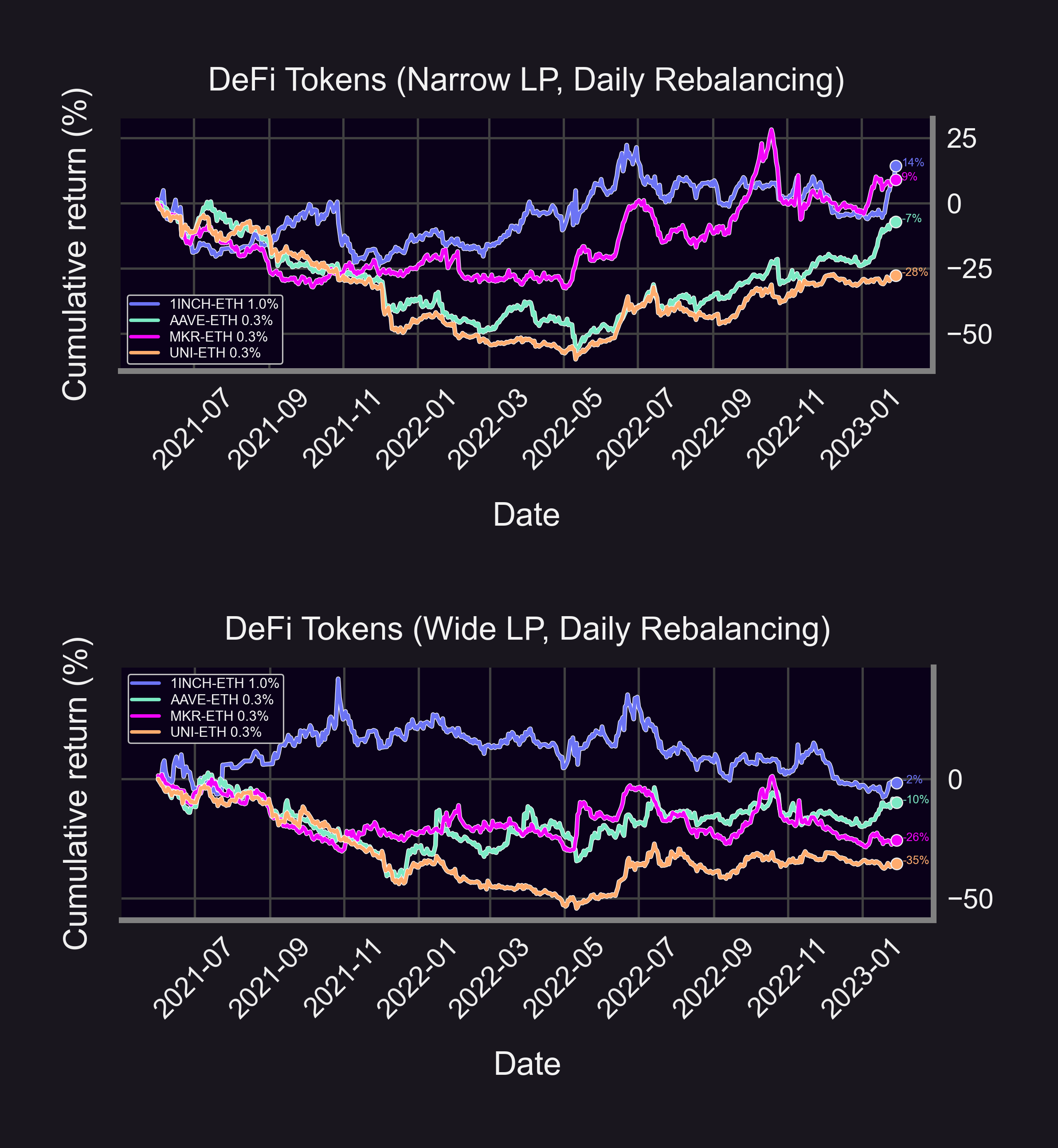

DeFi Tokens

Now for DeFi.

Good pools:

- 🙂 MKR (+9%, narrow)

- 😎 1INCH (+14%, narrow)

Bad pools:

- 😕 AAVE (-7%, narrow)

- 🙁 UNI (-28%, narrow)

