Maximizing Profits: Buying Put Options on 16 Uniswap Pools

Imagine a market that only lets you sell assets, never buy...Could you be profitable?

That market isn't imaginary. That market is...Uniswap Liquidity Providing!

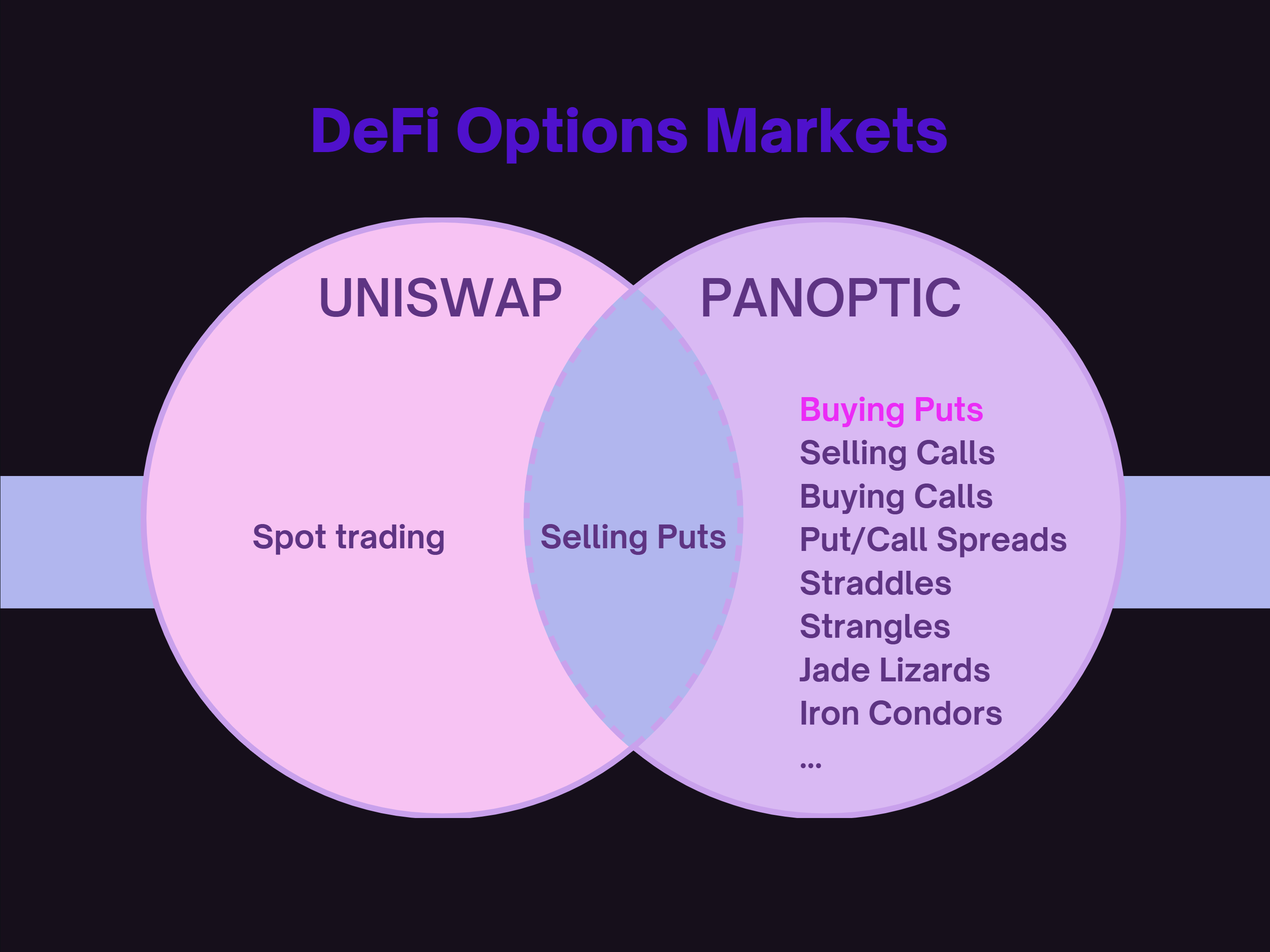

LPing = selling options, but what if users could SHORT LP tokens and effectively BUY options...?

