How to hedge ANYTHING (including Uni v3 LP positions) with options

How to hedge ANYTHING (including UniV3 LP positions) with options 👇

Why options?

- Flexibility: Construct any payoff curve

- Greater protection: hedge against price going up AND down

- Capital efficiency: Low upfront cost for OTM puts/calls

Let's construct a hedge!

1. Identify your strategy's position.

Assume initial ETH price is $1,000. Let's start with 1,000 USDC. We sell 50% of that for ETH:

- x0 = 0.5 ETH

- y0 = 500 USDC

We LP 0.5 ETH & 500 USDC in the ETH-USDC pool.

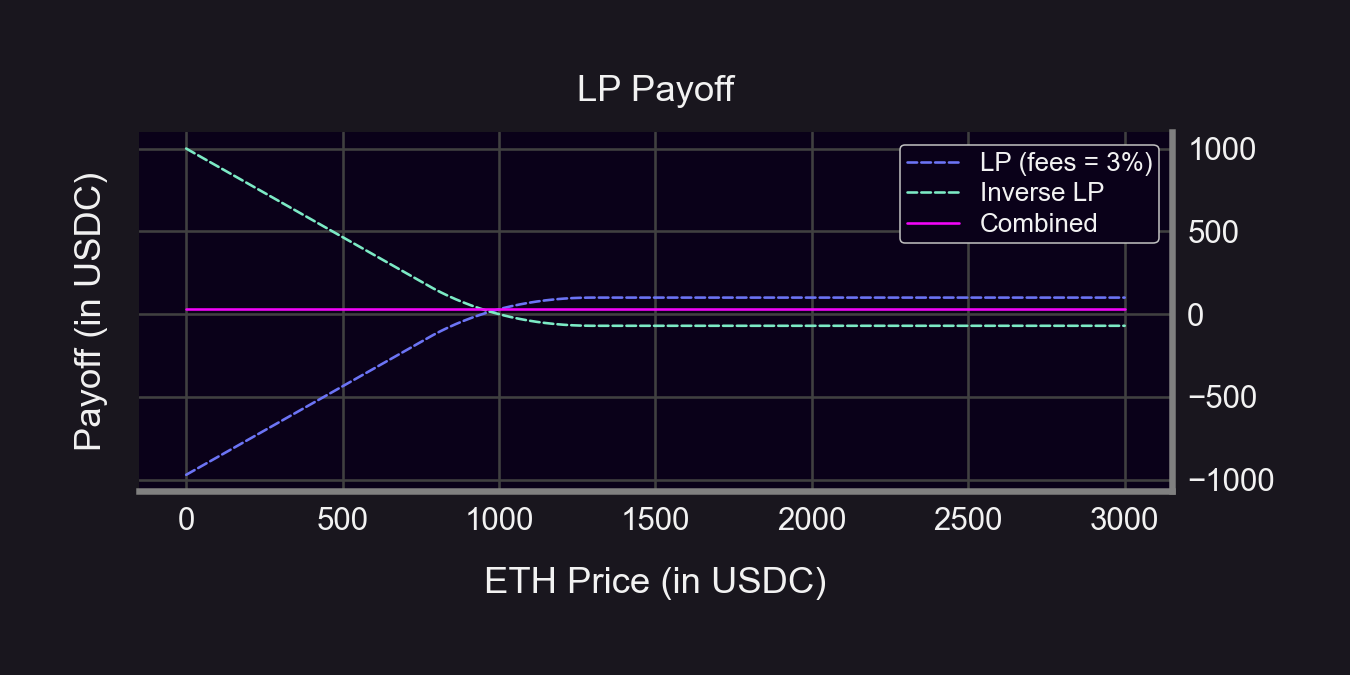

2. Calculate the payoff curve for your strategy's position.

- Uni v2 LP value: V = 2L√S + fees

- S = (Spot) price of ETH

- L = √(x0 * y0)

Subtract our initial capital:

And for Uni v3...

