From CEX to DEX: A New Formulation For Implied Volatility - Part 2

Computing Implied Volatility from Uniswap

In the evolving landscape of decentralized finance (DeFi), the transition from centralized to decentralized exchanges (DEX) presents unique challenges and opportunities, particularly in the computation of implied volatility (IV). This article explores the novel approach to calculating IV by leveraging the observation that liquidity provider (LP) positions in concentrated liquidity automated market makers (CLAMMs) like Uniswap v3 behave similarly to exotic options.

By taking this analogy to its fullest extent, we derive a new formula for IV that aligns with the liquidity provider DeFi (LPDfi) ecosystem. Our research details the step-by-step process of deriving IV from Uniswap's liquidity pools, providing a robust foundation for further comparisons of IV in decentralized versus centralized exchanges.

Step 1: Uniswap as an Options Clearinghouse

As seen in part 1 of our series "From DEX to CEX," the Panoptic protocol uses a streaming premium model called "streamia" for perpetual options. The premium accumulates continuously from block to block as the underlying asset's price moves relative to the strike price. This premium is based on the collected fees from providing liquidity in a Uniswap v3 pool.

Moreover, in traditional finance, extracting implied volatility involves using order book data, calculating the mid-price, the greek vega, and applying the Newton-Raphson (or bisection) method. However, the decentralized ecosystem does not support these conventional steps due to the absence of bid and ask prices, order books, and vega. What's even more different is the presence of concentrated liquidity in Uniswap v3 that allows liquidity providers (LPs) to allocate their capital more efficiently by providing liquidity within a specific price range rather than across the entire spectrum.

The liquidity provider (LP) ecosystem on Uniswap operates similarly to an options market. The positions taken by LPs, together with the spot trading volume on Uniswap, indicate an anticipated future volatility of the pool's price. Unlike traditional options market, implied volatility is not dependent on the upfront option price, but rather the fees collected in Uniswap.

Step 2: Collected Fees from Liquidity Provision

In order to calculate the fees collected from a Uniswap LP position, we consider the total liquidity amount deployed at a given tick.

We have the following:

Total fees accumulated:

Where feeRate is the percentage fee that spot traders on Uniswap pay when they execute a trade.

Fraction of those fees that goes to that LP position of size positionSize:

Here, the position size corresponds to the amount of liquidity a liquidity provider (LP) allocates within a specific price range in the liquidity pool.

Finally, we get:

Step 3: Cumulative Premia Using Theta

The cumulative premia is the integral of theta over the asset's price path :

Where theta () for an option (assuming a zero interest rate and no dividends) is given by:

Note that is the time to expiry in traditional finance, whereas we replace it with in DeFi, representing the time spent in range by a LP position.

Step 4: Approximating Theta Using The Dirac Distribution

The Dirac Distribution

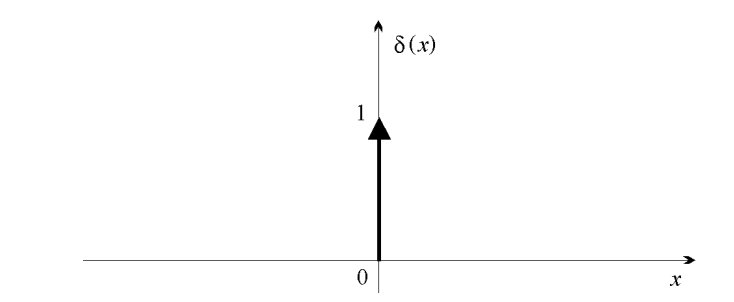

The Dirac function, denoted by , is a "pseudo-function" that has the following characteristics:

and

The graph of can therefore be represented by the entire x-axis and the positive half of the y-axis. With the "Dirac" , we aim to represent an impulse or (infinitely short) point event with finite, non-zero "energy".

Figure 1: Graph of the Dirac distribution .

Important Definition/Theorem (See Appendix 3.2): The Dirac function can also be perceived as the limit, as tends to 0, of the following centered Gaussian function:

Figure 2: Approximation of the Dirac delta function using different zero-centered normal distributions.

