How to Create a Delta-Neutral LP Position on Panoptic

Providing delta-neutral liquidity on Panoptic is a powerful way to earn yield without taking on directional exposure to ETH. This strategy allows you to earn fees from hedged LP positions while maintaining near-full USDC exposure, with only a minimal ETH requirement. Here’s a step-by-step guide using real numbers and examples.

Step 1: Understand the Setup

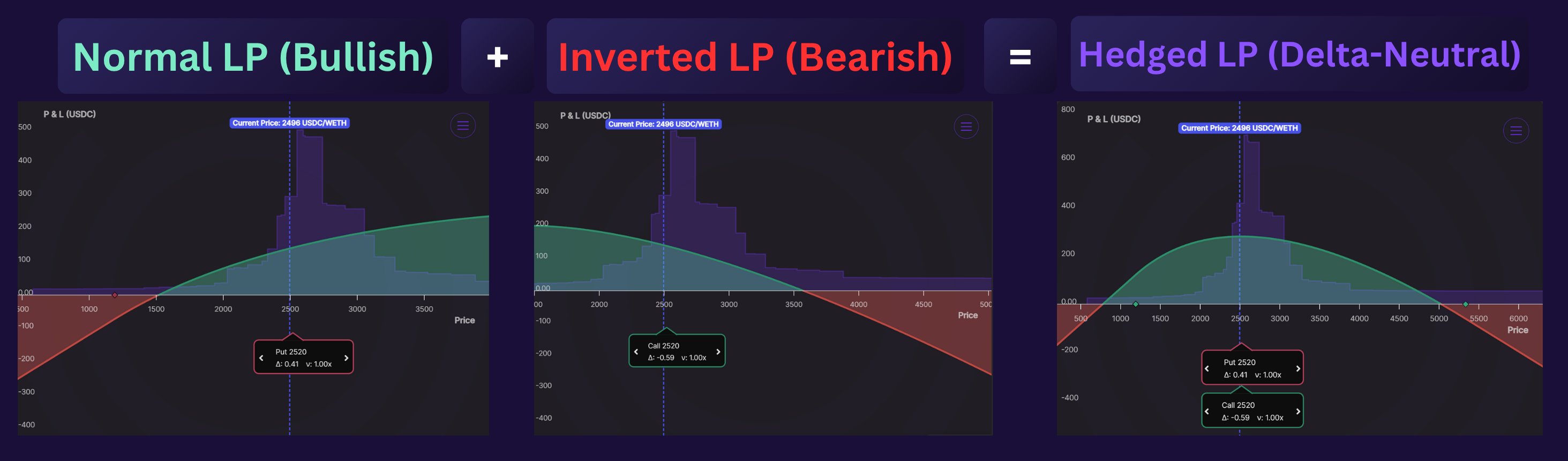

Delta-neutral LPing on Panoptic means creating a hedged LP position. Rather than simply providing liquidity in a single direction (bullish or bearish), a delta-neutral LP combines a normal LP position (which is bullish) with an inverted LP position (which is bearish) to produce a market-neutral strategy.

