11 posts tagged with "LP"

View All Posts

6min read

September 25, 2024

Panoptic Solves LVR

Panoptic addresses the issue of Loss-Versus-Rebalancing (LVR) for Uniswap LPs by boosting LP returns through LP token lending markets, passive liquidity provision, and the ability to short LP tokens, turning LVR from a risk into a strategic opportunity.

3min read

May 2, 2023

Whale Watching - Uniswap v3 LPs

WE take a closer look at whale behavior in Uniswap v3, examine the top 5 positions in popular pools, and explore how this information can be valuable for other investors.

2min read

April 11, 2023

How Concentrated is Concentrated Liquidity in Uniswap V3

The pareto principle applies to Uniswap, too.

2min read

April 4, 2023

Implied Volatility and Volatility Smile in Uni v3

Implied volatility and volatility smile are two concepts that underlie how the market prices options and perceives risk. In this post, we'll explore what they are, how they work, and what their role is in Panoptions.

2min read

February 15, 2023

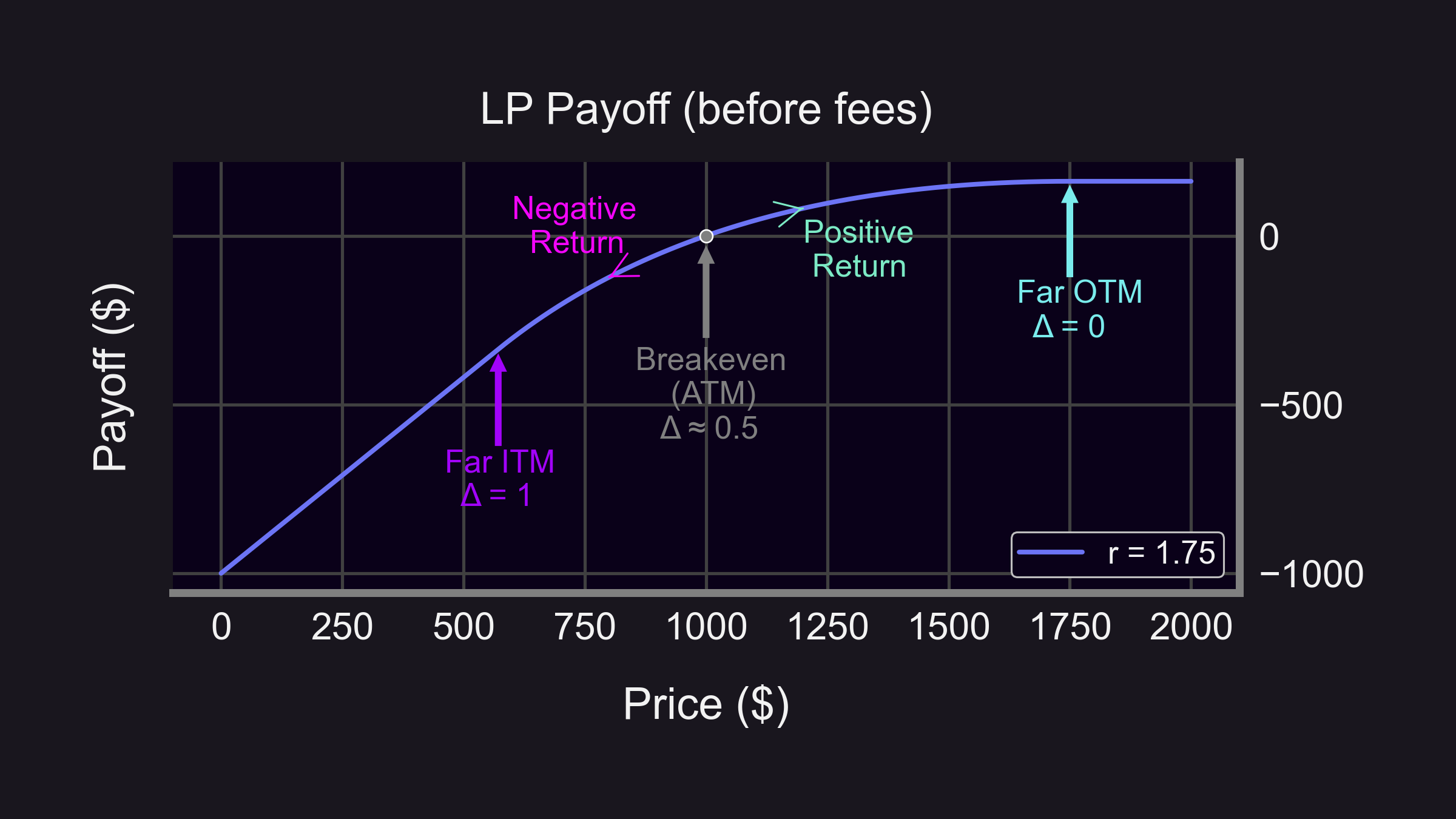

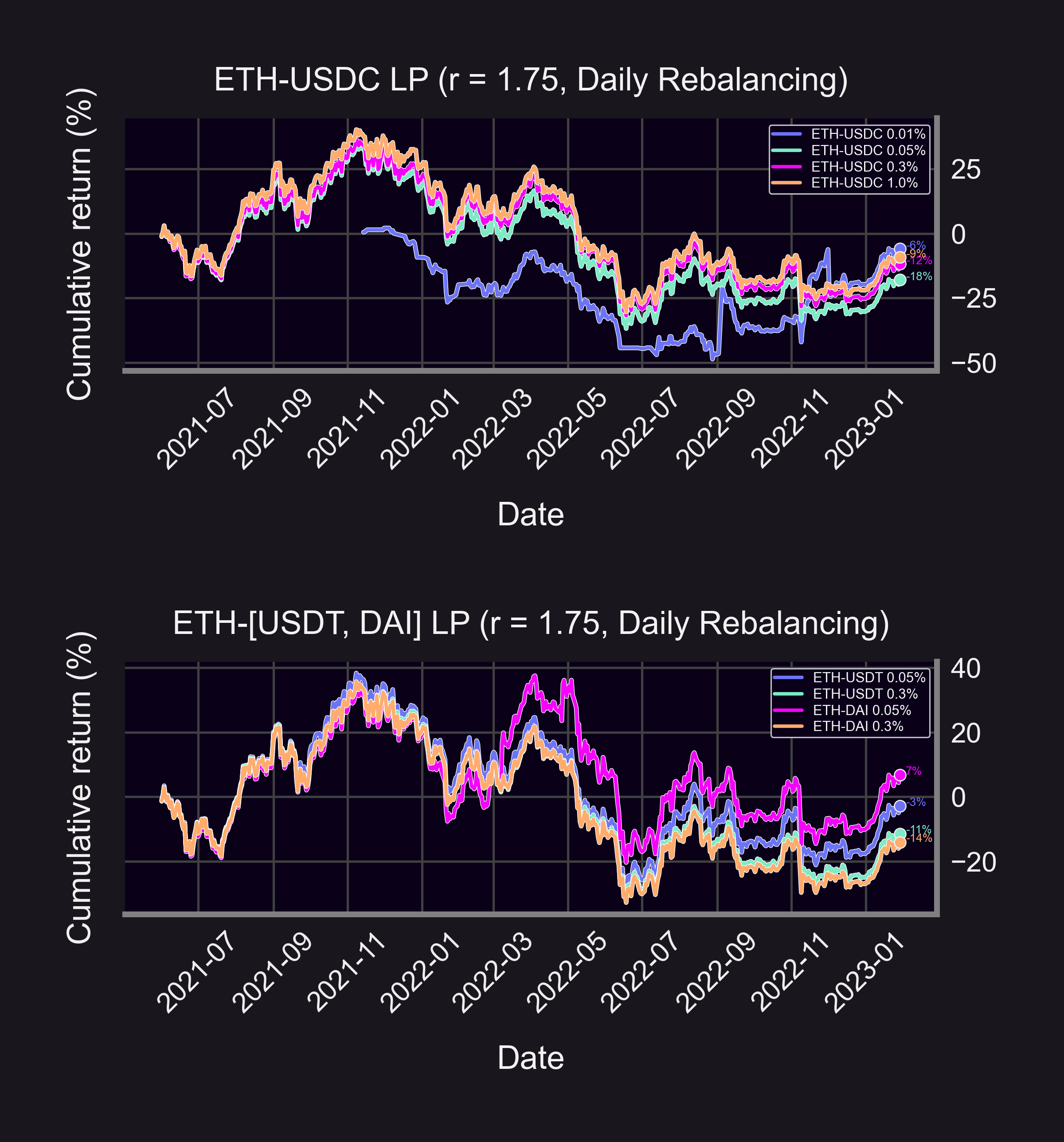

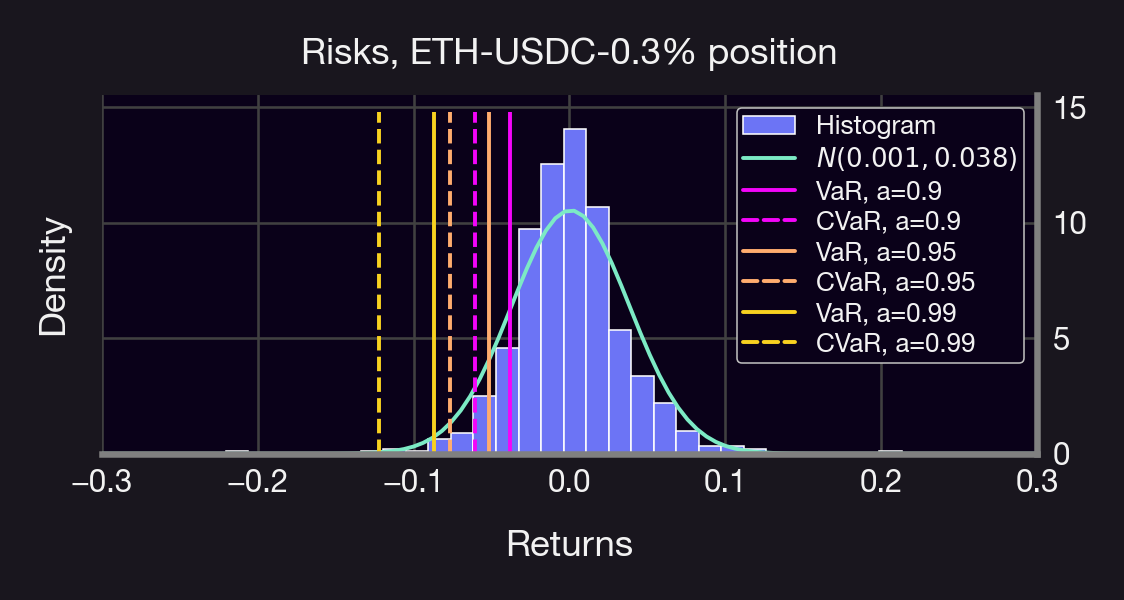

Good Pools and Bad Pools on Uniswap V3

We analyze the most profitable (and unprofitable) pools to LP on Uniswap.

2min read

February 8, 2023

Maximizing Profits on Uniswap V3: 21 Popular Pools LPed

We simulated LP performance for 21 popular Uni V3 pools. The results will surprise you.

2min read

February 6, 2023

HODL or LP - What's Riskier?

Is LPing riskier than HODLing?