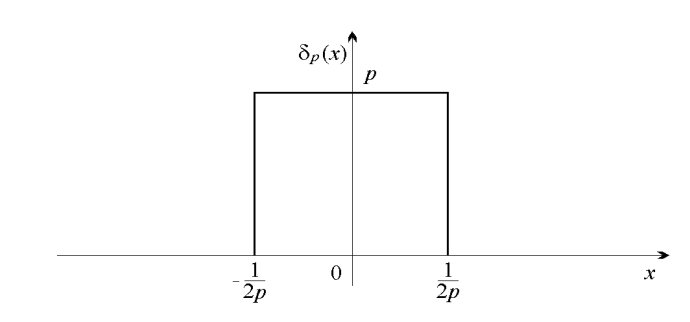

Example: One function commonly used to represent a Dirac delta function is , where:

Figure 3: Example of Dirac delta function: Graph of the function

Comparing the Dirac Function to Theta

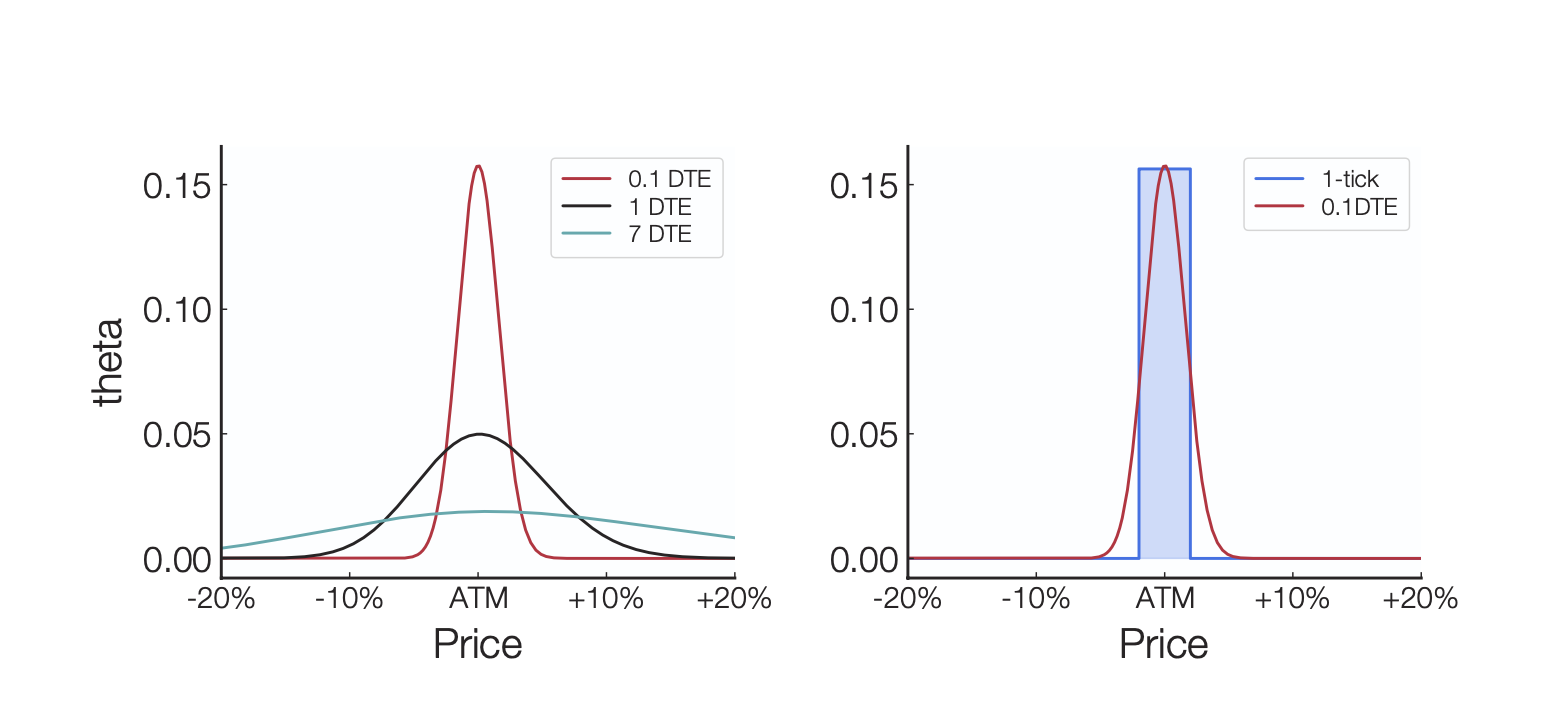

We aim to approximate the theta function of options by using an approximation of the Dirac function. The Dirac function increasingly resembles the theta function for options as the days to expiration (DTE) approaches 0. The figure below shows the theta of an option as a function of spot price movements for various DTEs: 7 DTE, 1 DTE, and 0.1 DTE.

Figure 4: Graph illustrating the variations in theta across different days until expiration.

Important Remark: The red curve is the theta of a 0.1 DTE traditional option. As being the time to expiry approaches zero, theta sharpens into a narrow peak which seems to converge towards a Dirac delta function (the rectangle in the example above), i.e. where is to be found.