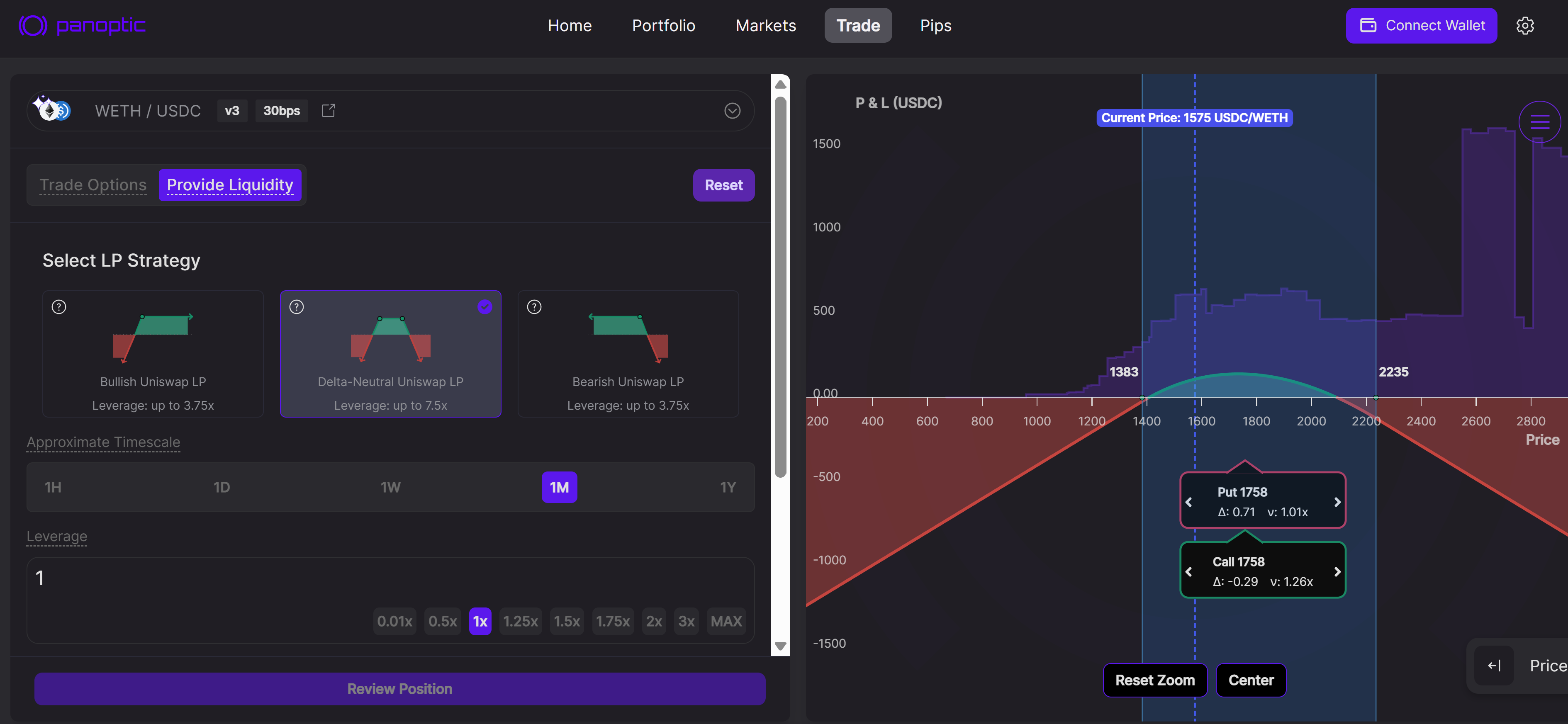

You can access this easily on Panoptic by navigating to the Trade page, selecting LP Mode, and clicking "Delta-Neutral LP".

This is made possible because Panoptic has its own built-in lending and borrowing market, enabling users to single-sidedly enter a Uniswap v3 or v4 LP position. For example, that means you can start with primarily USDC and still gain exposure to a delta-neutral LP strategy. The only limitation is that there must be enough ETH available to borrow on Panoptic at the time you initiate your position.

Step 2: Allocate Capital

Suppose you want to deploy $1,000,000 of liquidity.

