Optimal LP Width in Bull/Bear Markets

We analyzed simulated LP performance on ETH-USDC 0.3% pool. Results were surprising: the optimal width was wider than expected! 📢

- What's the optimal width for max returns?

- How does that change for 🐂 vs 🐻 markets?

Find out 👇

LP Strategy

The strategy is simple:

- 💦 LP around the current ETH price with ±X% width

- ⚖️ Rebalance your LP position after a day, week, or month (you pick)

- 💵 Collect & compound your fees!

Our analysis includes >1.5 years of data (Jun 2021 - Jan 2023) on 5 different range factors:

- ±5% (r = 1.05)

- ±20% (r = 1.2)

- ±50% (r = 1.5)

- ±75% (r = 1.75)

- ∞ (UniV2 full-range, r = 1000)

1/13 Read our latest #ResearchBites from @brandonly1000 of the@Panoptic_xyz research team!

— Panoptic (@Panoptic_xyz) January 18, 2023

=====

How do you LP on UniV3 with a ±% range?

E.g. if you wanted ±30% should you do:

1) Lower: P * 70%

Upper: P * 130%

or

2) Lower: P / 1.3

Upper: P * 1.3

Let's find out!👇 pic.twitter.com/QChXAuIonz

Which one did best?🤔

Full Period Results

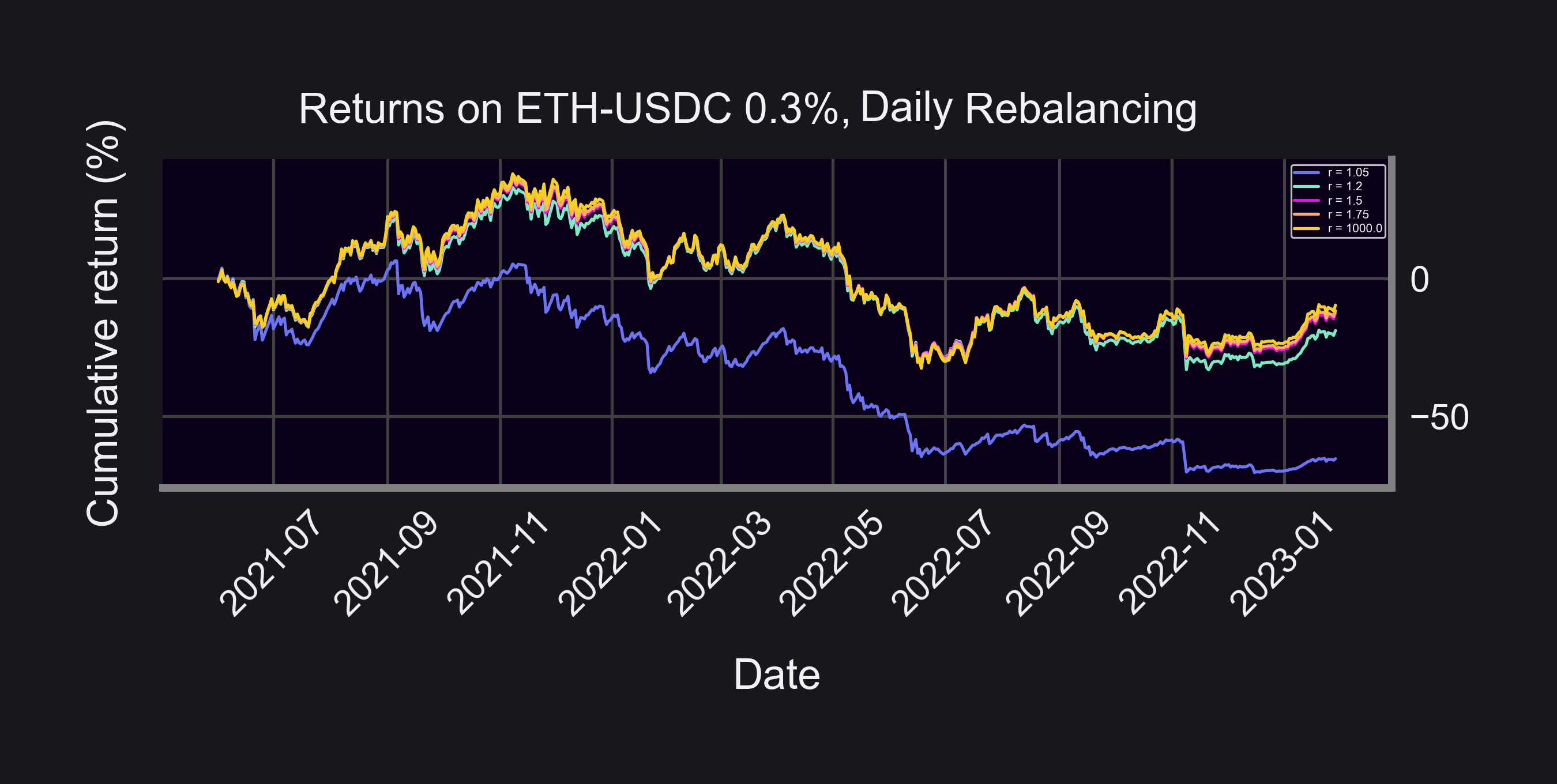

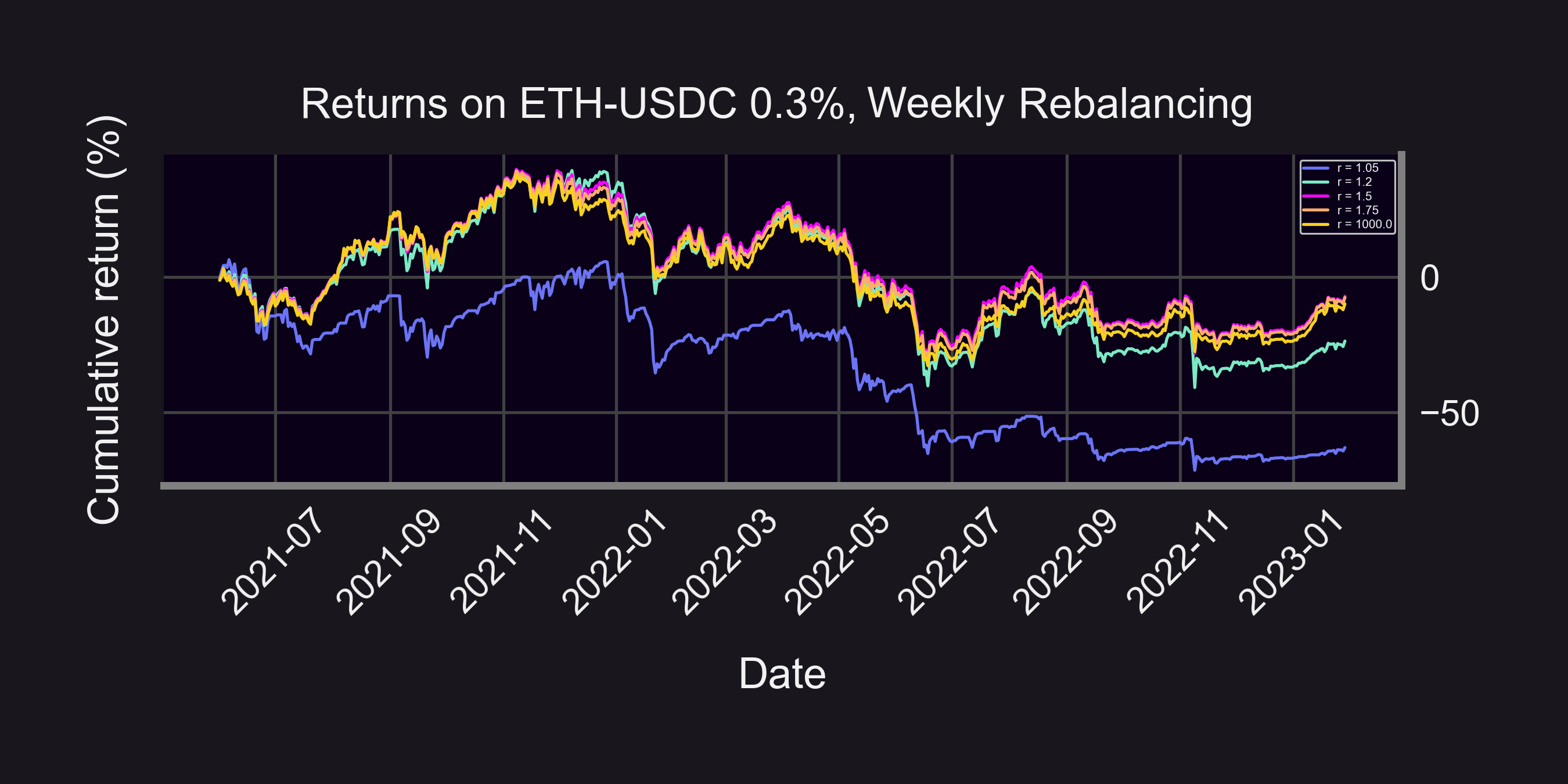

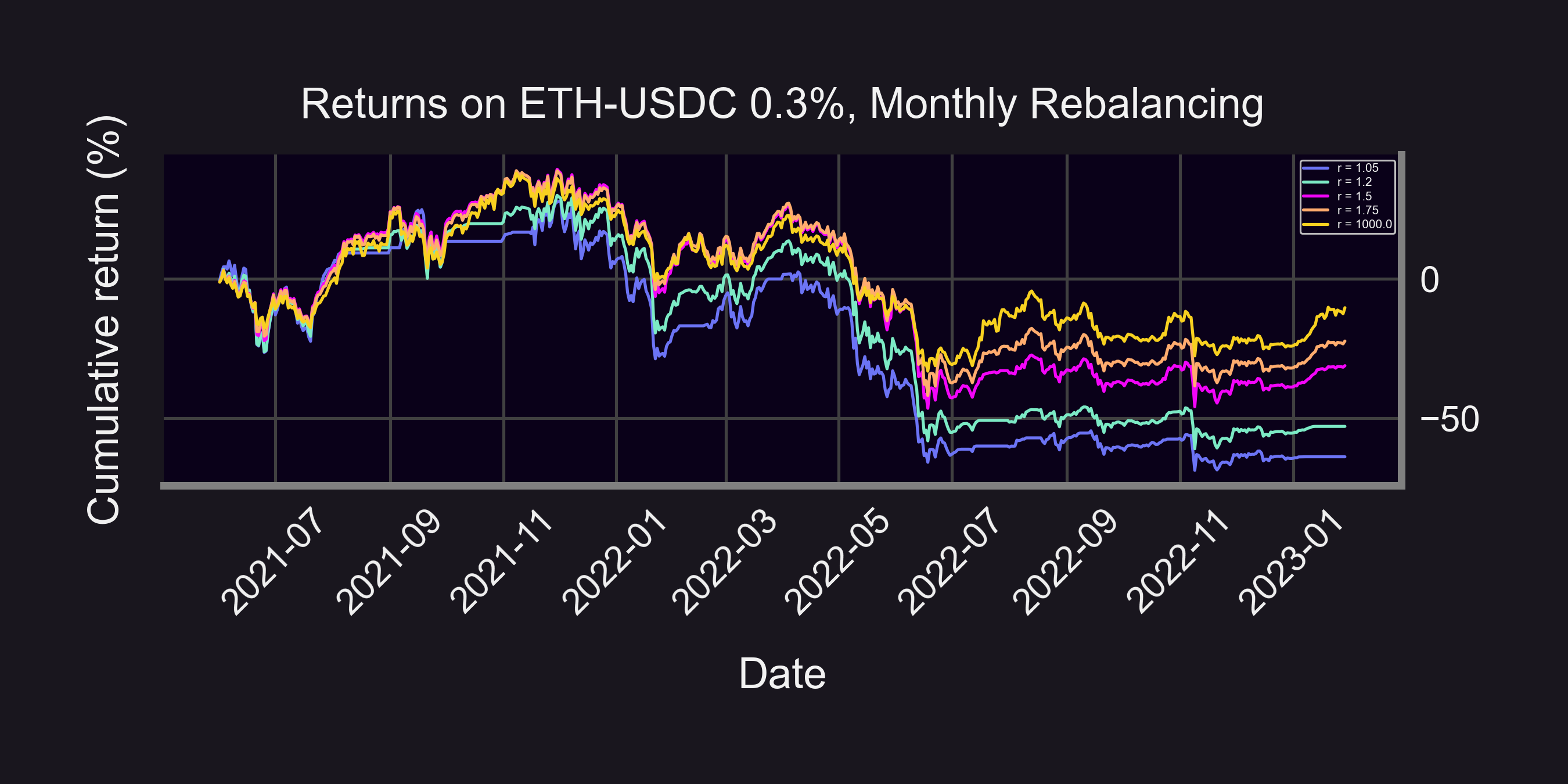

For the FULL period (Jun 2021 - Jan 2023):