To understand how this theta can have a limit resembling a Dirac delta function as , we analyze the components of the two expressions: the theta function and the Dirac delta function:

The Dirac delta function, , is defined such that:

The given equation for theta is:

We have

Set and . Then,

Setting the limit: As , the function approximates a Dirac delta function centered at as seen in Figure 4:

We need to make sure that this resulting limit is a Dirac delta function, in other words, it respects the two conditions of the definition of the Dirac delta function: a) At , we have that and elsewhere the function equals 0. b) To compute the integral of the expression over the entire real line , we utilize the sifting property of the delta function. This property states that for any function that is continuous at ,

Applying this property to the expression , where , we have:

Conclusion: is a Dirac delta function scaled by .

Now, we'll assume that the theta function converges to a Dirac delta that is similar to a rectangle (as seen in Figure 4). Hence, let's determine the optimal Dirac delta function by finding the best in the equation:

Important consequence: The area under both functions, the theta function and the Dirac delta function, are approximately equal, and we proceed to the following calculations:

Keep in mind that the minimum width of the Dirac delta function is intrinsically tied to the tick spacing of a Uniswap v3 pool.

| Fee Tier | Tick Spacing | Description |

|---|---|---|

| 1 bp | 1 | LP positions can be created with lower and upper prices and , respectively, that can be set at any multiple of 1.0001. |

| 5 bps | 10 | LP positions can be created with lower and upper prices and at any multiple of 1.0010. |

| 30 bps | 60 | LP positions can be created with lower and upper prices and at any multiple of 1.0060. |

| 100 bps | 200 | LP positions can be created with lower and upper prices and at any multiple of 1.0200. |

Table 1: Uniswap v3 Pool Tick Spacing and LP Position Ranges

Our objective is to achieve the narrowest width possible, which equates to the smallest range of an LP position, dictated by the pool's tick spacing. Given and as the lower and upper bounds of our range, respectively, and considering the width , it is helpful to use the following transformation to effectively apply Taylor's expansion:

Where is the geometric mean of the LP position's price range or alternatively the strike price of the corresponding option and is the range factor, a measure of width, of the LP position.

This allows us to express the width of an LP position as:

Remark: We take to represent an extremely narrow LP position, mimicking an option near expiry. We note, however, that the Uniswap v3 smart contracts limit the minimum width to the pool's tick spacing .

Given that where is the tick for the upper price, we can further simplify the expression:

Here, represents the difference between the ticks for the upper and lower prices. This transformation provides a more useful formulation for our width.

With this newly formulated expression for the width of an extremely narrow LP position, we can find the approximating Dirac function to approximate theta and the cumulative premium of a corresponding option.

- The area under the theta function is approximately (see Appendix below 3.1).

- The width of the theta function is .

- The height of the theta function is:

Therefore, .

Theta is approximated as the height of the approximating Dirac delta function multiplied by the time spent in range. Thus, the cumulative premia is:

Step 5: Derive the Implied Volatility (IV)

Equating Premia with Fees: We assert that the accumulated streaming premia (theoretical) of an option is equal to that of the fees collected from liquidity provision (actual). This aligns with our observation that LP positions behave similarly to options, and hence, their premia received is simply the fees collected by the position. By equating premia with collected fees we have:

We substitute and obtain:

Assumptions:

- The relationship between the tick spacing and the fee rate is as follows: In fact, tick spacings are 200 for 1% fee rate, 60 for 0.3%, 10 for 0.05% as seen in Table 1.

- The premia is calculated for one options contract, which corresponds to a position size of in terms of the quote asset.

- The LP position is centered around the current spot price, so the spot price is equal to its strike price .

With the above assumptions, this simplifies further:

Finally, we solve for , the implied volatility:

Conclusion

The observation that liquidity provider (LP) positions in concentrated liquidity automated market makers (CLAMMs) like Uniswap v3 behave similarly to exotic options can be taken to its fullest extent by deriving a new formula for the implied volatility (IV) of these options.

We seek to identify a robust and practical formulation for the IV of LP positions in Uniswap v3, and in the upcoming research of our series, we will delve into further derivations and technical comparisons of IV in DEXs vs. CEXs.

Appendix

Proof: Area Under the Theta Function

We need to integrate with respect to from 0 to , using the change of variable :

The integral becomes:

Simplifying to:

Which with gives us:

Using the properties of Gaussian integrals, the integral evaluates to:

This means that the area under the theta function in relation to the spot is .

Gaussian Approximation of the Dirac Delta Function

Distributions like Dirac's are defined as continuous linear functions over the set of compactly supported, infinitely differentiable functions, . Limits are defined in a weak sense.

Therefore, take . Then,

Now, by the dominated convergence theorem, where we take as the dominating function, we can take limits inside the integral:

This shows:

Join the growing community of Panoptimists and be the first to hear our latest updates by following us on our social media platforms. To learn more about Panoptic and all things DeFi options, check out our docs and head to our website.