- A bit more complicated than Uni v2

- Formula (while in range) by @guil_lambert here

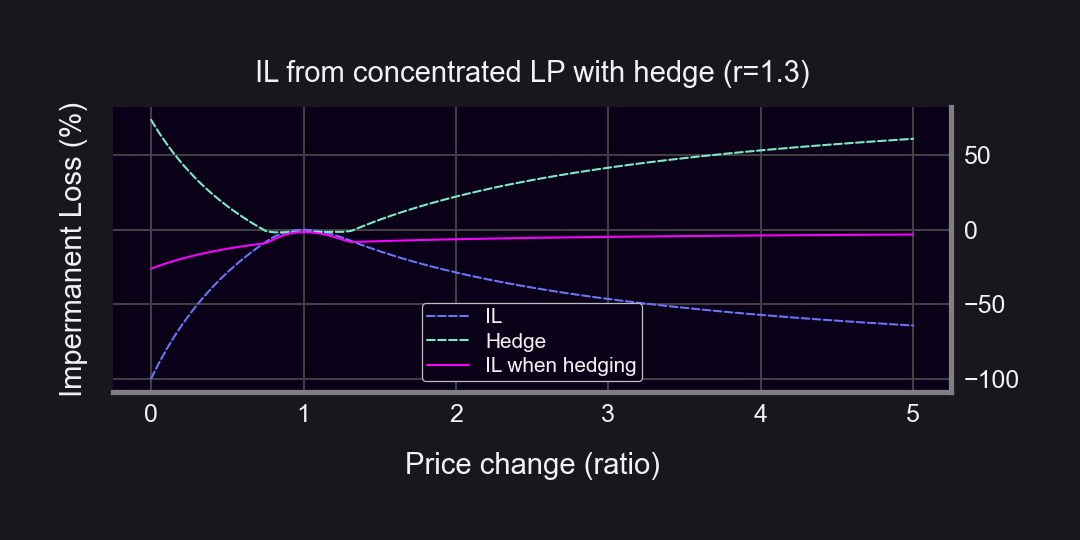

- Example: r = 1.3 → ±30% LP range (see 🧵 for why)

1/13 Read our latest #ResearchBites from @brandonly1000 of the@Panoptic_xyz research team!

— Panoptic (@Panoptic_xyz) January 18, 2023

=====

How do you LP on UniV3 with a ±% range?

E.g. if you wanted ±30% should you do:

1) Lower: P * 70%

Upper: P * 130%

or

2) Lower: P / 1.3

Upper: P * 1.3

Let's find out!👇 pic.twitter.com/QChXAuIonz

where

3. Find an "inverted" payoff curve.

You want to hold a portfolio that pays the opposite. So just flip the payoff curve on its head. The goal is to flatten the curve into the pinkish line.

Example when r = 1.3 👇

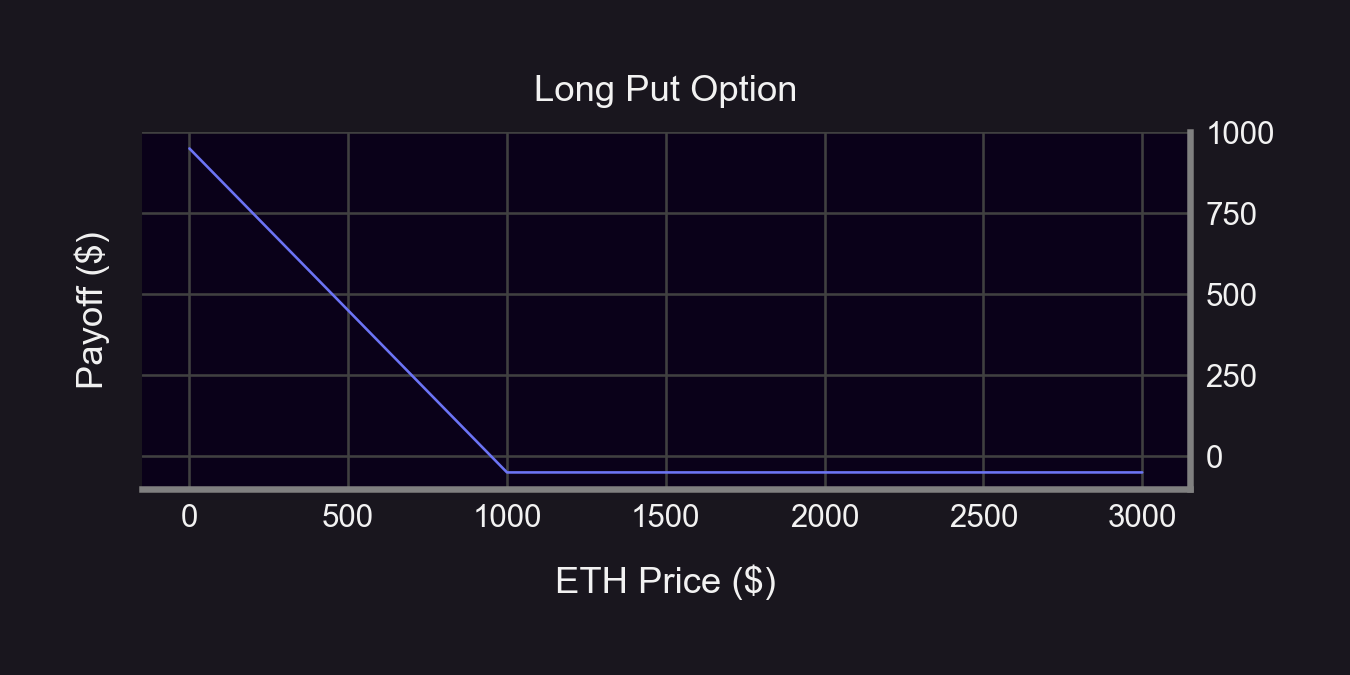

4. Construct a portfolio replicating the inverse curve as closely as possible.

A long put option is a natural choice here since it benefits from $ movements down.

5. Finally, let's put them together.

Buy the hedge portfolio and hold it with your original position!

Assumptions:

- Initial ETH price = $1,000

- Long 1 ATM Put (strike = $1,000, DTE = 10)

- Put premium = $50

- LP fees = 3% (r = 1.3 ⇔ DTE ≈ 10)

How'd we do?