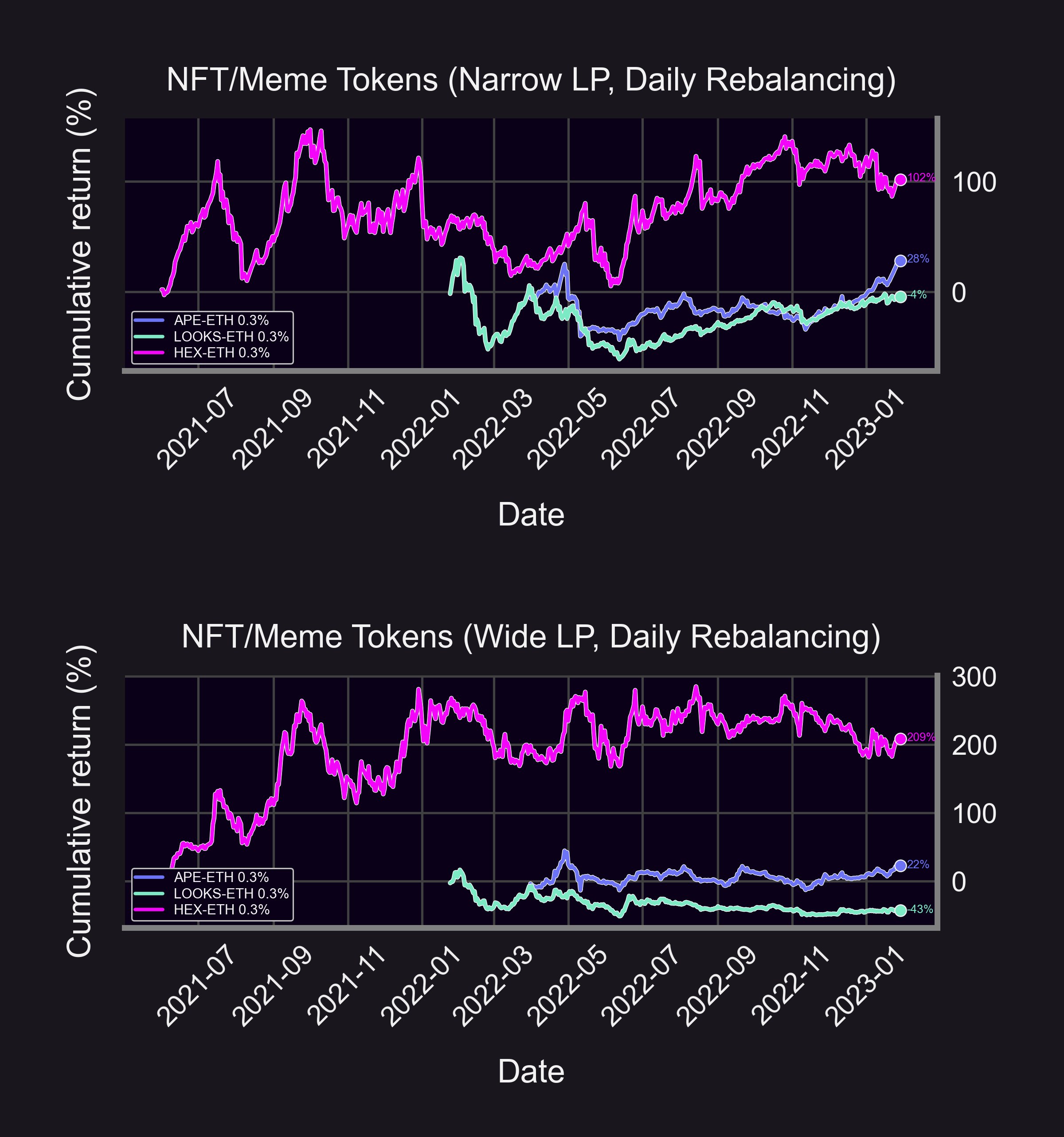

NFT/Meme Tokens

And NFT/Meme tokens???

Good pools:

- 😅 APE (+28%, narrow)

- 🤣 HEX (+209%, wide)

Bad pools:

- 😶 LOOKS (-4%, narrow)

For ERC20-ETH pools, returns are in ETH. Even if we earn 209% in ETH, if ETH price in $ is falling, we might lose in terms of $. But you can always hedge by shorting ETH! (Panoptic sooon!)

(What if we calculated returns in the ERC20 token...future #ResearchBites? 😉)

1/18 Read our latest: #ResearchBites from @brandonly1000 of the @Panoptic_xyz research team!

— Panoptic (@Panoptic_xyz) January 25, 2023

=====

How to hedge ANYTHING (including UniV3 LP positions) with options 👇

Summary

Key Insights:

- 💀 ETH-stablecoin pools underperformed (too popular?)

- 🏆 ERC20-ETH pools outperformed (not enough ❤️)

Common traits for outperforming strategies:

- Narrow LP range

- Minimal pool price change

- ⬆️ Volume ⬇️ TVL

Caveats:

- ⛽ Ignores gas/slippage/swap fees

- 📈 Assumes fees/returns compound day-over-day

- ⚠️ Past performance is no guarantee of future results!

Question:

- 🐂🐻 What if we LP with bullish or bearish bias? (Future #ResearchBites 😉)

I've created a couple of flowcharts to help beginners deploy+manage their @Uniswap v3 liquidity position.

— Guillaume Lambert | lambert.eth | 🦇🔊 (@guil_lambert) January 20, 2022

•Part 1: Choosing a size+range for a given holding timeline –eg. 1d, 1w, 1 mo, 1y?

•Part 2: Managing LP positions via daily checks –ie. when to exit position+take profits pic.twitter.com/Y6mPe8Cp28

Disclaimer:

- 📢 None of this should be taken as financial advice.

- ⚠️ Past performance is no guarantee of future results!