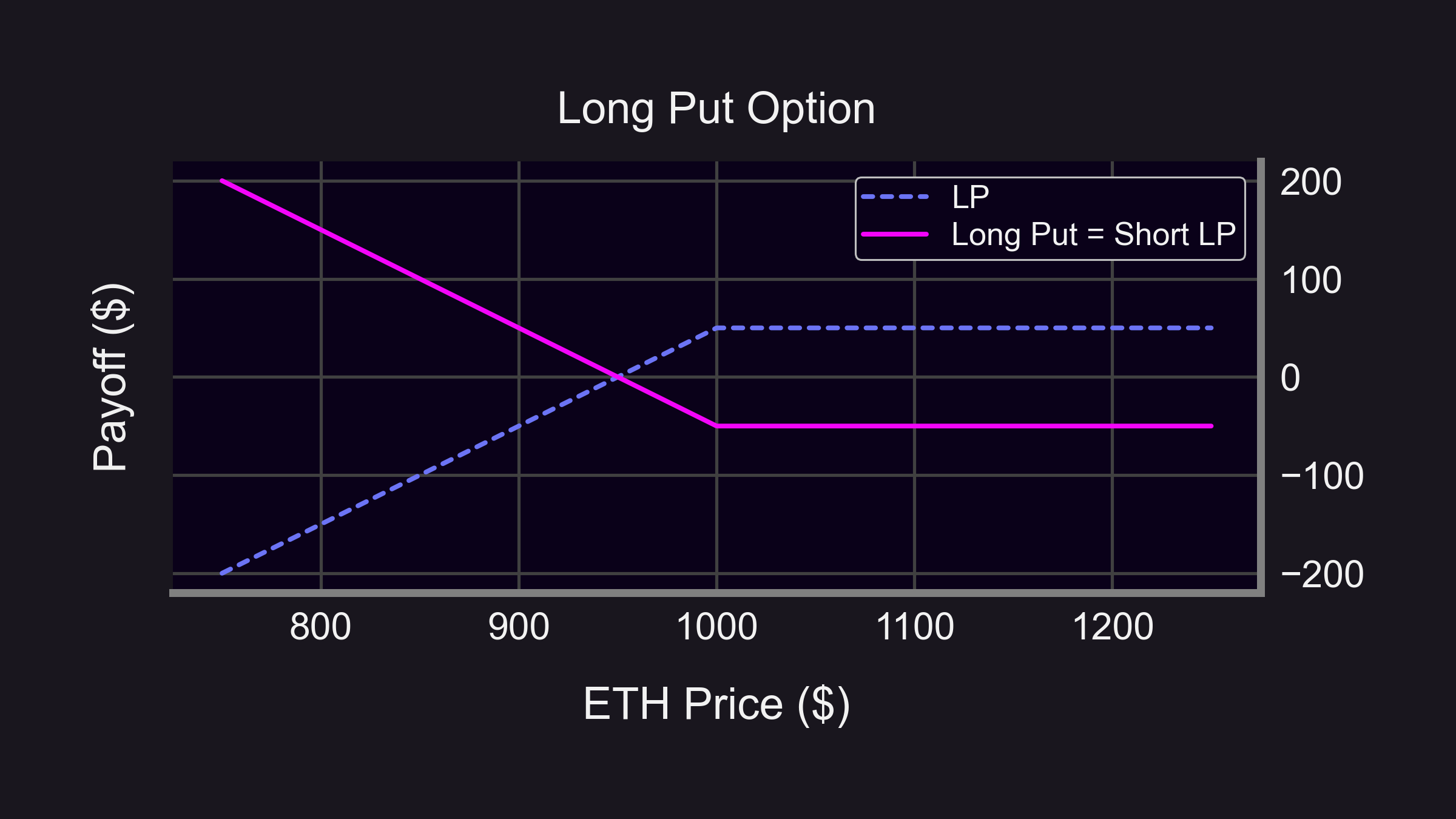

LP = Short Put

LP positions on Uni V3 mimic the payoff of selling put options. Uniswap users can only deposit liquidity and sell put options, which means they can only take a bullish position.

Let's try to clear some misconceptions about providing liquidity in Uniswap v3:

— Guillaume Lambert | lambert.eth | 🦇🔊 (@guil_lambert) January 29, 2023

🟣Uni v3 LPs aren't making markets, they're selling cash-secured puts.

- Token goes up, LP value goes up (but capped) 🚀

- Token goes down, LP value goes down 😭

While selling options can be profitable, our backtests show that it wasn't always the case 👇

3/11 Bad pools 😔 (but can you spot the good pool 🐶?)