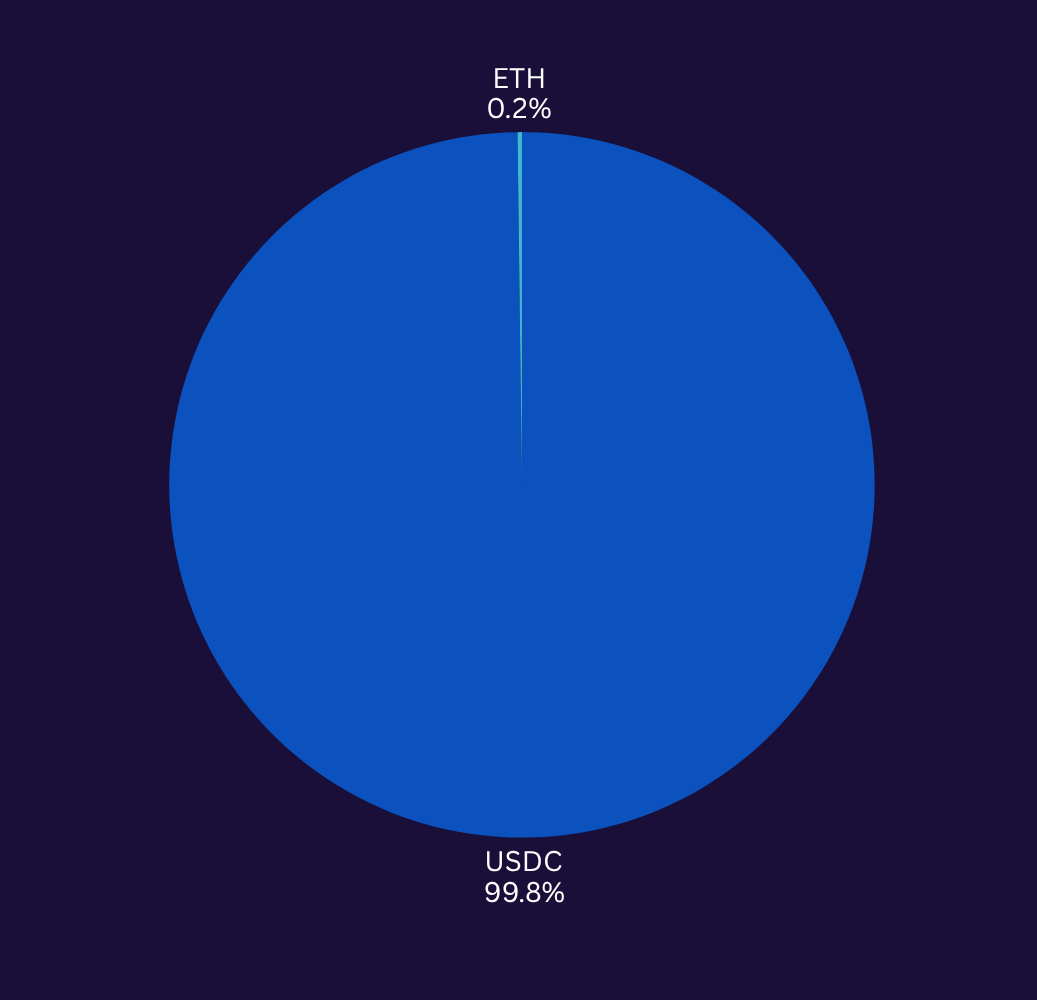

To stay delta-neutral, your collateral mix can be:

- $998,000 USDC

- 2 ETH (e.g., if ETH is priced at $1,000)

This ETH covers:

- The commission fee (0.1% in ETH, 0.1% in USDC) when initiating the position.

- A potential small ETH top-up if the ETH price rises and you want to close the position.

This setup gives you nearly 99.8% USDC exposure while enabling a hedged LP position.