- Daily rebalancing: r* = ∞ (full range)

- Weekly rebalancing: r* = 1.5

- Monthly rebalancing: r* = ∞ (full range)

LPs end up w/negative returns for this pool, but were raking in $ during the bull market (~40% returns in < 6 months)

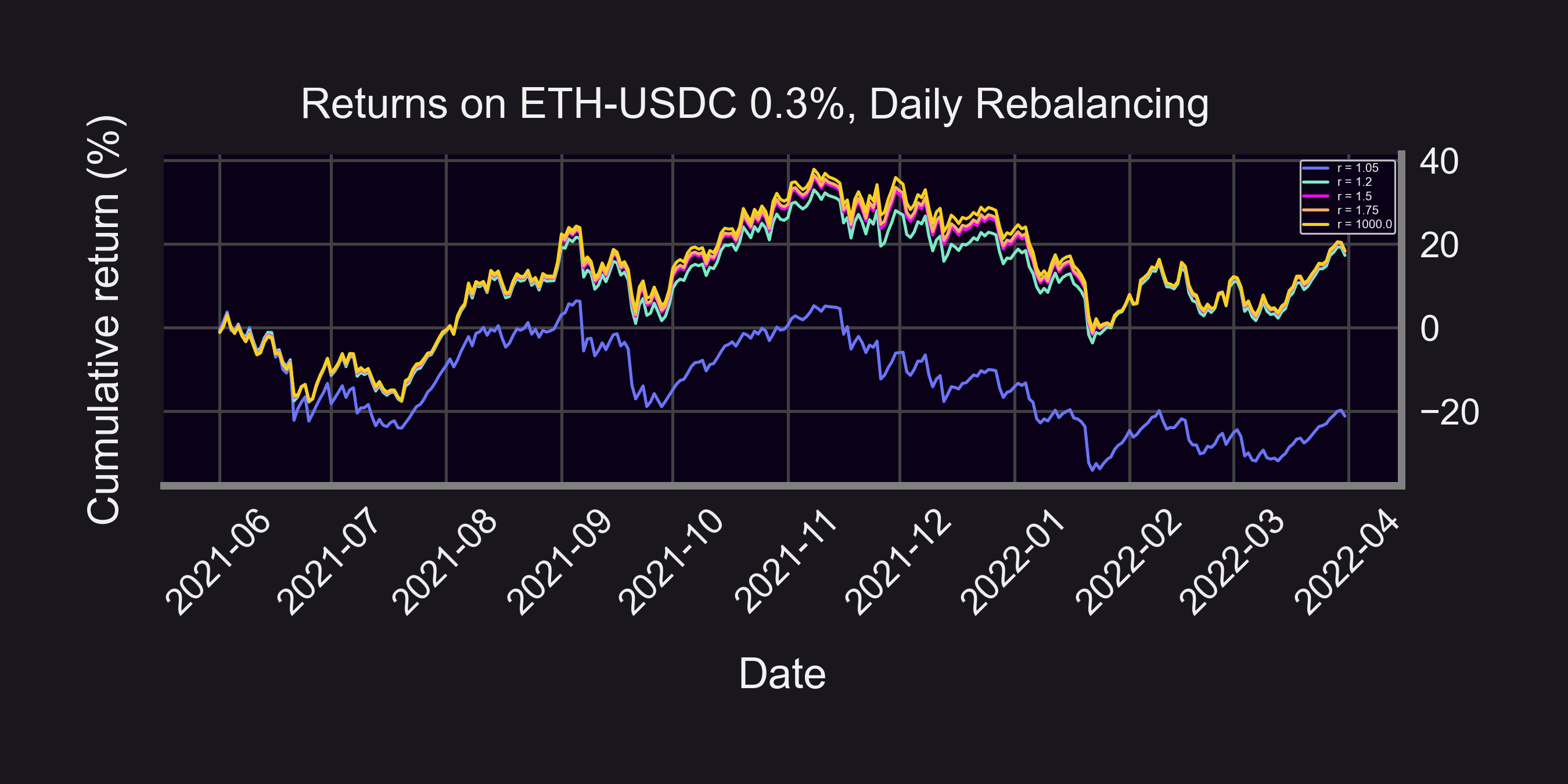

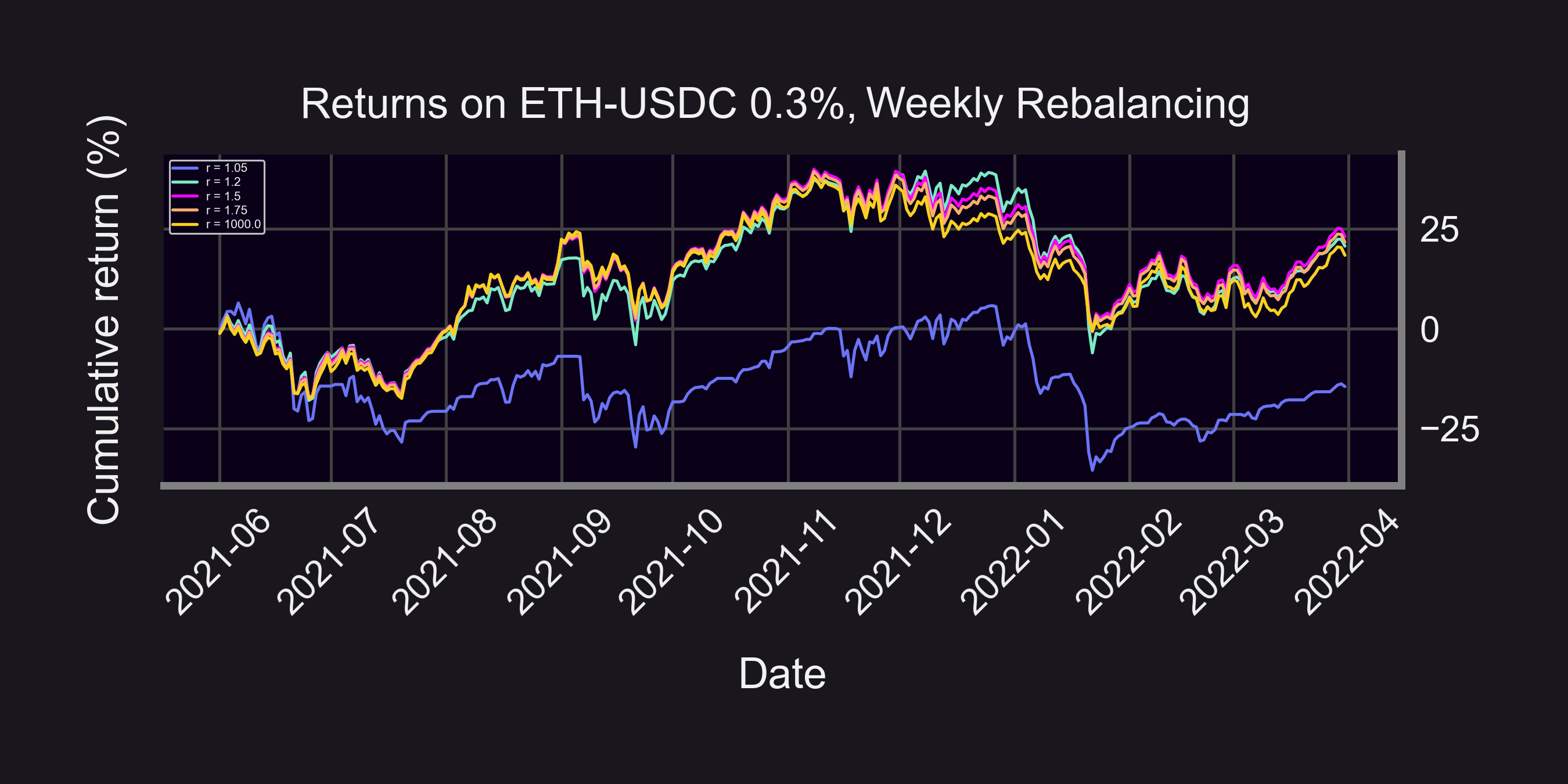

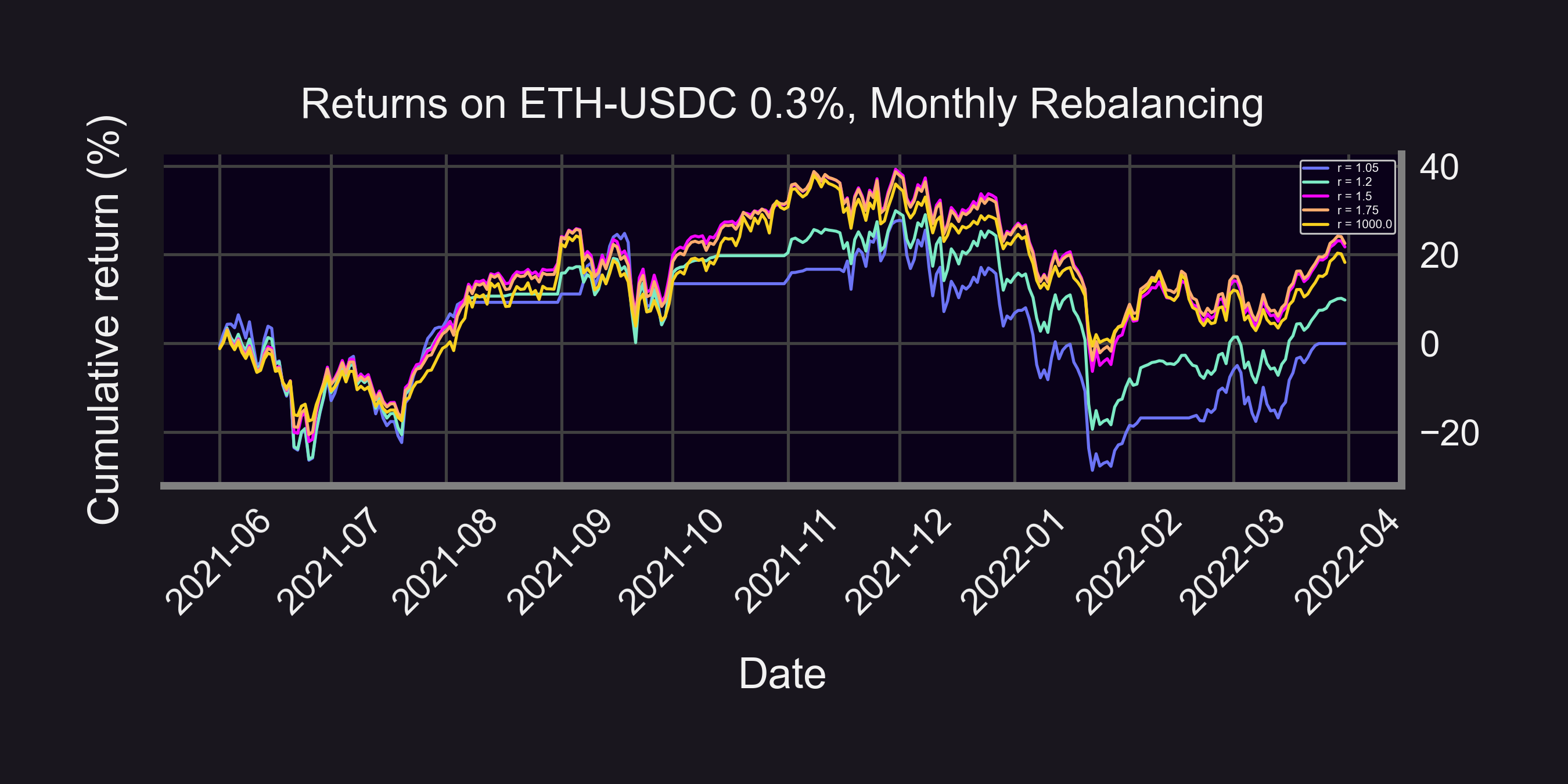

Bull Market Results

For the 🐂 market (Jun 2021 - Mar 2022):