— Panoptic (@Panoptic_xyz) February 8, 2023

• ETH-USDC (5bps): -18%

• ETH-DAI (30bps): -14%

• ETH-USDC (30bps): -12%

• ETH-USDT (30bps): -11%

• ETH-USDC (100bps): -9%

• ETH-USDC (1bp): -6%

• ETH-USDT (5bps): -3%

• ETH-DAI (5bps): +7%

(Returns in stablecoin) pic.twitter.com/l1RWO8cLx6

Is there a way to "short" an LP position and effectively buy a put option...?

We'll answer this... But first, let's simulate an options buying strategy!

Backtest Strategy

For this study:

- 🗓️ Jun 2021 - Jan 2023 (20 months) where applicable

- ⚖️ Daily rebalancing

- 📏 Narrow (r = 1.05) range ↔️ 0DTE

Daily strategy:

- Buy ATM put option by shorting LP position

- Exercise/close put option at end of day

- Pay LP swap fees as premia

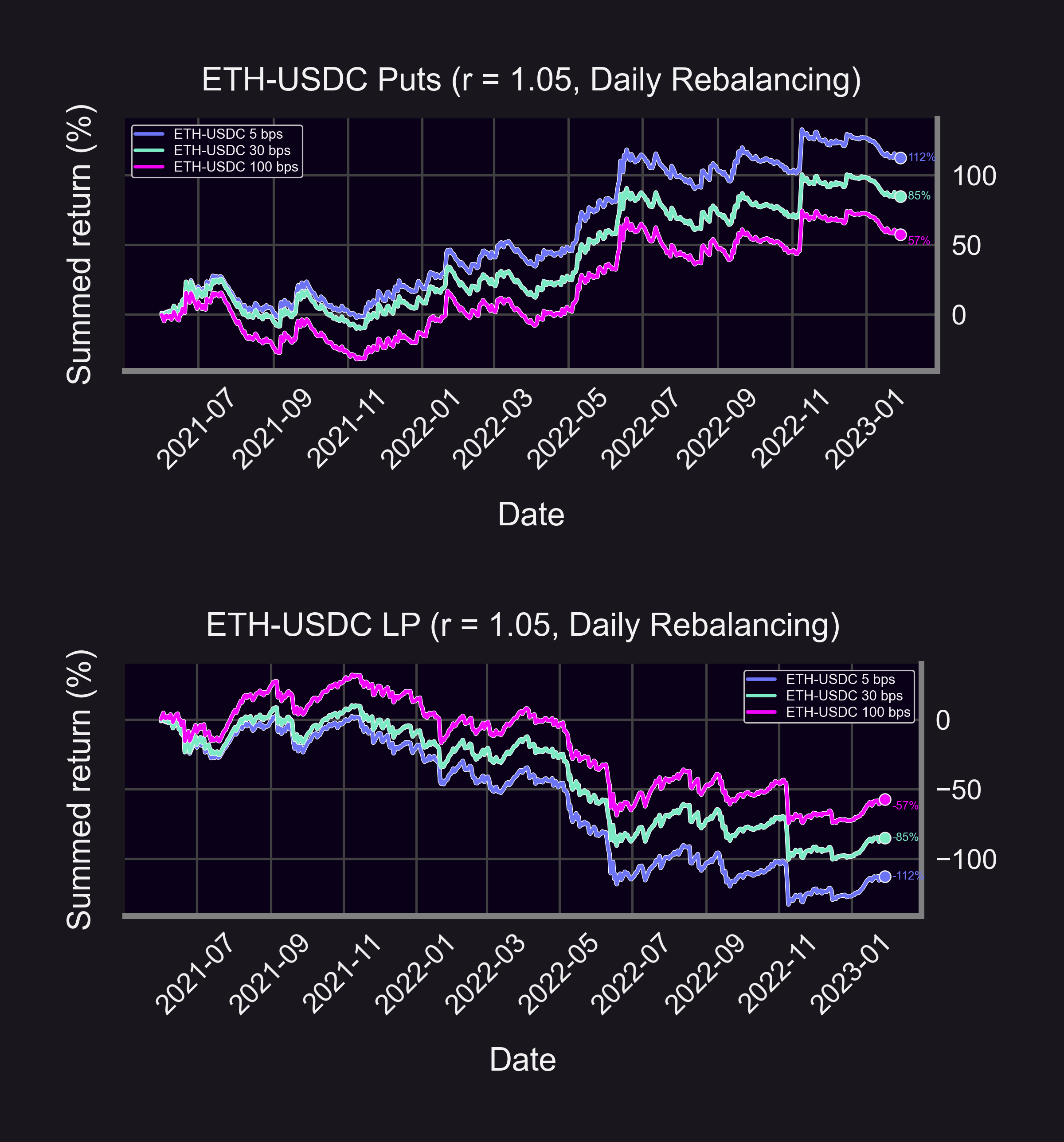

ETH Puts

Returns on buying ETH put options:

- 🌕 ETH-USDC (5bps): 112%

- 🚀 ETH-USDC (30bps): 85%

- 🧑🚀 ETH-USDC (100bps): 57%

(Returns in USDC)

👉Put option returns are exactly opposite of LP returns👈

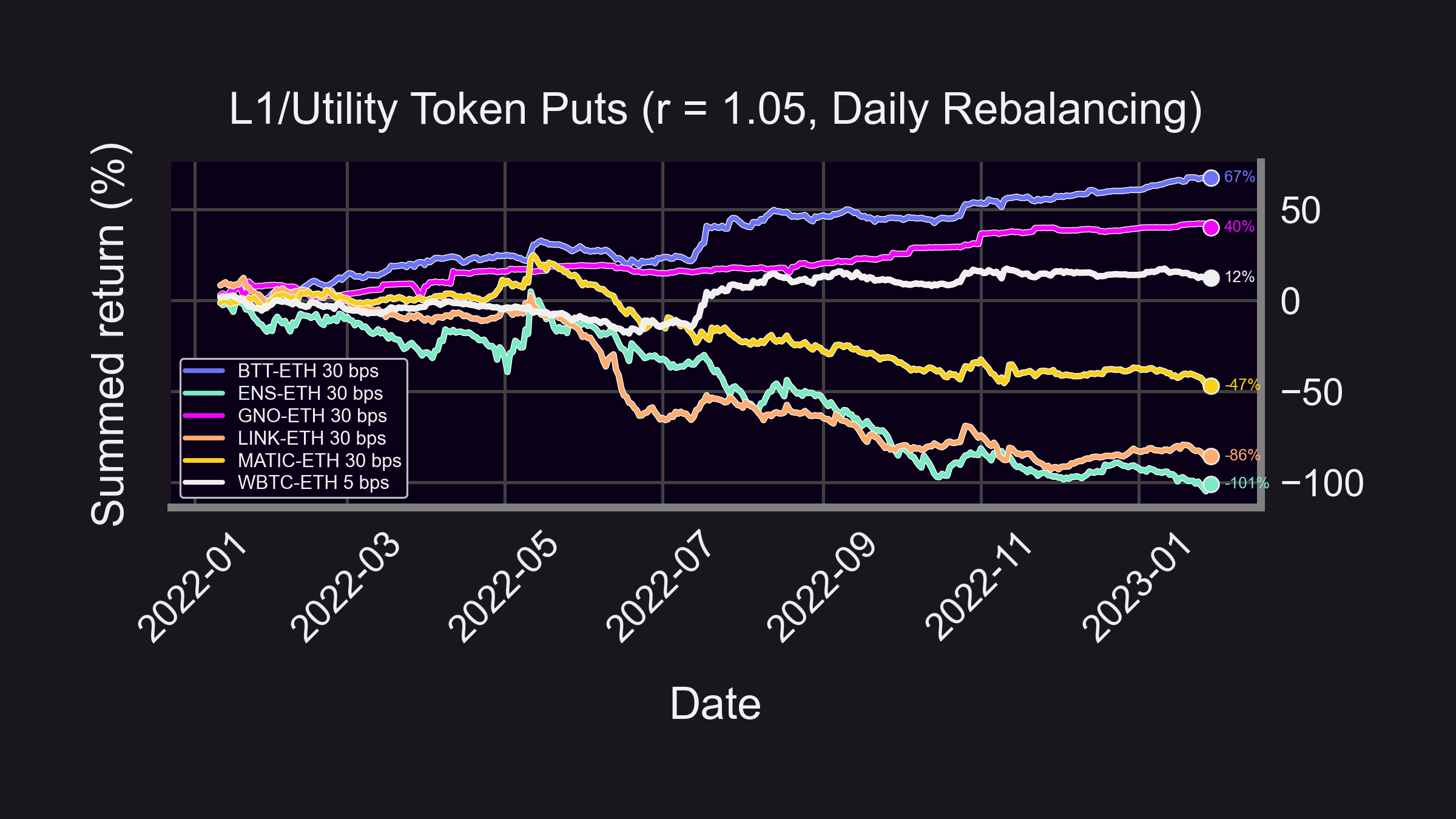

L1/Utility Token Puts

Buying "L1/Utility token" put options:

- 🤩 BTT (+67%)