3min read

February 2, 2023

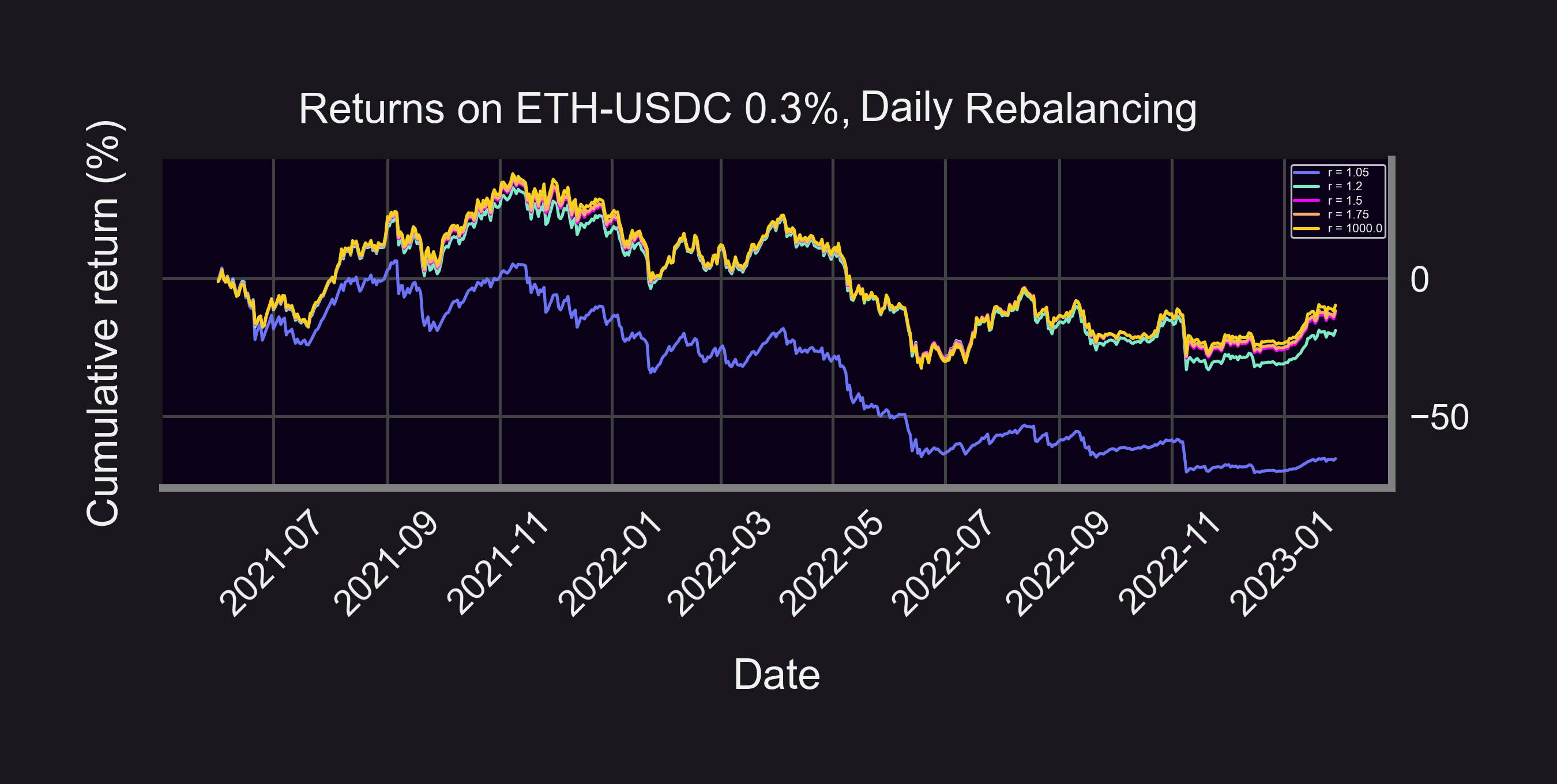

Optimal LP Width in Bull/Bear Markets

We analyzed LP performance on the ETH-USDC 0.3% pool. The results will surprise you.

3min read

January 25, 2023

How to hedge ANYTHING (including Uni v3 LP positions) with options

Learn how to hedge with options.