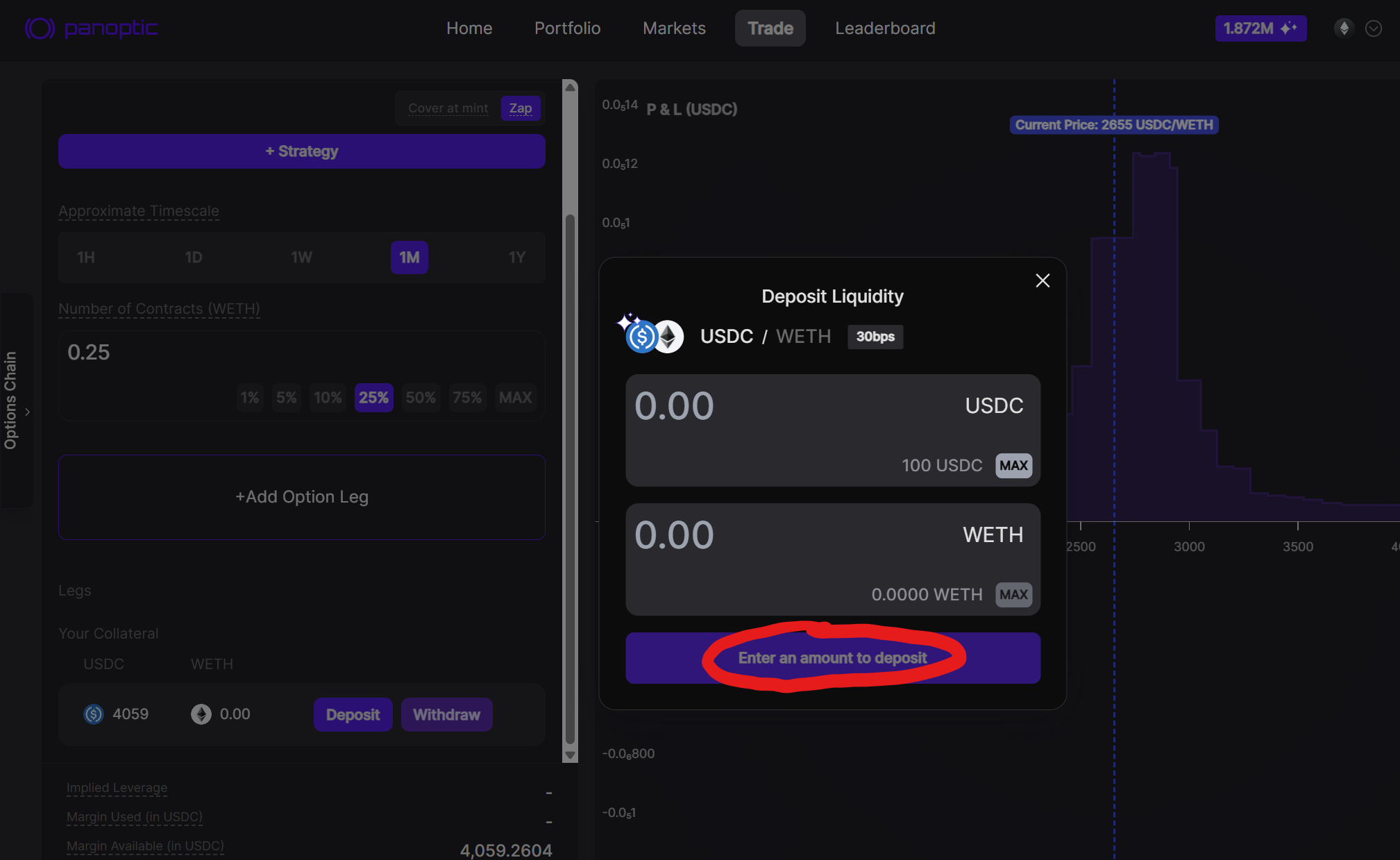

Step 3: Deposit Your Collateral

- Go to app.panoptic.xyz

- Deposit $998,000 USDC (or 99.8% in USDC)

- Deposit 2 ETH (or 0.2% in ETH)

You're now ready to provide liquidity.