- 😍 GNO (+40%)

- 😊 $WBTC (+12%)

- 😦 MATIC (-47%)

- 😢 LINK (-86%)

- 😭 ENS (-101%)

(Returns in ETH, see legend 👇 for pool details)

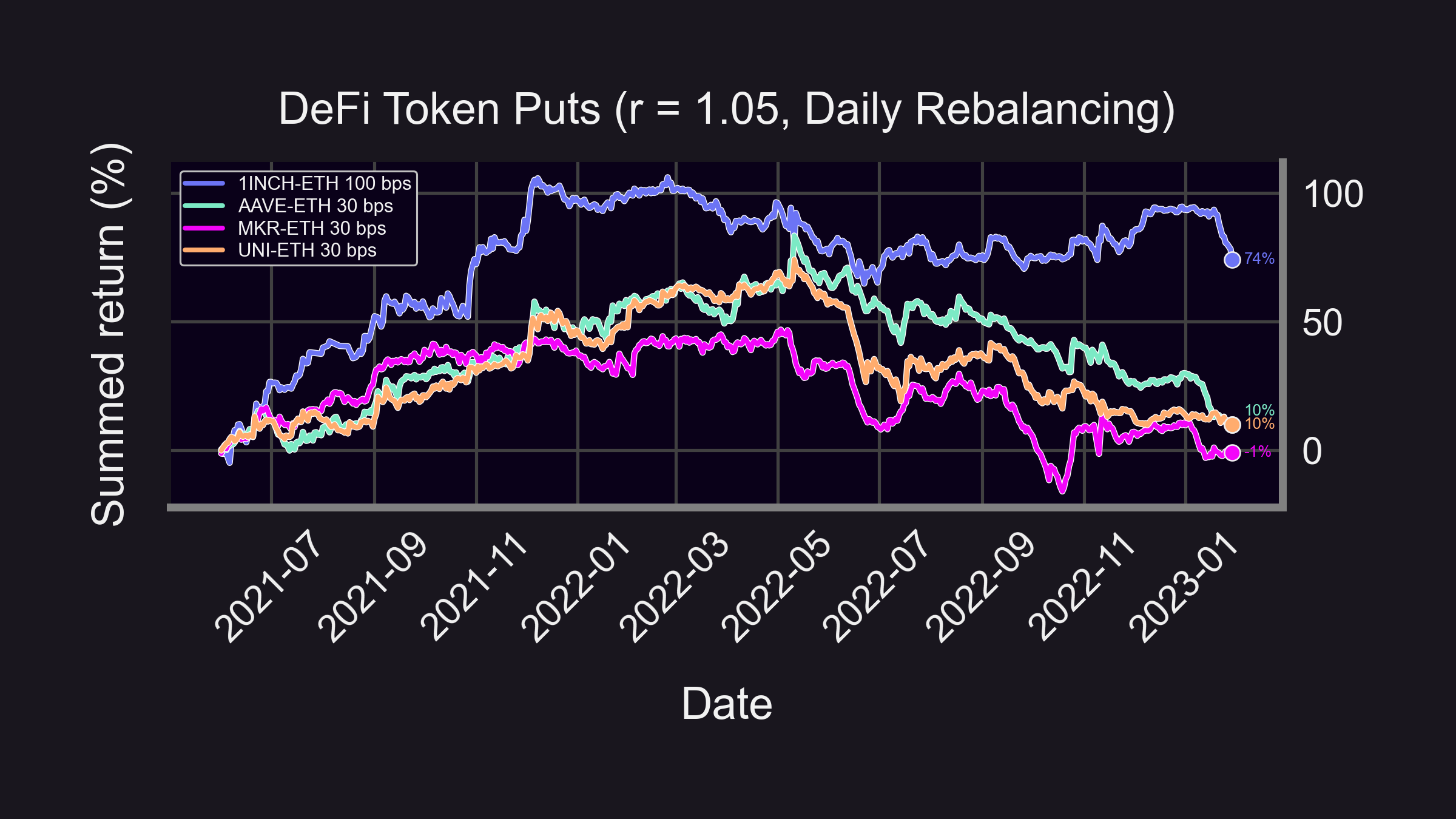

DeFi Token Puts

Buying "DeFi token" put options:

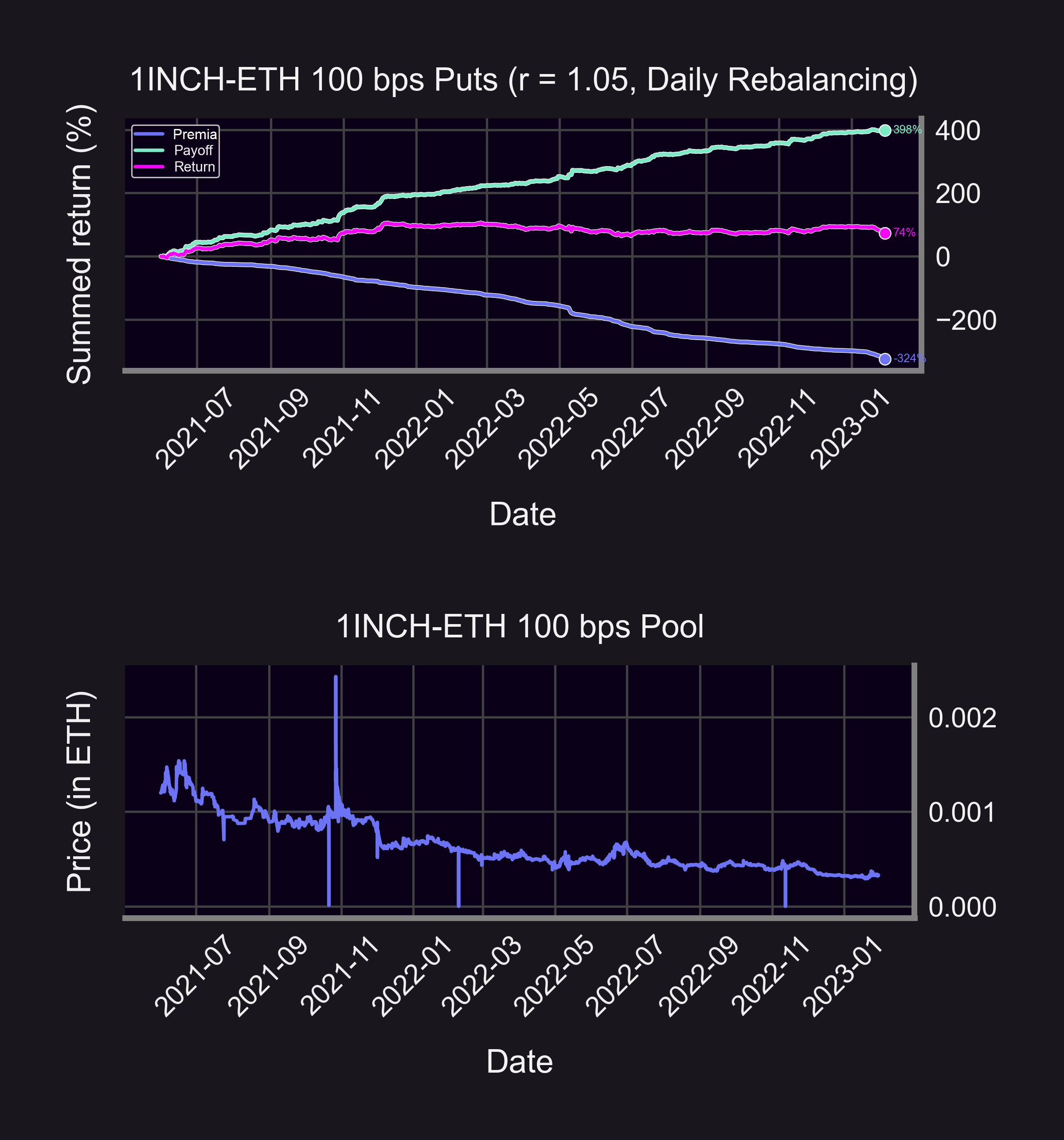

- 😎 1INCH (+74%)

- 🙂 AAVE (+10%)

- 🙂 UNI (+10%)

- 😕 MKR (-1%)

(Returns in ETH)

