Provide Liquidity

Panoptic lets you provide liquidity to Uniswap through the Panoptic protocol — unlocking higher yields by earning additional premiums on top of Uniswap trading fees.

LP on Panoptic

Follow these steps to start LPing.

Step 1: Go to app.panoptic.xyz

This is the official Panoptic trading interface.

Step 2: Connect Your Wallet

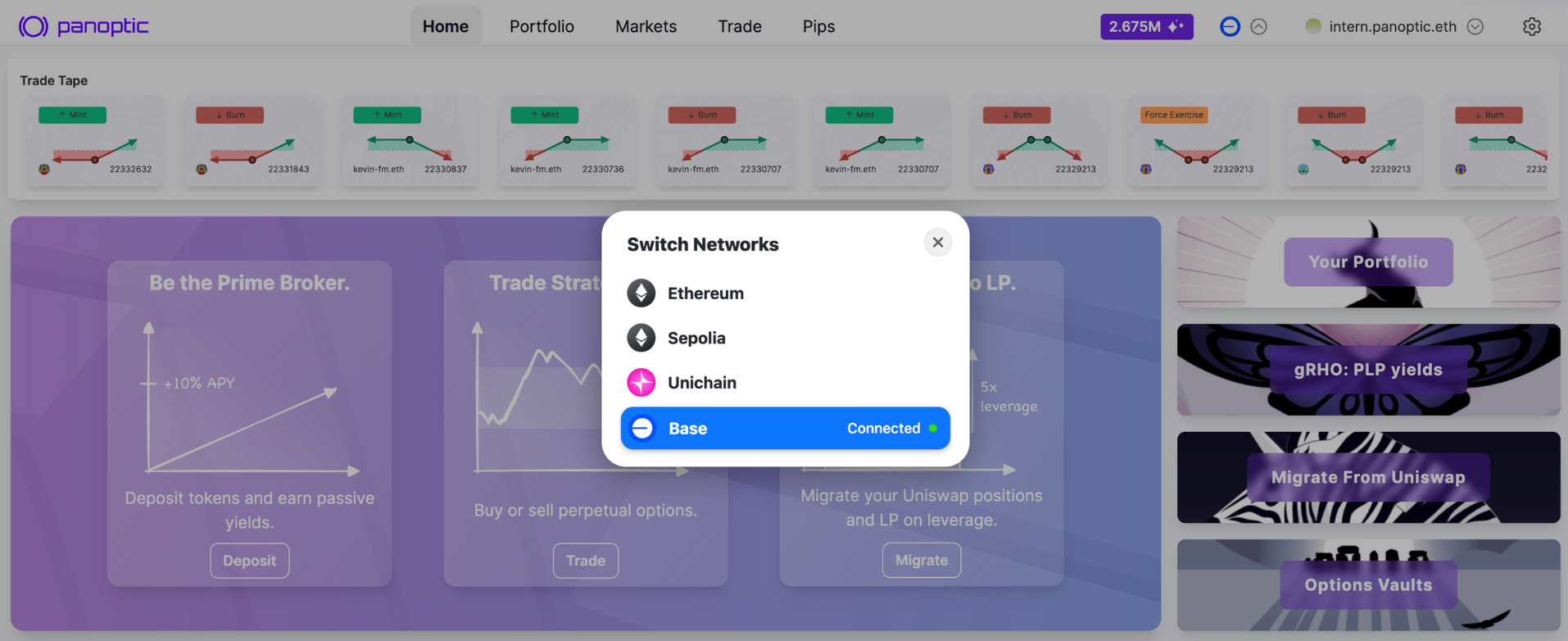

Click Connect Wallet and choose your preferred wallet provider. Then, select the network you want to provide liquidity on (e.g., Ethereum, Base, Unichain, etc.).