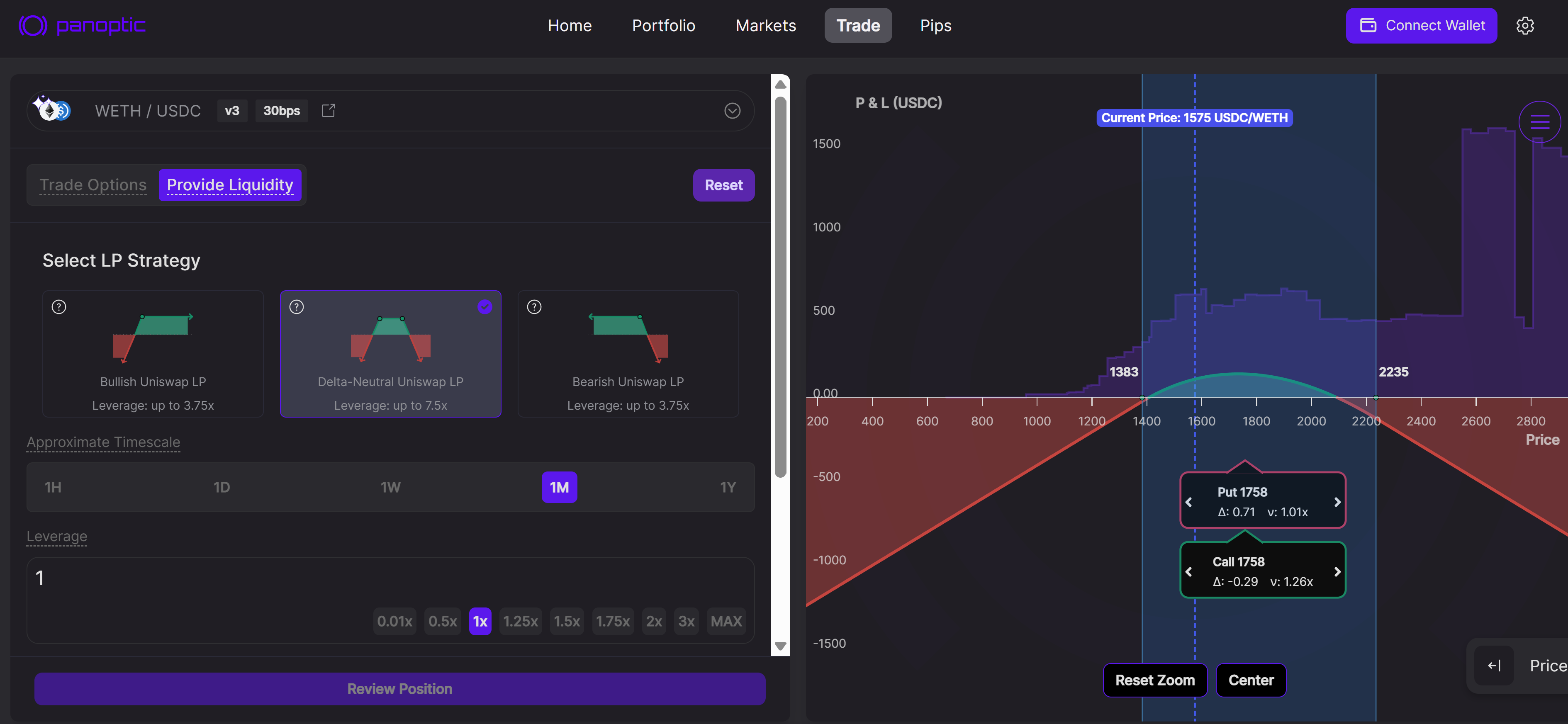

Step 4: Create the Delta-Neutral Position

- Navigate to the Trade page on Panoptic

- Toggle to LP Mode

- Select "Delta-Neutral LP"

- Choose the Uniswap pool you want to LP in (e.g., WETH/USDC 0.3%)

- Specify the size of your position (e.g., 500 ETH contracts)

- Specify the timescale of your position. A longer timescale (e.g. '1Y' or '1M') corresponds to a wider price range. A wider position allows you to stay delta-neutral longer, but earns less fees per unit of liquidity.

- Confirm and click "Provide Liquidity"

Panoptic automatically handles the hedging in protocol. This creates an LP position in Uniswap that earns fees and is less affected by small price movements in either direction.

Step 5: Monitor and Maintain

- Passive earnings: You earn fees in USDC and ETH

- Impermanent loss: Your position is hedged, so directional price movement has less impact on your PnL

- Rebalance: If the ETH price moves significantly, your position may no longer be delta-neutral. You can rebalance by closing and reopening your position to restore neutrality.

- ETH Top-Up: If the ETH price increases and you unwind your LP, you may need to supply a small additional amount of ETH to fully close the position.

Summary

- Strategy: Delta-neutral = Hedged LP by combining normal and inverted positions

- Capital needed: 99.8% USDC + 0.2% ETH

- Returns: Earn fees in both USDC and ETH with less price exposure

- Benefits: Minimizes impermanent loss on the downside, capital-efficient

Join the growing community of Panoptimists and be the first to hear our latest updates by following us on our social media platforms. To learn more about Panoptic and all things DeFi options, check out our docs and head to our website.