Panoptic Insights: Betting on Volatility

Market updates:

- Deribit Insights found that markets expect smooth sailing with low vol for BTC and ETH

- Panoptic lets you make volatility bets DIRECTLY on BTC-ETH relative prices

- Options sellers profit in April-May.

Is low Volatility the new normal in Crypto?

— Deribit Insights (@DeribitInsights) May 11, 2023

Read everything about it (+ some nice opportunities)

in this great analysis by Imran Lakha from @options_insight #volatility #cryptooptions #Bitcoin #Ethereum #ETH #DeribitExchangehttps://t.co/CmHwkCIbAD

Let's review.

Introduction

Deribit Insights found that the market is pricing in low vol based on declining implied vol on crypto options. They also analyze the ETH/BTC vol spread and volatility skews. Straddles are great ways to bet on volatility, so we analyze their performance below.

We'll cover:

- How you can sell straddles NOW on Uniswap

- Backtest BTC straddles

- Backtest ETH straddles

- Backtest BTC-ETH straddles

For a refresher on straddles and volatility bets see here.

Straddles

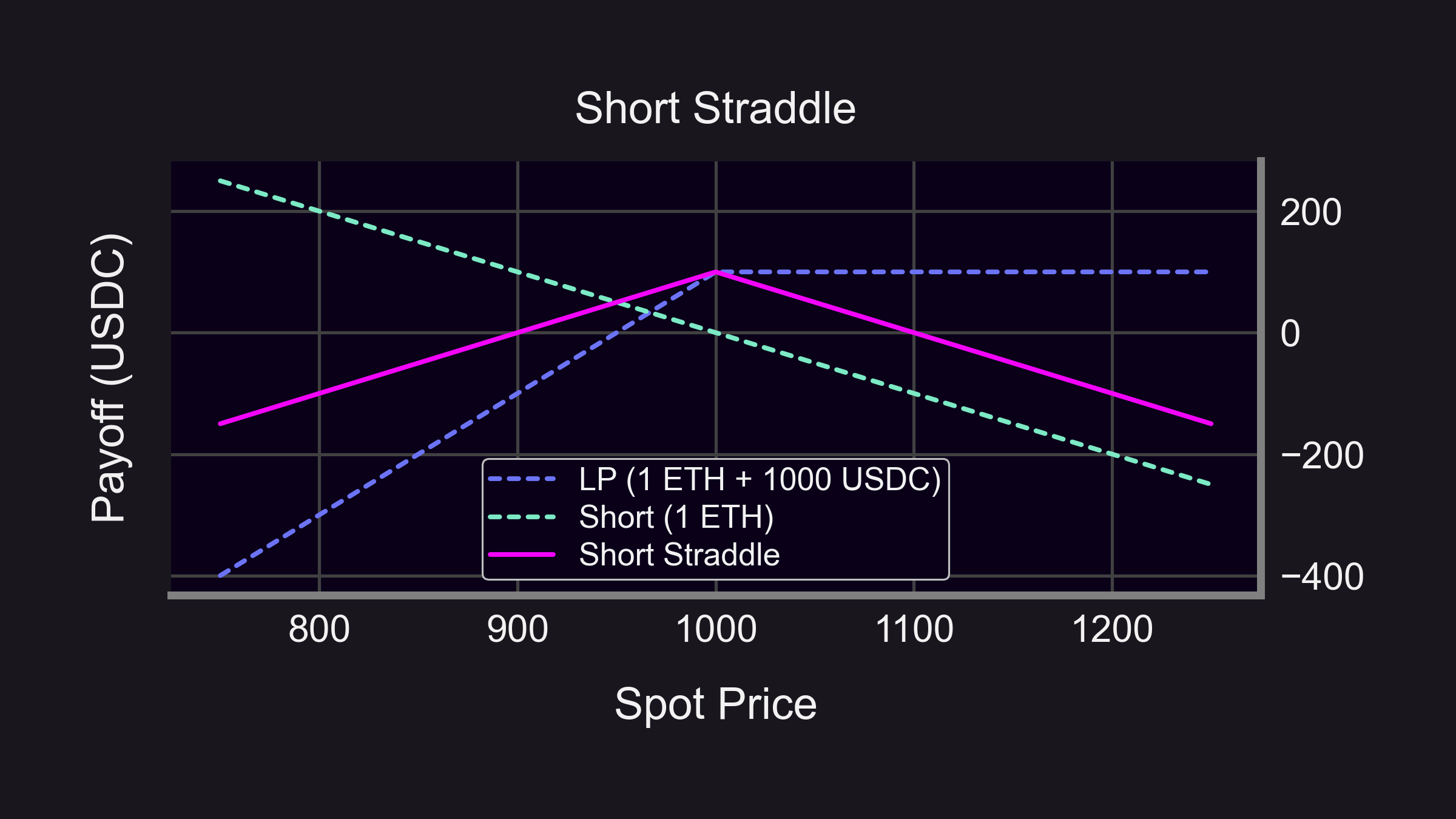

You can sell (perpetual) straddles via Uniswap v3 & Aave right now. For example, if ETH price = $1,000:

- LP centered around $1,000. Use 1 ETH + 1,000 USDC.