- Daily rebalancing: r* = 1.5 - ∞

- Weekly rebalancing: r* = 1.5

- Monthly rebalancing: r* = 1.75

LPs end up positive! (~20% returns in 10 months)

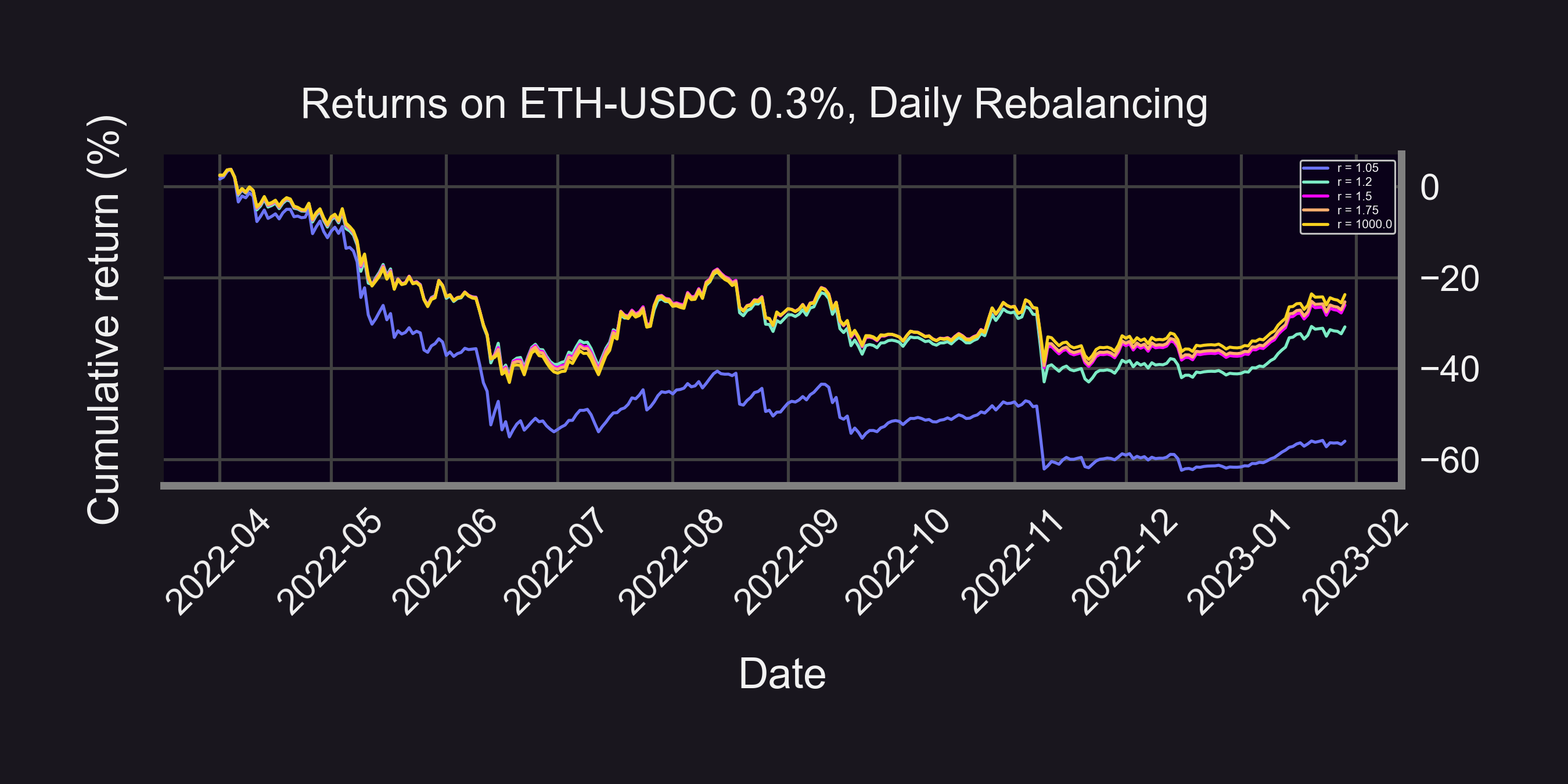

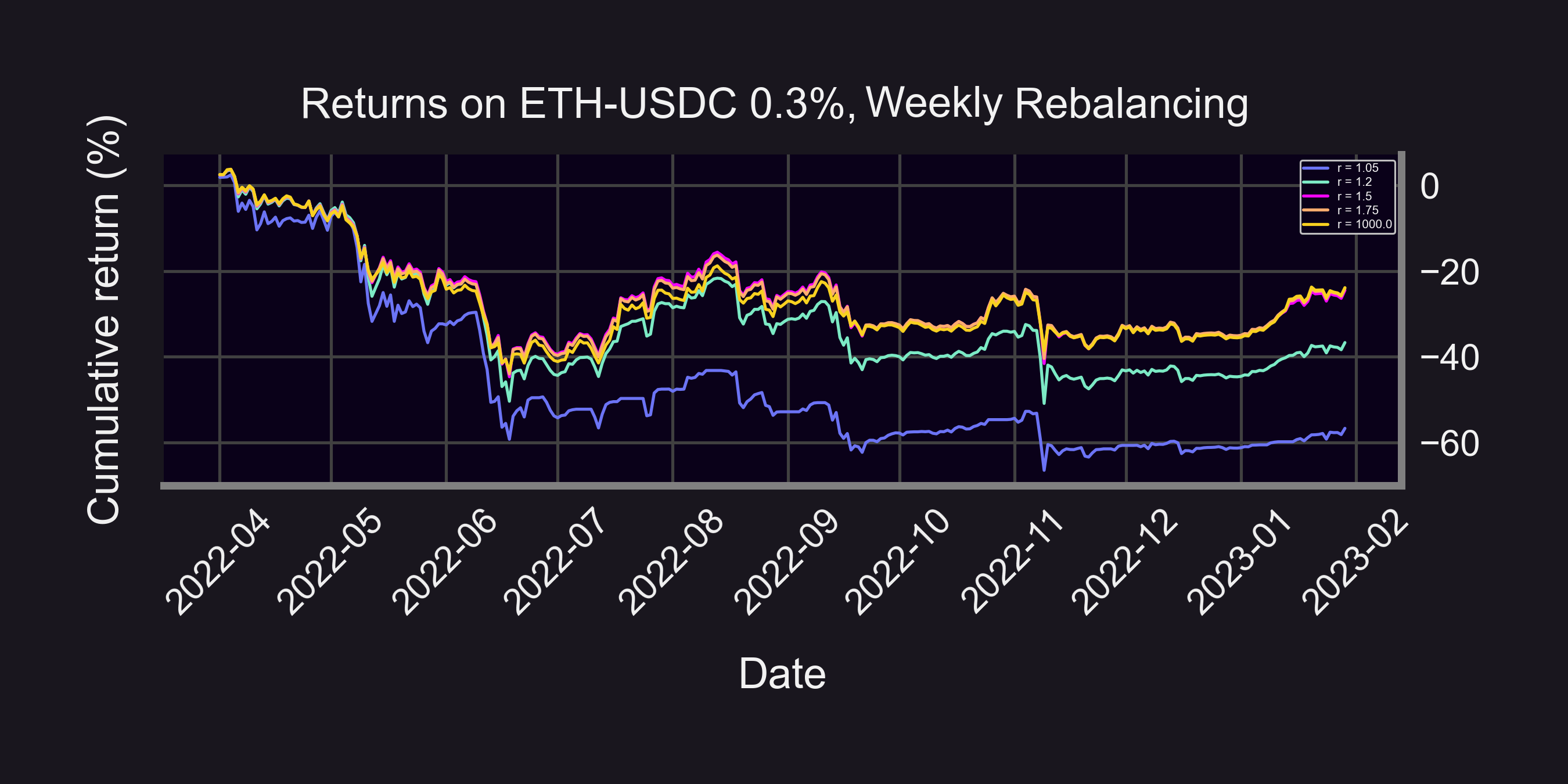

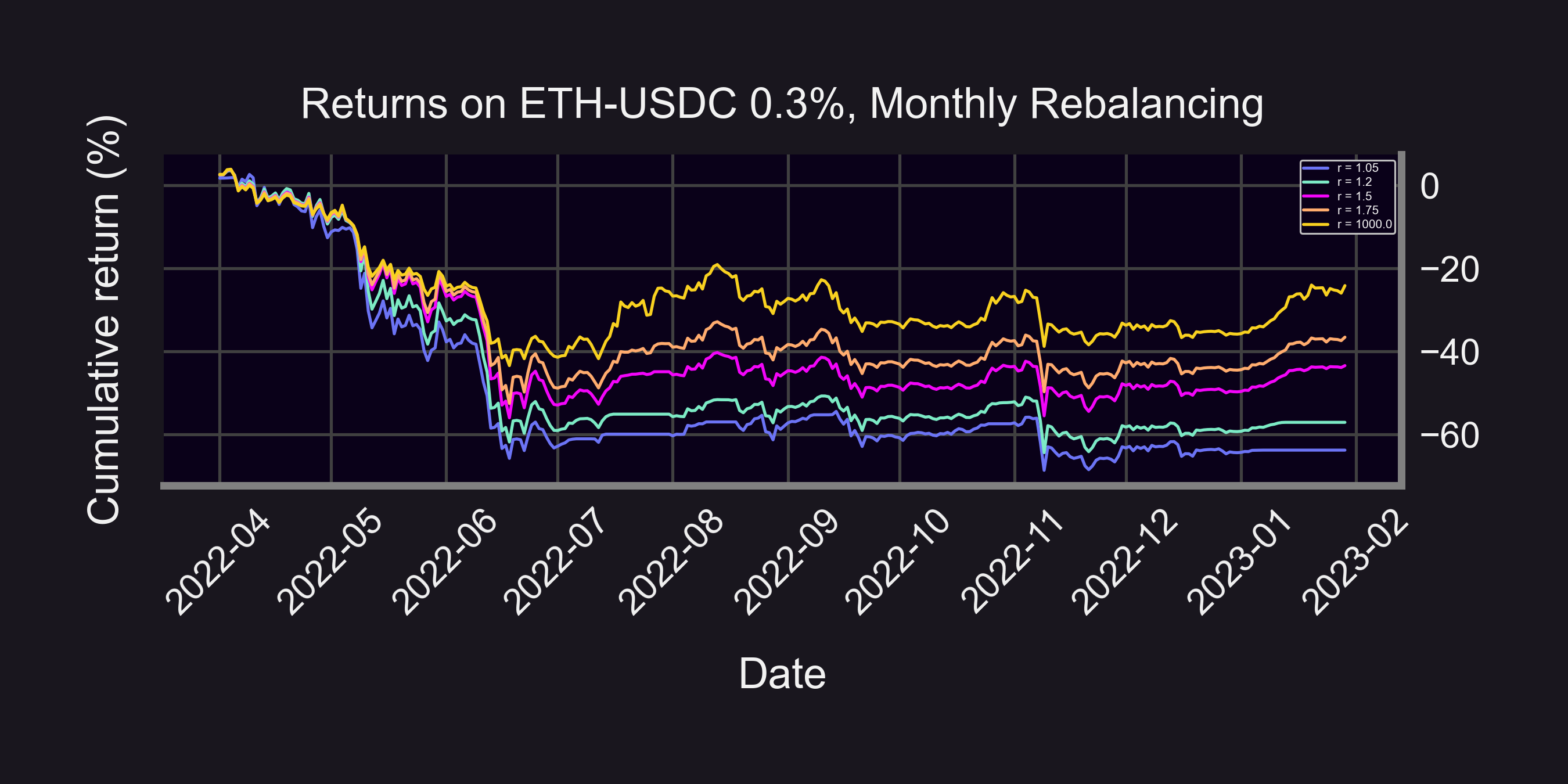

Bear Market Results

For the 🐻 market (Apr 2022 - Jan 2023):

- Daily rebalancing: r* = ∞

- Weekly rebalancing: r* = 1.75 - ∞

- Monthly rebalancing: r* = ∞

LPs end up negative (-24% returns in 10 months, but compare that to -55% returns on ETH!)