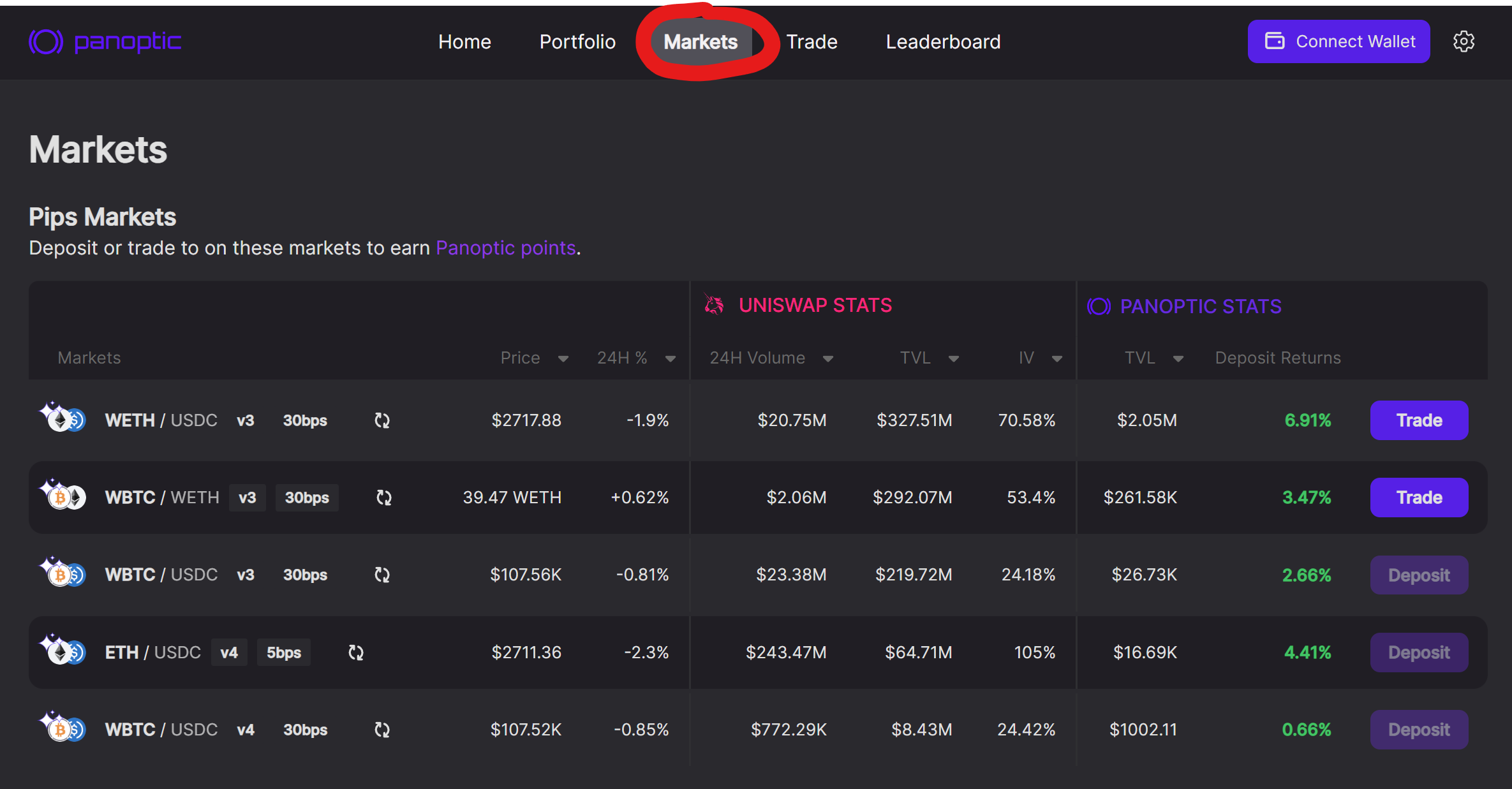

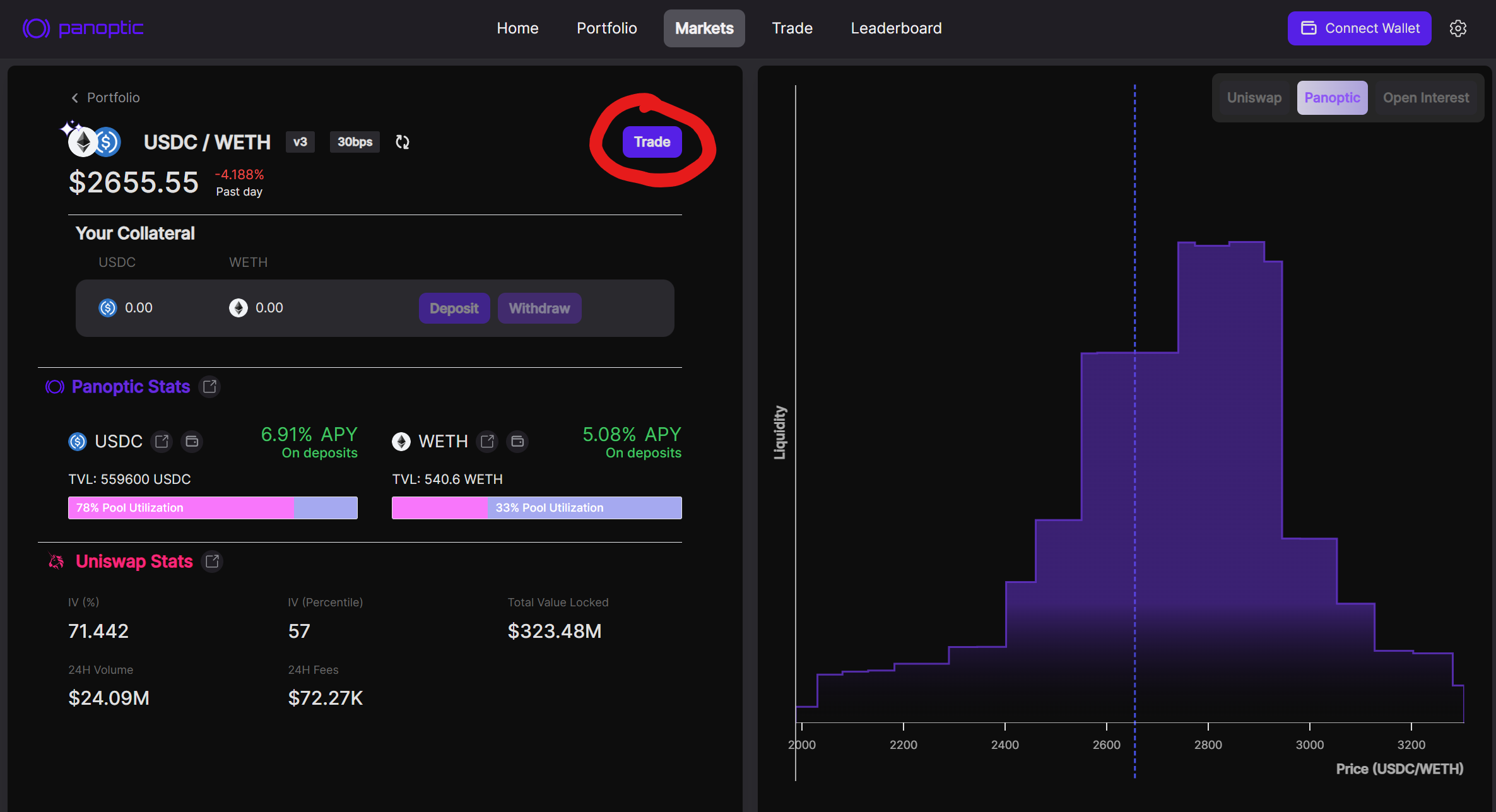

Step 3: Navigate to the Markets Tab

This shows all Uniswap pools available through Panoptic.