- Short 1 ETH (e.g. borrow on Aave & immediately sell)

- Your payoff curve will look like the pink curve

Tips:

- Your "perpetual premia" is the fees you collect from LPing

- The more fees you collect, the wider your straddle breakeven points become

- Use a narrow range (e.g. r = 1.1) for short-term positions

- Use a wide range (e.g. r = 1.6) for longer-term positions For more info on how LP range and time horizons correlate, see here.

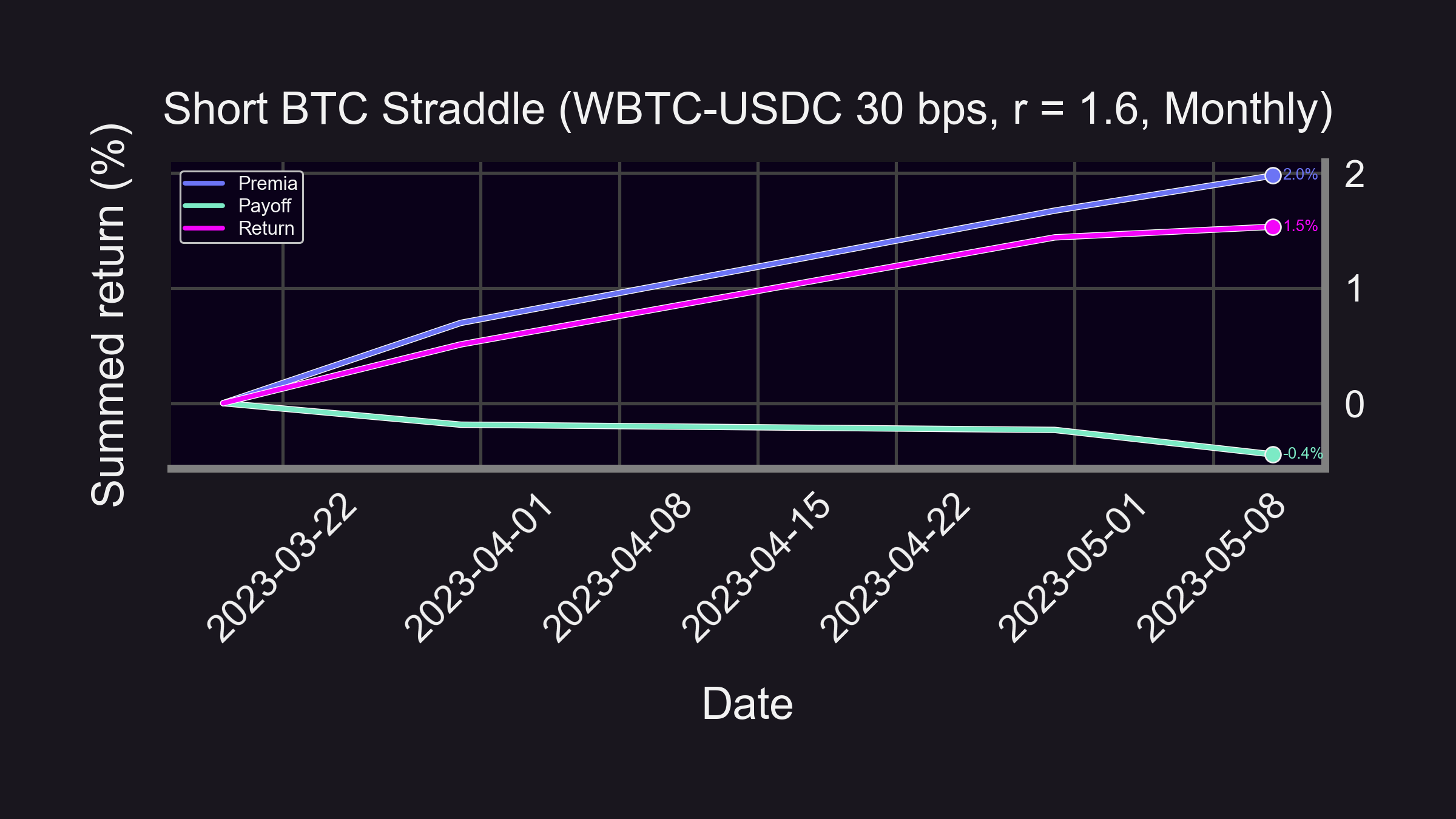

BTC straddle backtest (3/19 - 5/10)

Annualized return: +10.32%

When realized volatility (RV) is lower than expected, option sellers profit. The drop in RV for BTC in April resulted in positive profits for short straddles.