During 🐂 market, optimal range was tighter (r = 1.5 - 1.75). But during 🐻 market, optimal range was wider (r = 1.75 - ∞). Here's why 👇

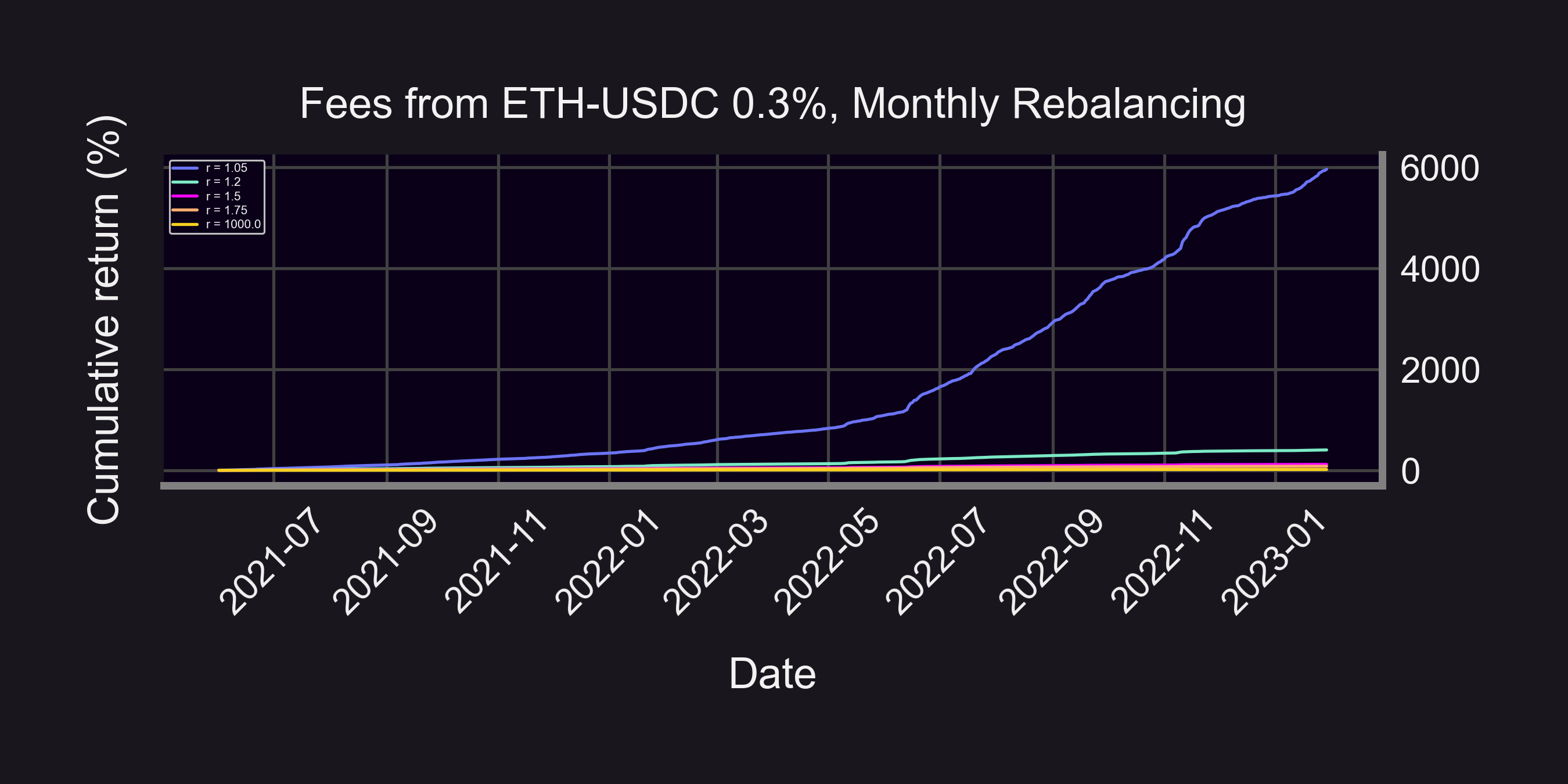

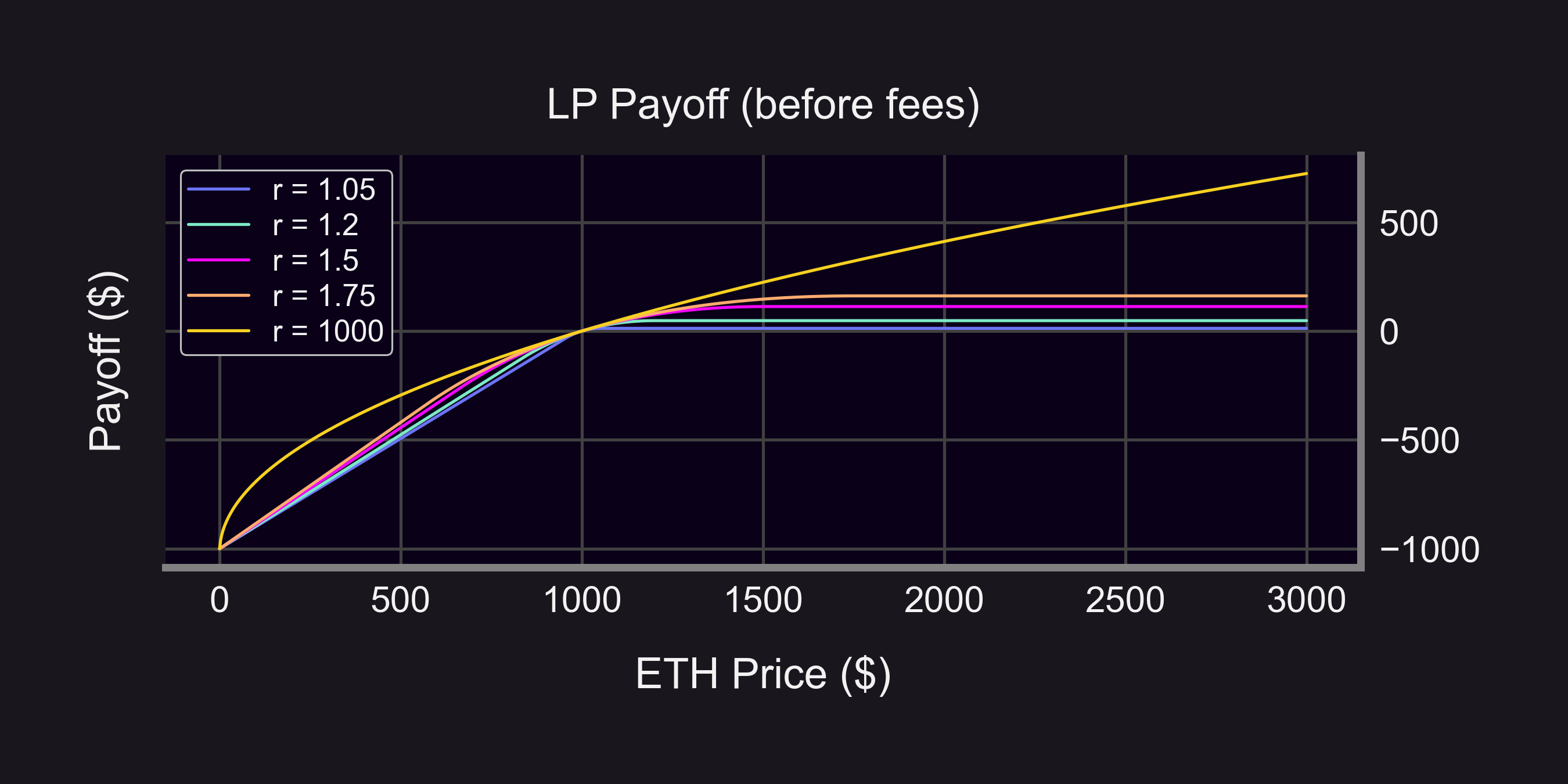

Summary

Tight range:

- 🤑 "Greedy"

- 🚀 More fees! (~6,000% cumulative fees in 1.5 years, r = 1.05)

- 💩 Buy losing asset faster, sell winning asset faster

Wide range:

- 🦺 "Safe"

- 🚀 Buy losing asset slower, sell winning asset slower

- 💩 Less fees (16% cumulative fees, r = ∞)

There's a tradeoff in choosing r:

- ⬆️ fees ⬇️ payoffs or

- ⬇️ fees ⬆️ payoffs

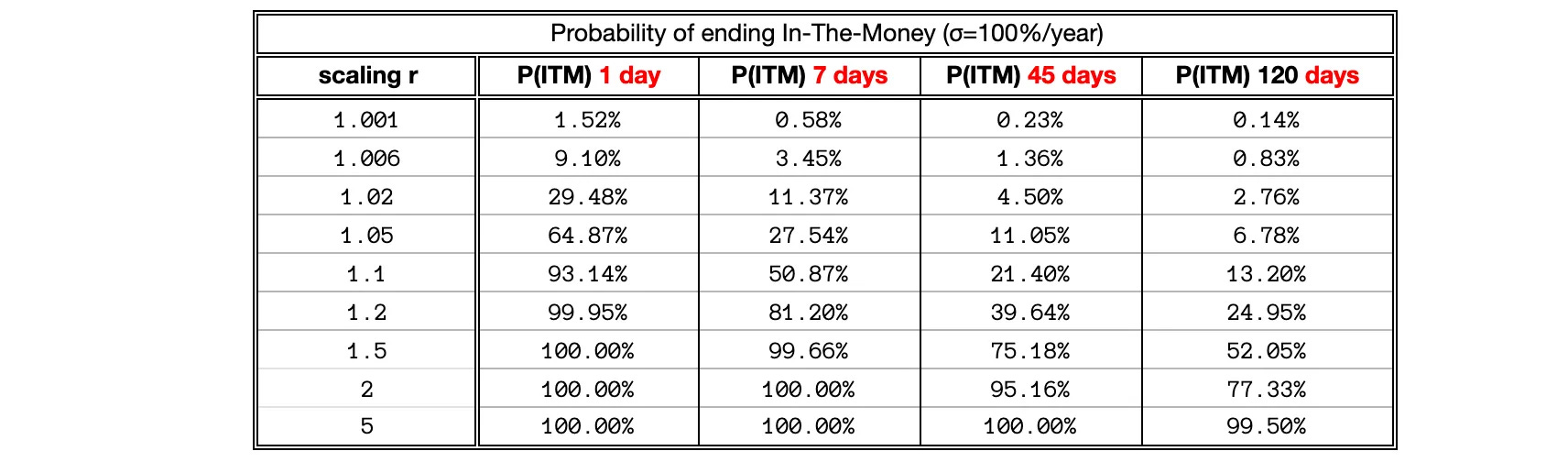

@guil_lambert has a good "Guide For Choosing Optimal Uniswap V3 LP Positions" 👇

- ✅ Gives probability of landing ITM

- ❌ Doesn't account for where we land ITM

- ❌ Doesn't account for time spent ITM

Caveats:

- ⛽ Ignores gas & rebalancing fees

- 📈 Assumes fees/returns compound day-over-day

- ⚠️ Past performance is no guarantee of future results!

Questions:

- 🌊 What about other pools? (🦄, ₿, SHIB, ...)

- ⚖️ What about stablecoin pools?

Well it turns out ALL performed extremely well: 700% returns for the long/vanilla LP strategy over the past 2 years!

— Guillaume Lambert | lambert.eth | 🦇🔊 (@guil_lambert) January 27, 2023

Even the short strategy gained 400%

What's going on here? Why are returns so high? pic.twitter.com/YJ17pSFs3D

Disclaimer:

- 📢 None of this should be taken as financial advice.

- ⚠️ Past performance is no guarantee of future results!