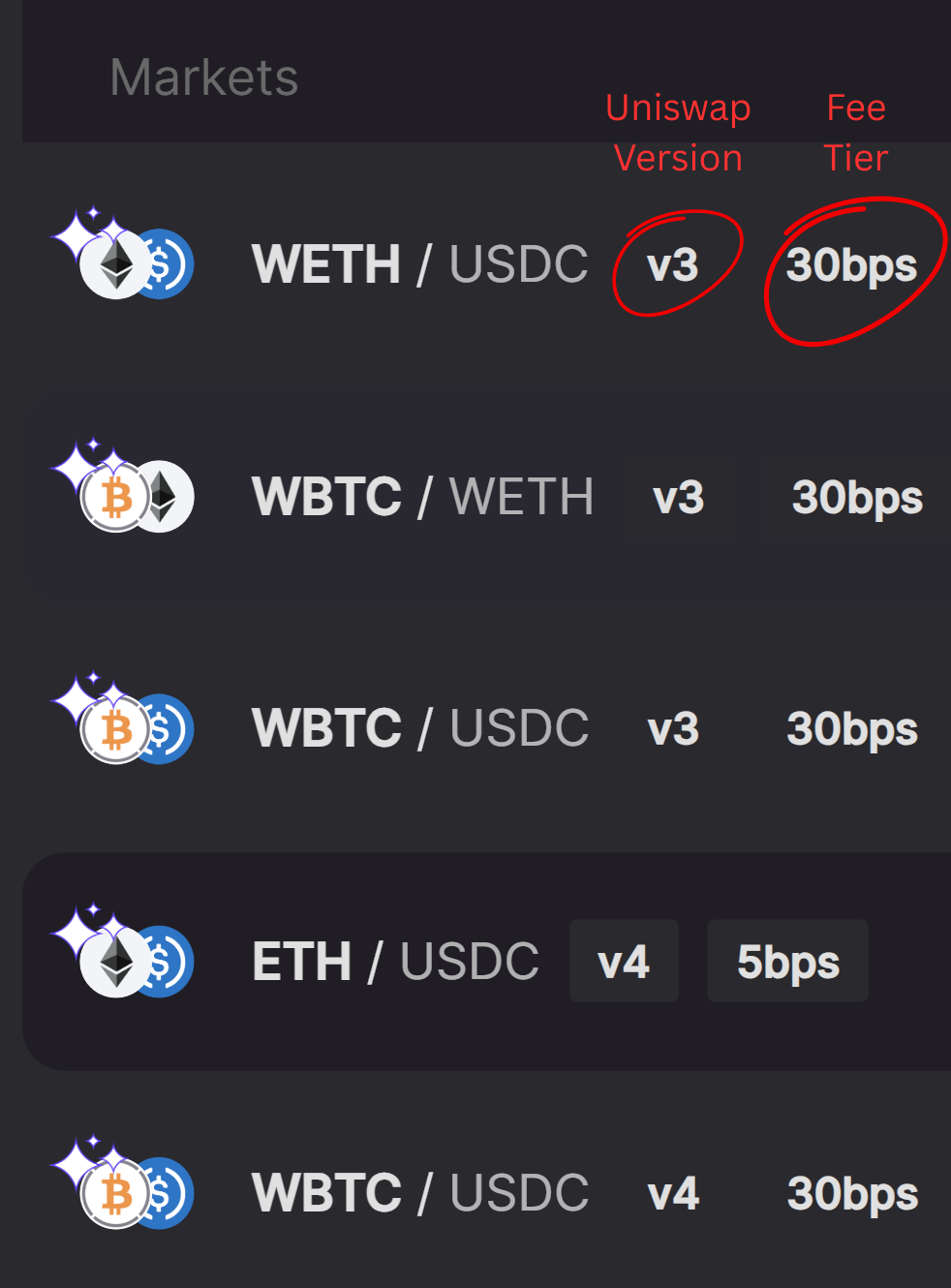

Step 4: Choose a Pool

Click a pool you’re interested in (e.g., WETH/USDC 30bps v3).

- Fee tier (30bps) means the Uniswap pool charges 0.3% per swap — higher fees often mean more rewards.

- v3 vs v4: Panoptic currently supports Uniswap v3 and v4. Uniswap v4 adds new features like hooks.

Step 5: Click Trade

This opens the trading panel for the selected pool.