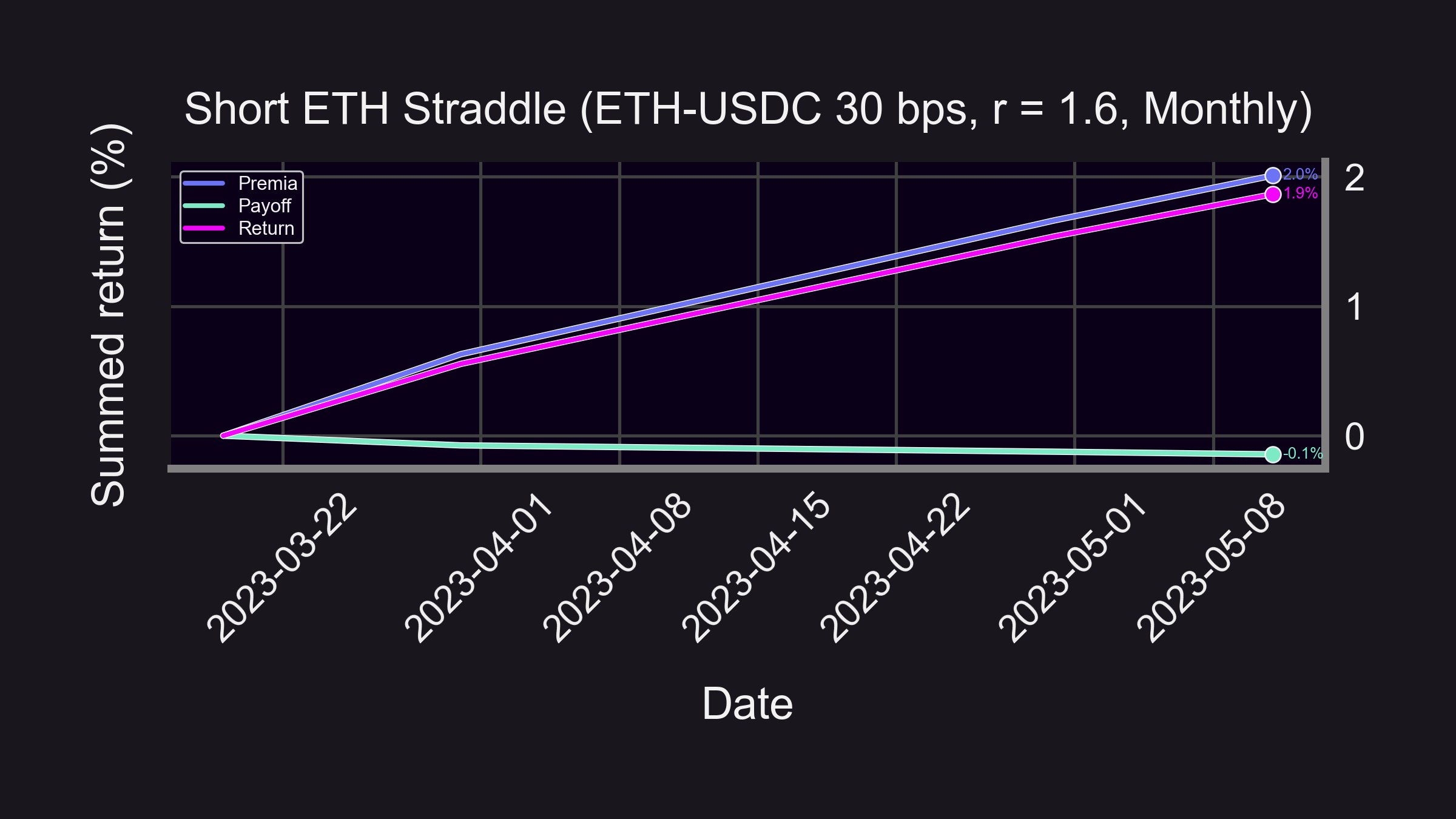

ETH straddle backtest

Annualized return: +13.8%

RV for ETH also saw a drop in April, resulting in short straddles on ETH being profitable.