- S < $1,000: hedged payoff is flatter (and positive at times!)

- S $1,000: hedged payoff is lower (due to premium)

Hedging always costs $. We need to earn enough fees to cover the hedge price.

Summary

- Understand how your position reacts to price changes

- Find an opposite reaction

- Figure out what assets you can hold to mimic the opposite reaction (this is your hedge!)

- Buy the hedge (with Panoptic😉)!

- Take comfort knowing you're protected🛡️

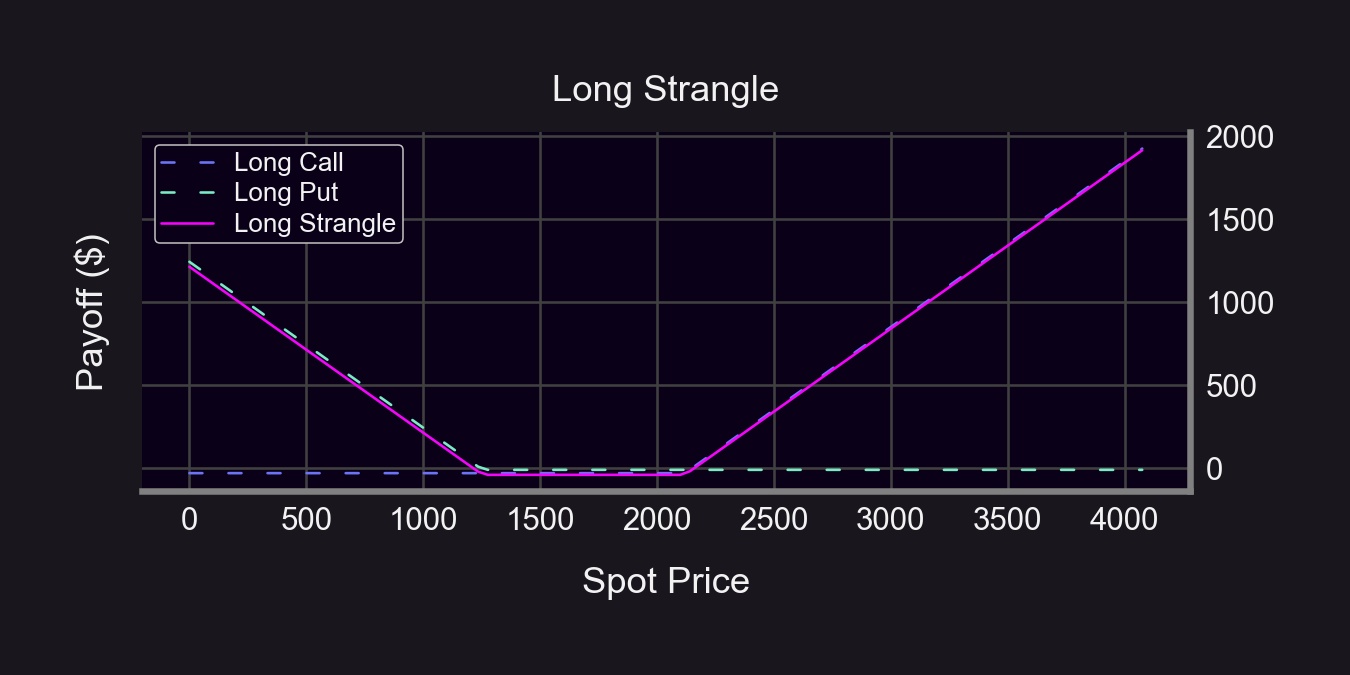

What about impermanent loss (IL)?

- Notice we started with 100% of our capital in USDC.

- HODL portfolio of 100% USDC doesn't fluctuate → We already accounted for IL against a 100% USDC portfolio

But if we define IL against a 50/50 ETH-USDC HODL, we can hedge with a strangle:

What about hedging with perps?

Pros:

- More liquid

- More asset listings

- Static delta (no gamma!)

Cons:

- Less flexible: can only short/long at current contract price

- Pay funding rate (if on the "wrong" side)

- Static delta (no gamma...)

What about hedging with Squeeth?

Pros:

- More liquid

- Able to completely hedge delta/gamma

Cons:

- Only works for ETH-stablecoin pools

- High funding rates

What are the drawbacks to using options?

- Listings: no long-tailed assets on Deribit/OKX/Binance (just ETH/BTC)

- Illiquidity: lower liquidity on deep OTM options

- High maintenance: options expire + time decay

Panoptic solves this! Here's how 👇

Panoptic is permissionless:

- Listings: Permissionless pool creation on top of UniV3

- Liquidity: Permissionless LP for options at any strike price

- No expiry: XPOs are non-expiring, perpetual options

Read the whitepaper here.

Conclusion

Insights:

- LP positions look like short puts → LPers are selling options

- Only way to fully hedge an LP position is to short it

Only Panoptic enables shorting LP positions (any asset, any strike)!

- Broke: Hedging with expiring options

- Woke: Hedging with Panoptic XPOs

Disclaimer: This content is for educational purposes only and should not be relied upon as financial advice. Please DYOR!