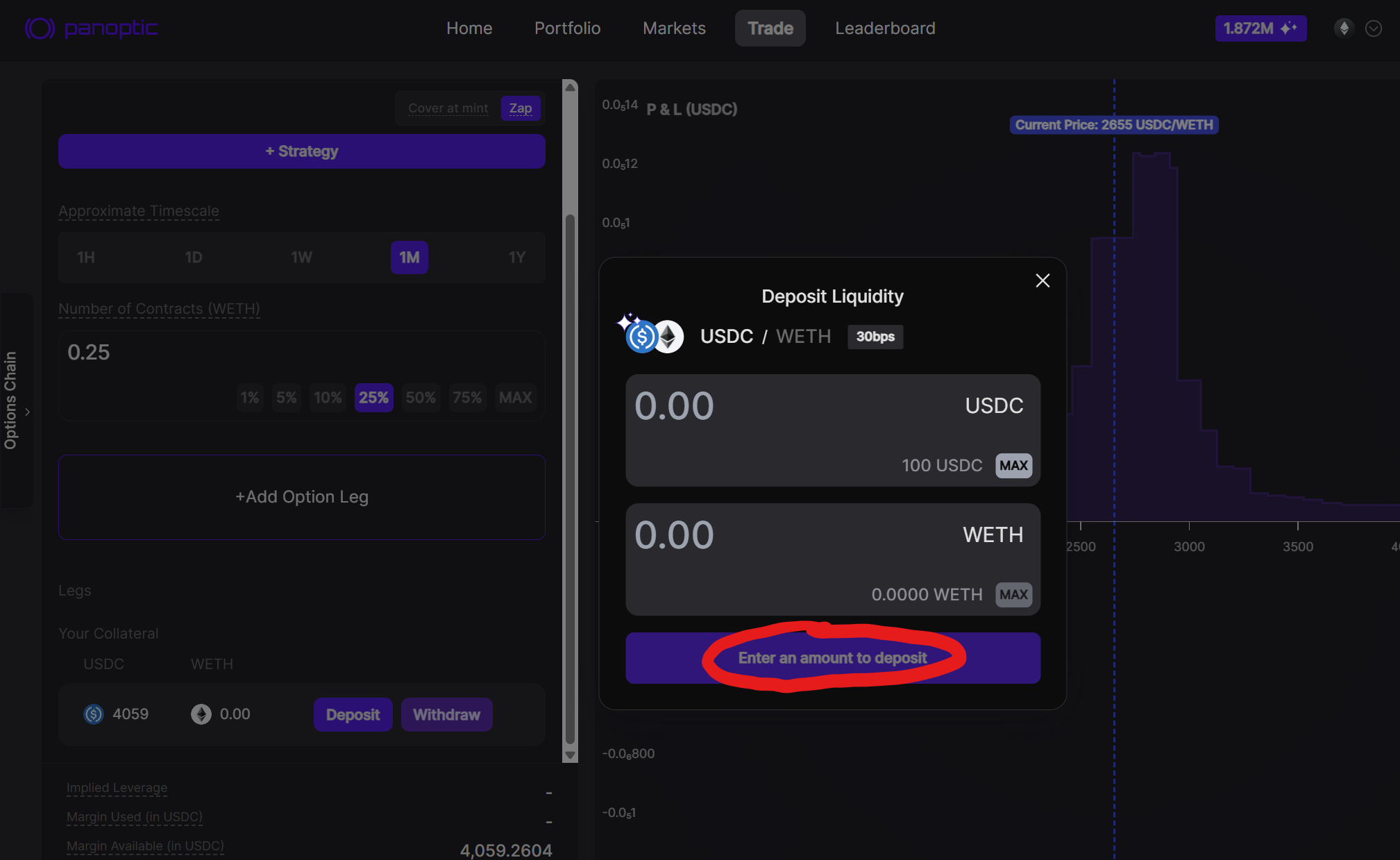

Step 6: Deposit Tokens

You can deposit any amount of either token.

- It’s recommended to deposit at least a small amount of each token (e.g., both WETH and USDC), even if it’s not 50:50.

- Don’t worry about perfect balance — Panoptic has built-in lending markets that let you borrow the missing token.

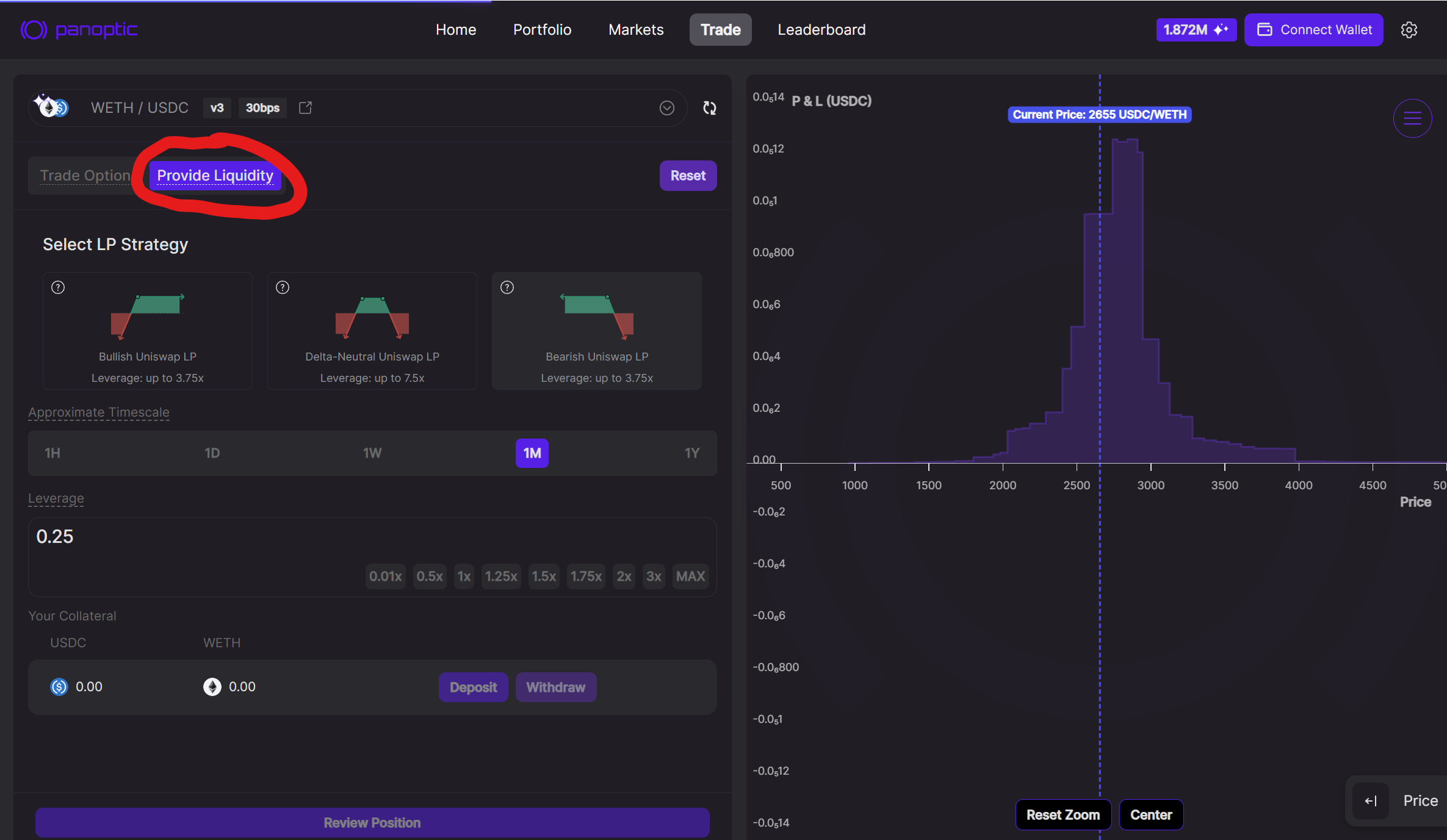

Step 7: Click Provide Liquidity

Switch from “Trade Options” to “Provide Liquidity” mode.