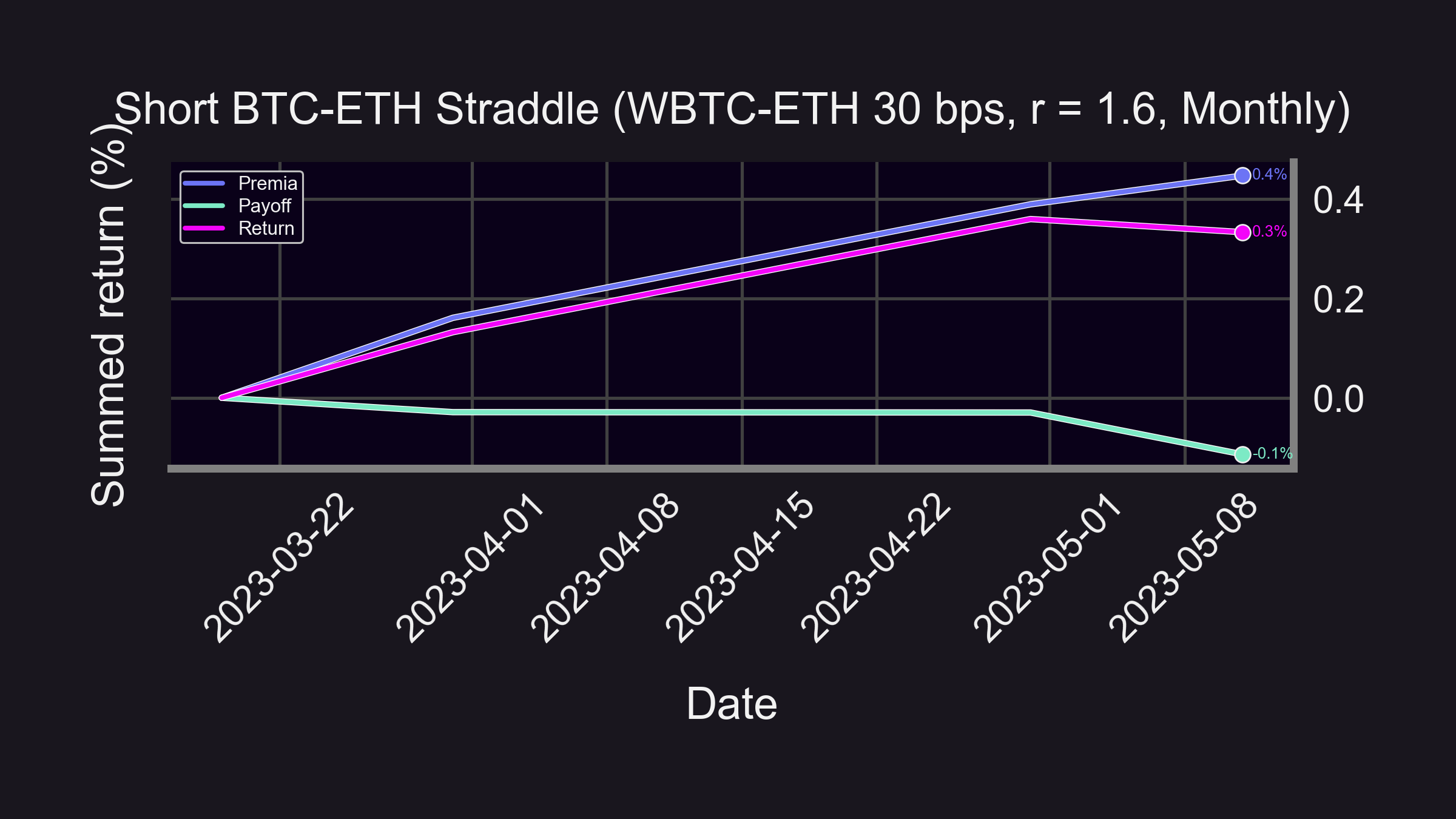

BTC-ETH straddle backtest

Annualized return: +2.1% (in ETH)

Panoptic revolutionizes options trading by introducing user-defined numeraires. For the first time, you can trade options directly on BTC-ETH prices (as opposed to BTC-USD + ETH-USD).

Caveats

- Ignores gas/swap fees ⛽

- Disclaimer: None of this is financial advice 📢

- Past performance is no guarantee of future results ⚠️

- Short straddles have unlimited loss potential! 📉

Curious about other strategies? Run your own backtests by following our fully open-source Jupyter notebook code.