👉DeFi puts did pretty good!👈

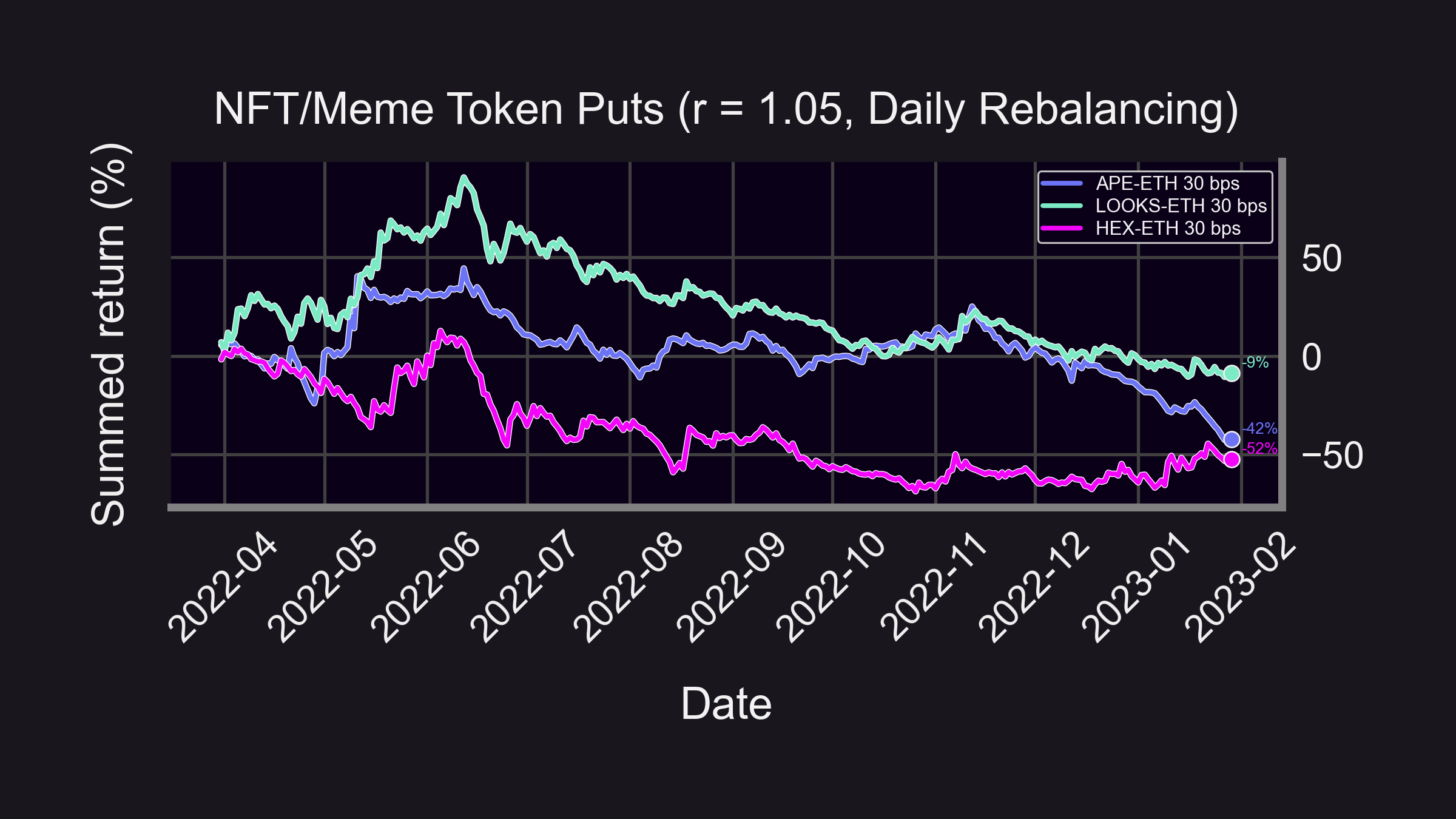

NFT/Meme Token Puts

Buying "NFT/Meme token" put options:

- 😶 LOOKS (-9%)

- 😬 APE (-42%)

- 😳 HEX (-52%)

(Returns in ETH)

👉Don't "put" ⤵️ down the meme tokens👈

Summary

Key Insights:

- 🐻 Bearish price action = high payoff

- 💰 Payoff > premia → profit!