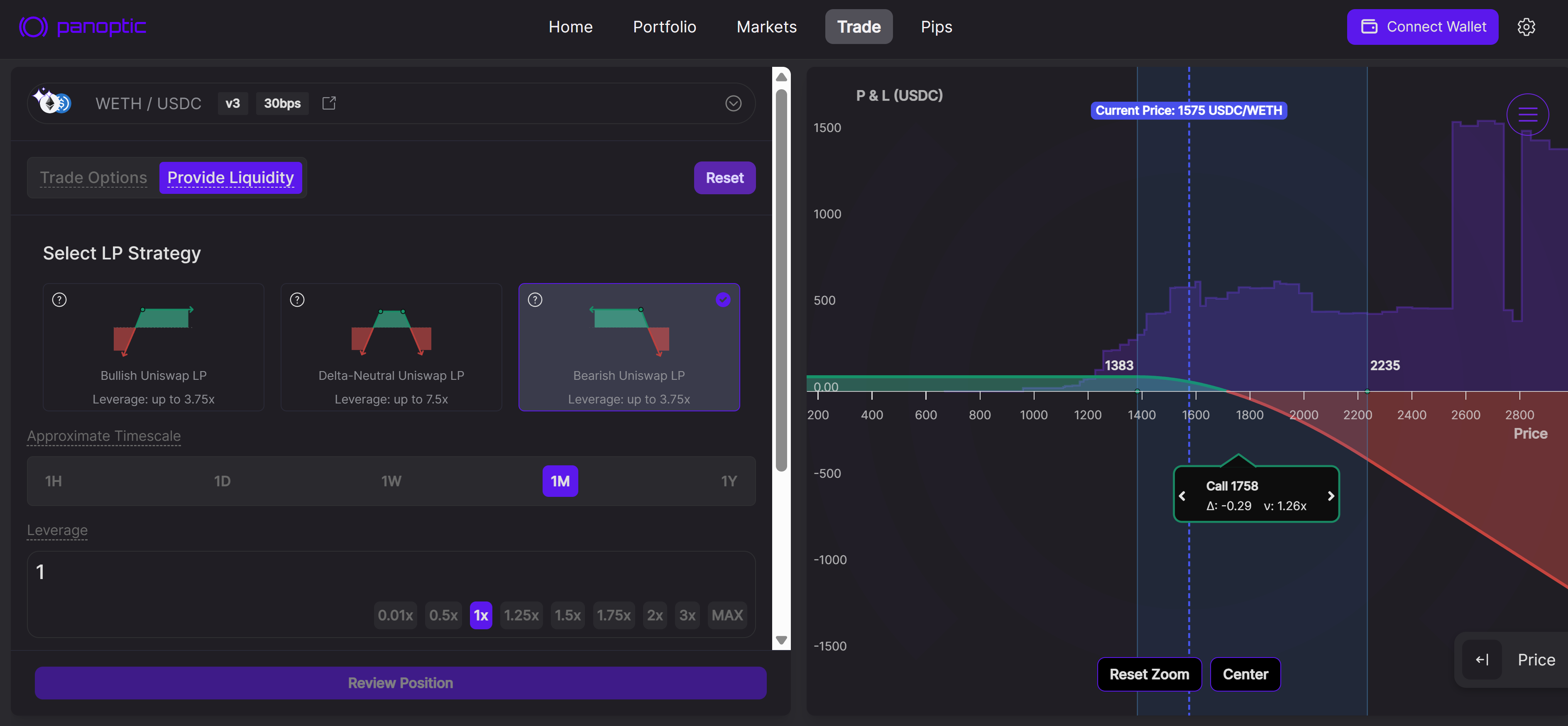

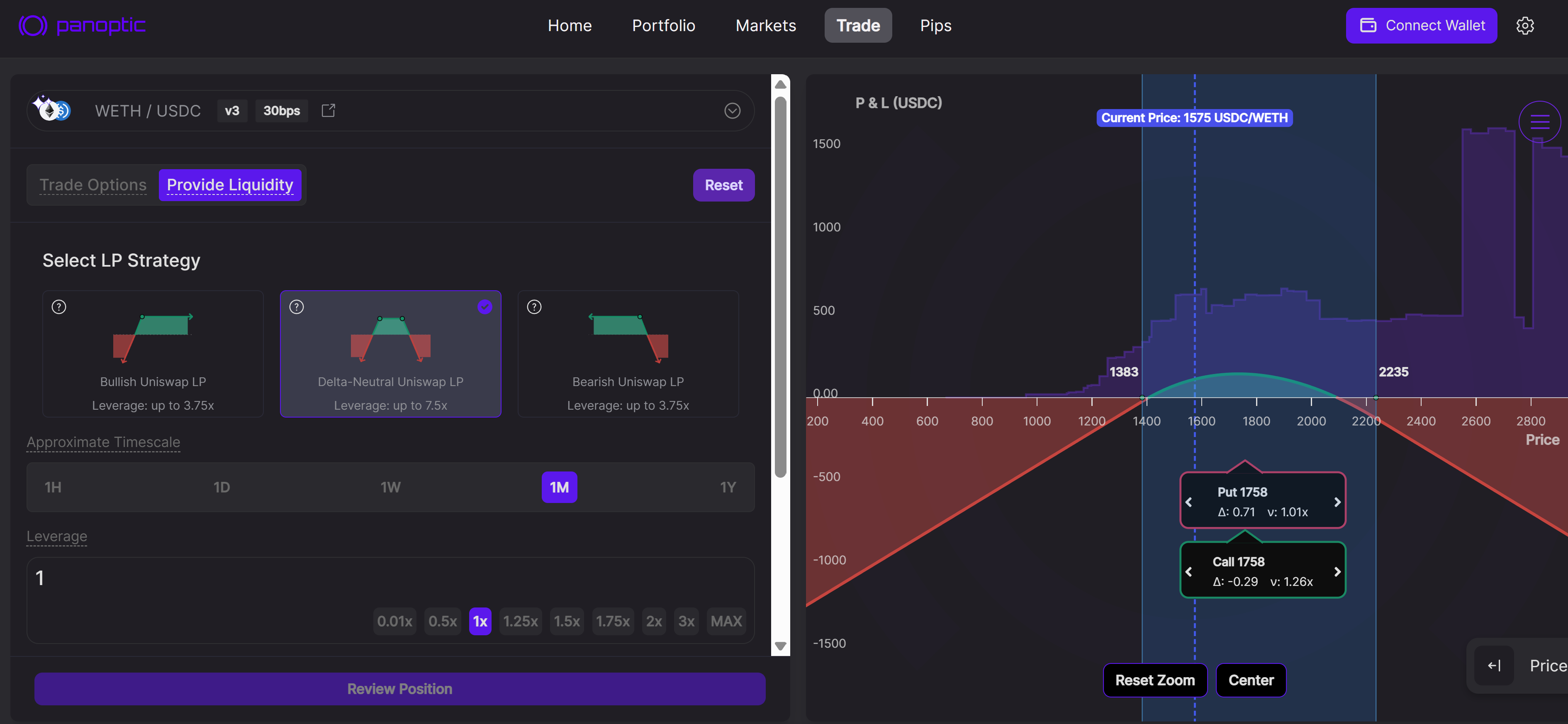

Step 8: Select LP Strategy

Panoptic comes with built-in Hedging

A Uniswap LP is structurally bullish: when price falls, you receive more of the underperforming token and book impermanent loss. Panoptic makes that risk optional:

| Exposure | What Happens when Price Drops | What Happens when Price Rises |

|---|---|---|

| Standard LP (bullish) | You hold more of the falling token → impermanent loss | You hold more of the quote token → limited gain |

| Inverted LP (bearish) | You gain on the falling price → impermanent gain | You lose as the price rises → impermanent loss |

| Delta-neutral LP | You are hedged against price dropping | You are hedged against price rising |

With one click you can choose between bullish, bearish, or fully delta‑neutral stances.

Each strategy comes with different payoff shapes and leverage limits.

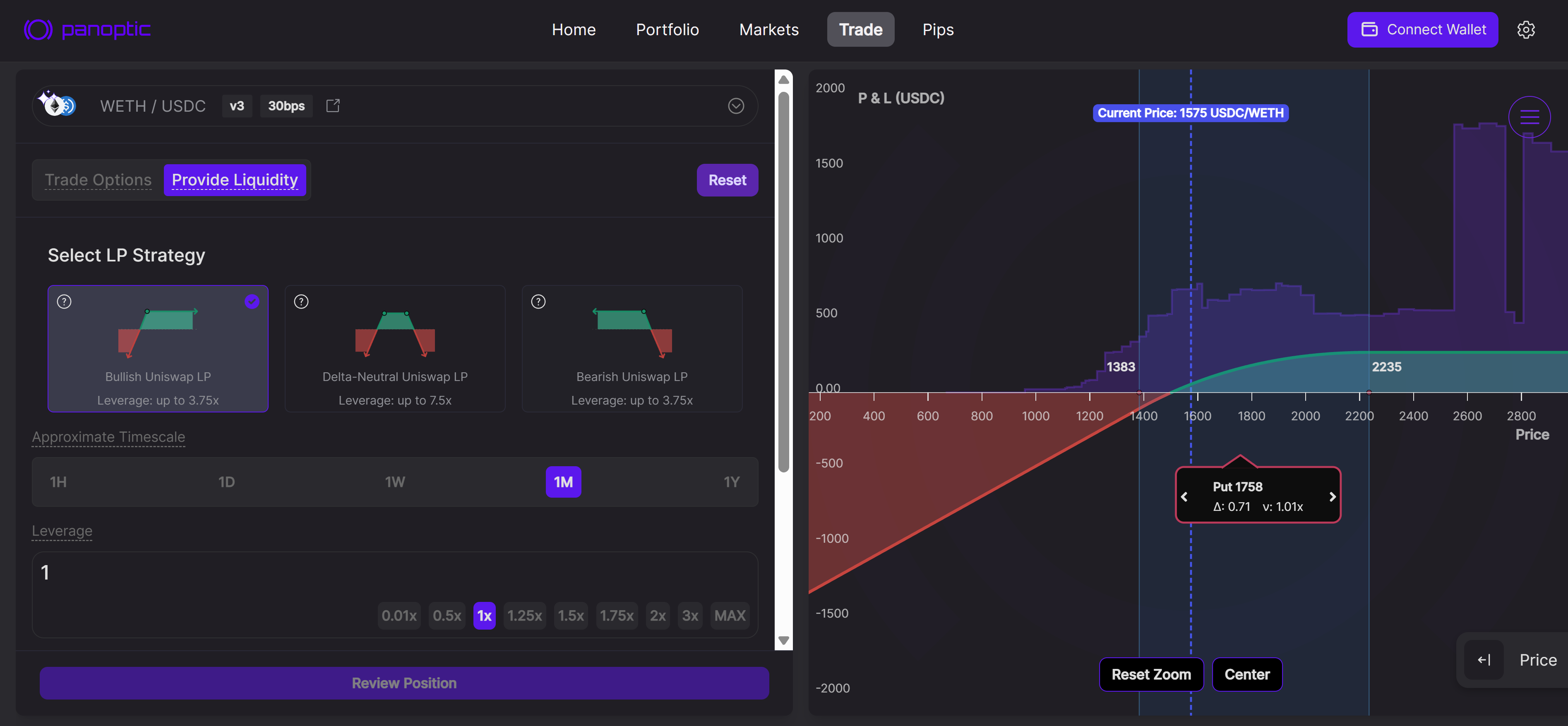

Standard Uniswap LP Position (Bullish)

Standard Uniswap LP Position (Bullish)

Inverted Uniswap LP Position (Bearish)

Inverted Uniswap LP Position (Bearish)

Delta-Neutral Uniswap LP Position

Delta-Neutral Uniswap LP Position

Step 9: Choose a Timescale

Pick a timescale that fits your expected duration in range:

1H≈ ±1% wide LP price range1D≈ ±%4 wide LP price range1W≈ ±13% wide LP price range1M≈ ±27% wide LP price range1Y≈ ±112% wide LP price range

This affects your LP price range width and projected fee earnings.

Also, choose your leverage. Higher leverage = higher returns, but higher risk of liquidation.