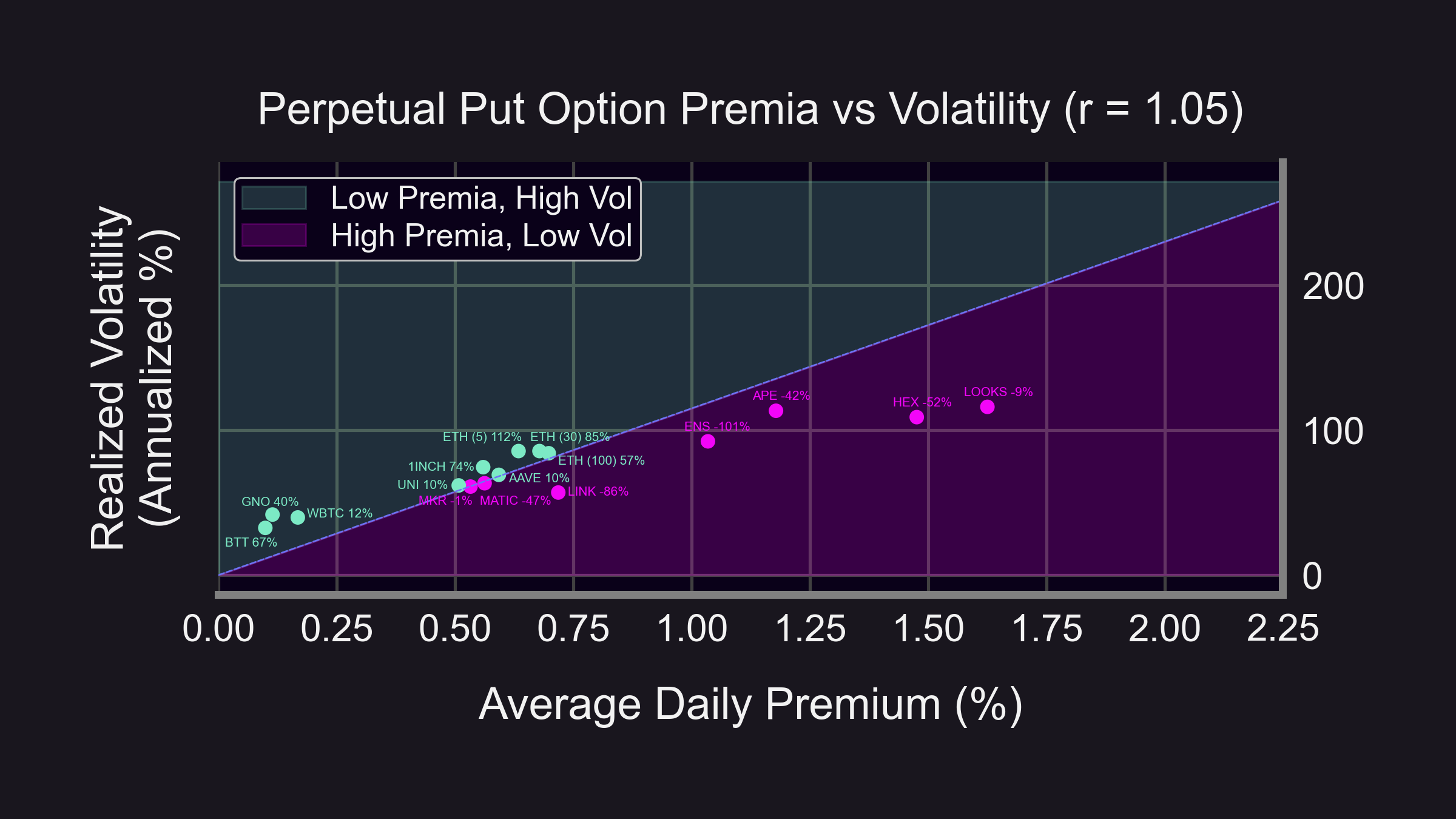

In TradFi, options buying is more profitable when Implied Volatility (IV) < Realized Volatility (RV). Do we see the same result here?

Instead of IV let's use the premia:

- Easier to calculate 🧮

- ⬆️ IV ⇔ ⬆️ Premia

Graph above:

- 🐶 Outperforming puts (green dots): lie above the line, low premia given volatility ("IV < RV")

- 😈 Underperforming puts (pink dots): lie below the line, too expensive ("IV > RV")

Is there a way to "short" an LP position and, hence, buy a put option?

Enter Panoptic! Panoptic allows you to buy and sell DeFi options for any crypto asset, any strike, any size.

1/25 DeFi Options Trading Is Powerful!

— Panoptic (@Panoptic_xyz) February 22, 2023

There can be unlimited upside…😈

But also unlimited downside 😣

Every trader should know how to create these 18 options strategies in @Panoptic_xyz for any crypto asset, any strike, any size:

❤️ & rt 👇 pic.twitter.com/BAlyxdn0lz

Caveats:

- ⛽ Ignores gas/spread/swap fees/commission

- 💲 Assumes put option premia = LP collected fees

- ❓ This is a "what if" scenario — you can't buy put options on Uniswap (yet)

Question:

- ⚖️ Are LP returns in disequilibrium?

(Future #ResearchBites 😉)

Disclaimer:

- 📢 None of this should be taken as financial advice.

- ⚠️ Past performance is no guarantee of future results!