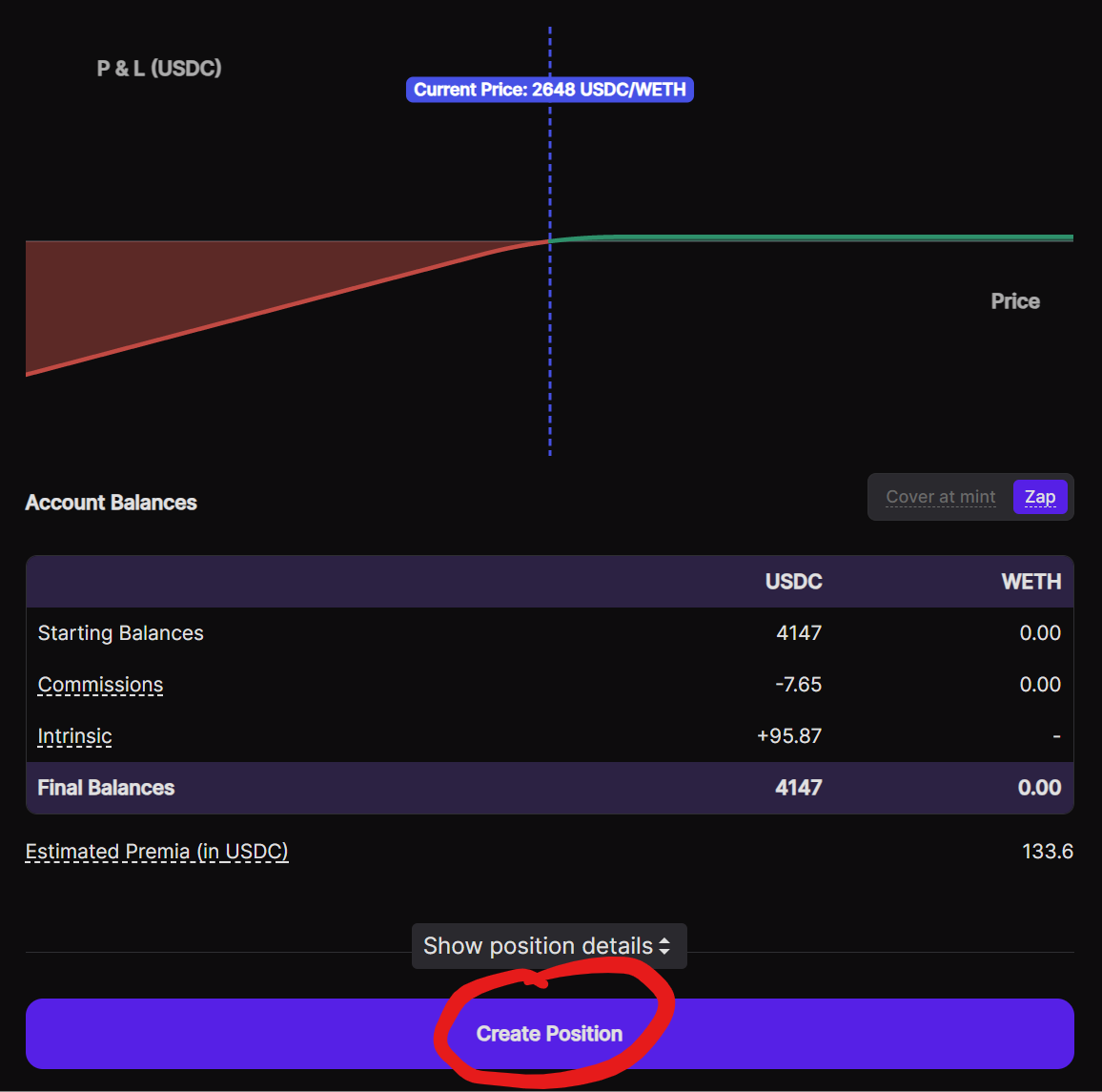

Step 10: Review and Confirm Position

Inspect your position details, payoff chart, and estimated earnings. Click Create Position to mint your LP position. You now earn Uniswap fees + Panoptic streaming premiums.

To learn how to manage or exit your position, visit: Panoptic Position Management Guide

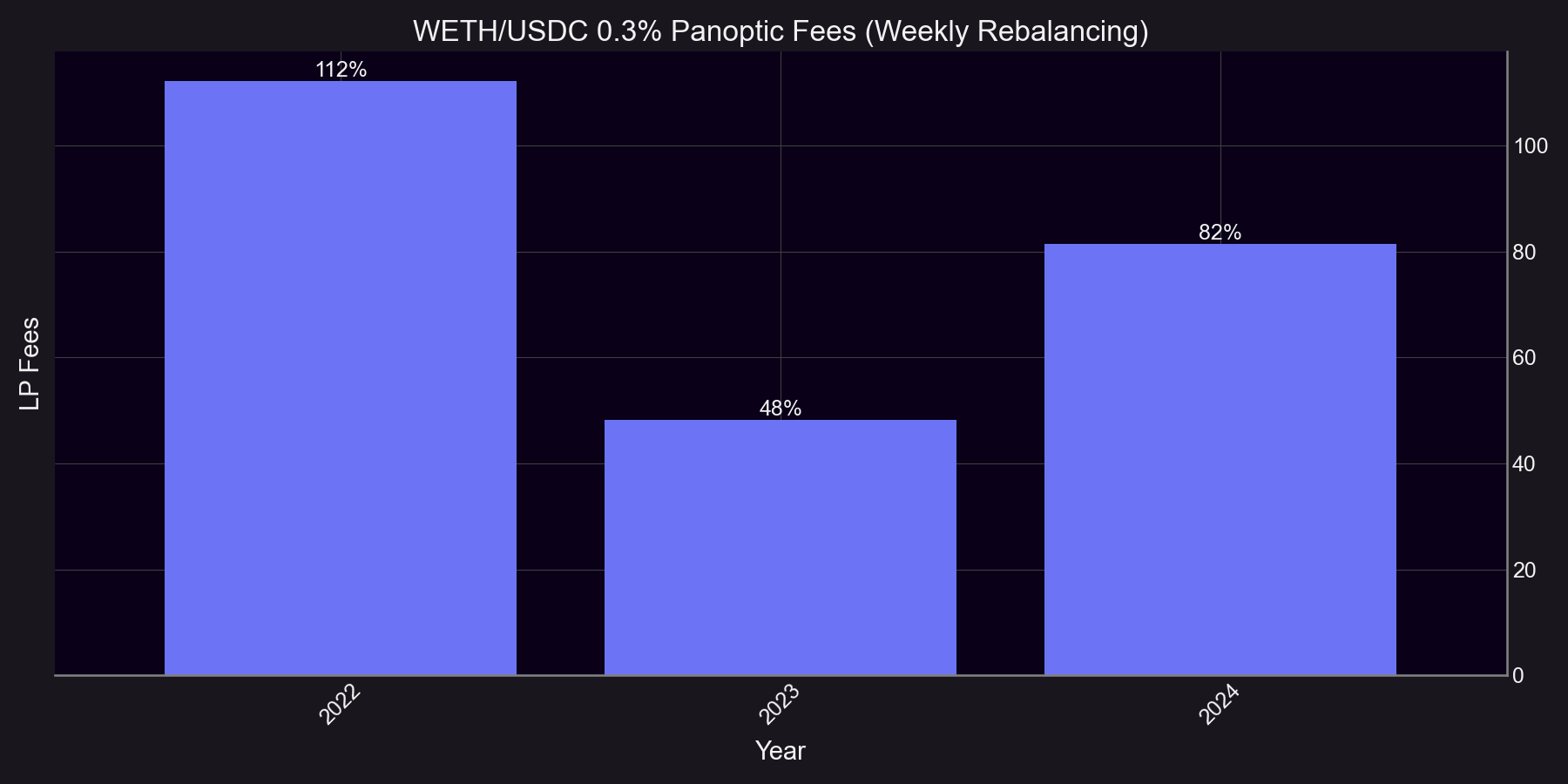

LP Returns

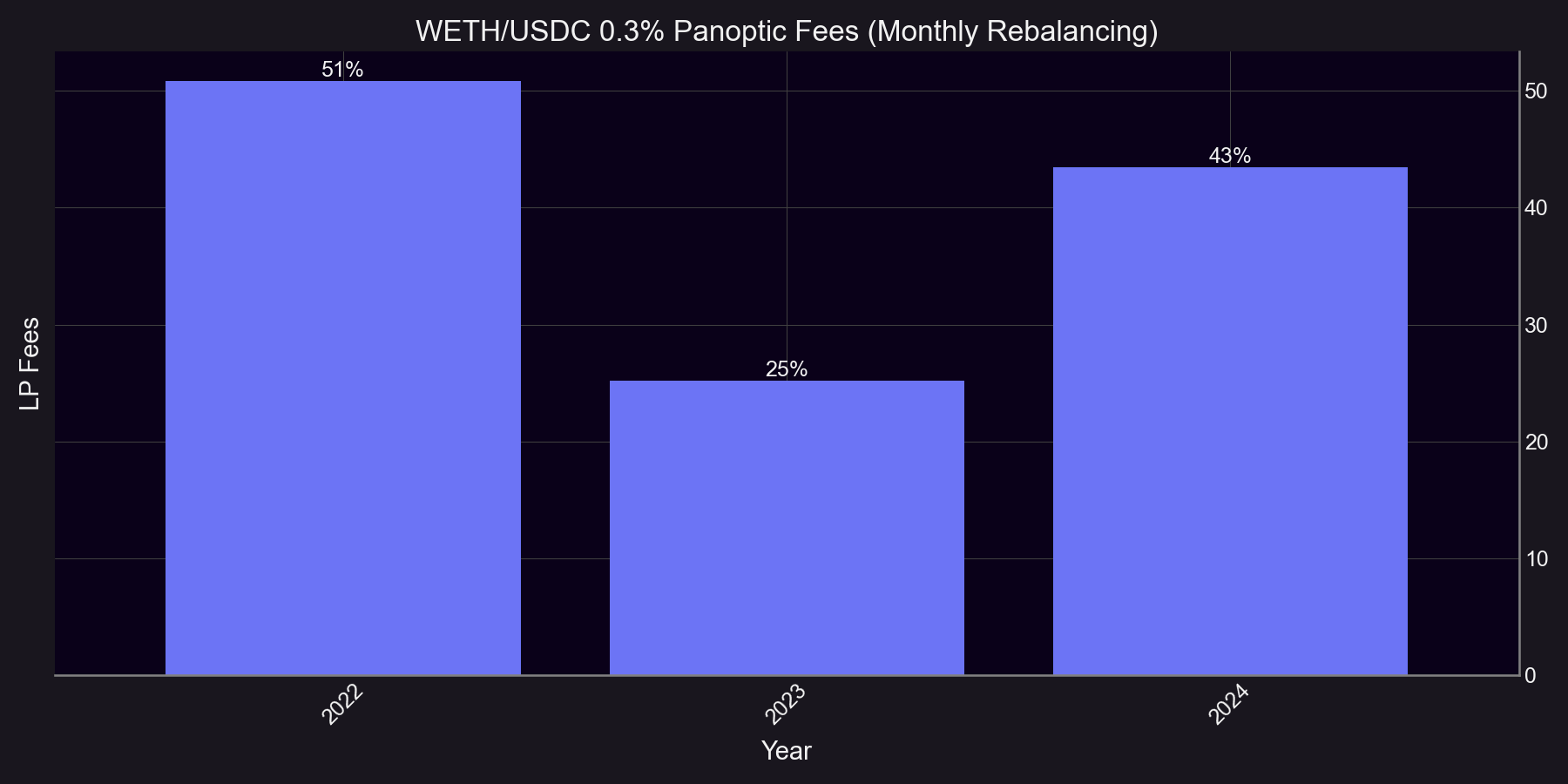

Historical data shows that Panoptic liquidity providers may have earned 25 %–112%+ APR on fees. These earnings combine:

- Uniswap trading fees (21%-95%) – the baseline return every LP receives.

- Panoptic streaming premia (4%-17%) – an extra premium from lending out LP positions to option buyers that can increase total fees to as much as 3× the Uniswap amount.

Additional Incentives: UNI Tokens (currently live on select Unichain and Ethereum v4 pools and coming to Base)

LP Backtest (Weekly Rebalancing)

LP Backtest (Monthly Rebalancing)

Risk Highlights

- Smart Contract Risk: Panoptic completed multiple third-party audits (Cantina, Code4rena, Trail of Bits, OpenZeppelin, ABDK) and economic reviews (Three Sigma, Simtopia).

- Impermanent Loss: LP positions underperform compared to HODL when price moves rapidly out of range. This risk can be hedged in Panoptic by creating inverted LP positions or even shorting LP positions for impermanent gain.

- Liquidity Lock-Up Risk: If LP positions are borrowed in Panoptic, then only a portion of the position may be closed. When liquidity utilization reaches 90%, positions can temporarily become uncloseable until utilization falls. To incentivize LPs, Panoptic dynamically increases the fees they earn as their positions are borrowed—these fee curves grow non-linearly, with accelerating rates as utilization nears full capacity. If an LP position goes out of range, LPs may forcibly close it at any time by paying a fee, even if it’s currently being borrowed.

- Liquidation Risk:

Panoptic lets LPs provide liquidity at up to 5× effective leverage, increasing potential profits and losses. If the value of LP positions in a pool falls below the account’s maintenance margin, the protocol can liquidate the account to protect its solvency. LPs can curb this risk by:

- Sticking to lower leverage ratios.

- Monitoring the position’s health or setting stop‑losses.

- Topping up collateral before the margin buffer is breached.

Join the growing community of Panoptimists and be the first to hear our latest updates by following us on our social media platforms. To learn more about Panoptic and all things DeFi options, check out our docs and head to our website.